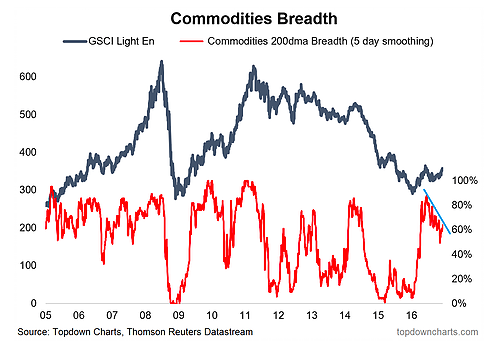

5. Commodities – Breadth Divergence

Commodities as an asset class are seeing breadth divergence for the S&P GSCI [note: this chart has been prepared using the individual commodities that make up the GSCI]

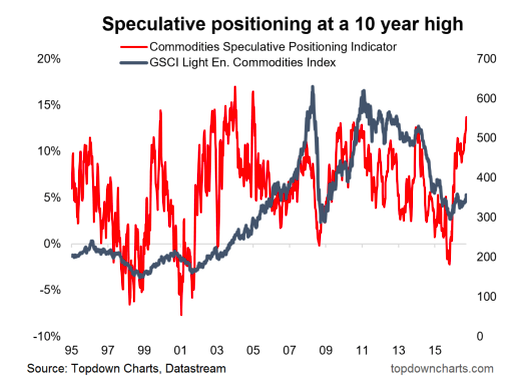

On a similar (arguably bearish) note, average speculative positioning across commodities is stretched to the upside at a 10 year high

Appears to be an ascending triangle forming, this will serve as an important trigger point (downside break vs upside break) in setting direction, as the breadth divergence could resolve to the upside and the stretched positioning is common around a market bottom.

Overall technical view: Bearish bias, but on watch for a breakout (either way)

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.