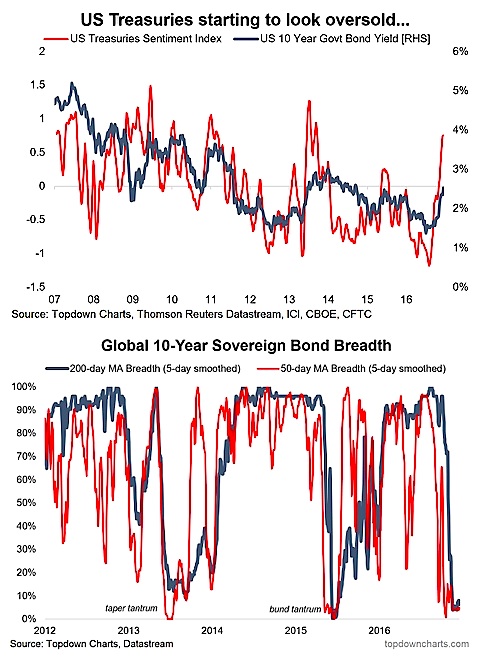

4. Bonds – Stretched Sentiment

Our bond sentiment indicator (uses mutual fund flows, speculative futures positioning, bond market implied volatility, and bond breadth) is looking increasingly stretched – similar to the 2013 taper tantrum. At the same time, sovereign bond breadth looks to be in the process of bottoming out. Need to see a turn back in sentiment and a turn up in breadth for confirmation; it’s worth noting that previous bottoms have taken some time to form, despite sharp corrections.

Overall technical view: Bearish bias, but temper bearishness on oversold indicators

Next chart (Commodities)…