The S&P 500 (SPX) is up an incredible 5 months in a row. That has to be bearish, right? Most would think a market up ‘a lot’ is probably due to come back down and negatively impact S&P 500 performance thereafter. Makes sense, yes?

But as Lee Corso would say, “Not so fast my friends!”

First things first, here are the longest monthly winning streaks for the SPX going back to 1950. The current streak is impressive, but has a ways to go to get up near the record of 11 in a row.

S&P 500 Historical Monthly Winning Streaks:

Now, going back to 1950 there have been 23 times the SPX was up at least five months in a row (including the current streak). To my surprise, the S&P 500 performance returns are actually extremely bullish AFTER five straight months of gains!

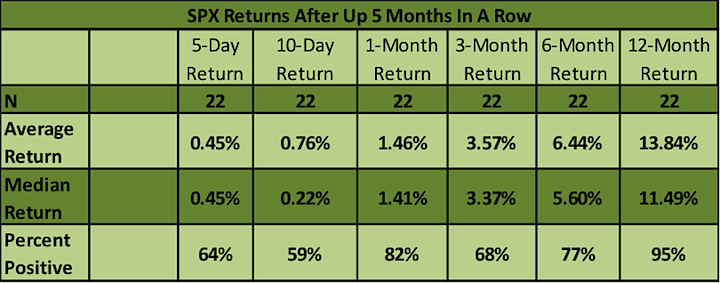

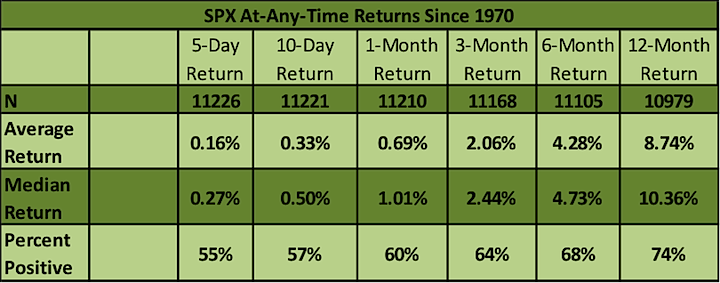

Check out the returns below. The SPX is up 82% of the time the next month versus the average month up just 60% of the time. Also the average return in this instance is twice as much as the average return. Not bad. Going out further, the S&P 500 is up 21 times a year later (out of 22). This is means the SPX is up 95% of the time a year later for those scoring at home. Now I’ll admit 22 isn’t the most instances, but it is enough for me to take that higher 95% of the time very seriously.

S&P 500 Performance After Being Up 5 Months In A Row:

I’ve been saying for a long time now that we’re in a bull market and trying to pick a top is a pointless game. This study does little to change my opinion. We’ll see corrections and I fully expect small caps to continue to lag, but bigger picture blue chip stocks should continue to gain over the next 12 months.

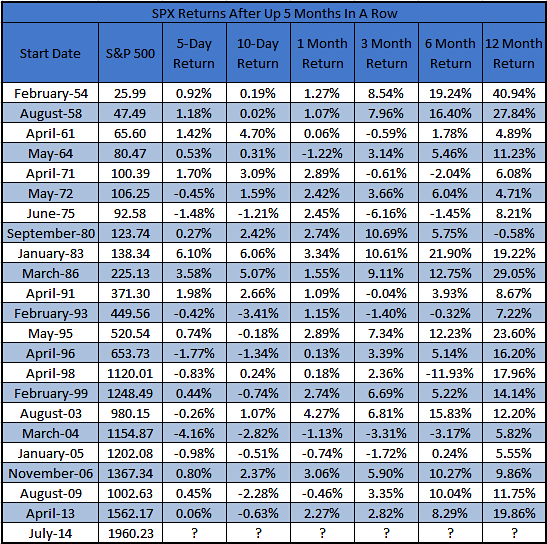

In case you wondered, here are the 23 times the SPX was up 5 months in a row and the S&P 500 performance afterwards.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.