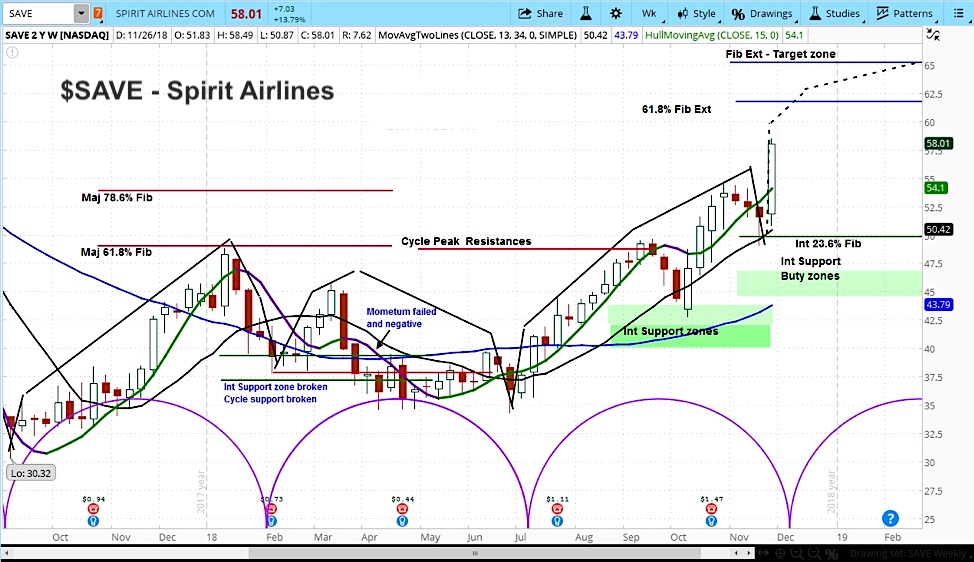

Spirit Airlines Stock (SAVE) – Weekly Chart

Spirit Airlines stock (NYSE: SAVE) traded 20% higher on Tuesday morning, after nudging its guidance for Q4 revenue per seat mile.

Given that it recently started a new market cycle, we see more upside for Spirit Airlines stock price.

Our projection combines technical analysis with market cycles, which has been positive for this stock.

In fact, this move marks the start of a new rising phase of a new cycle for Spirit’s stock (SAVE). We see more upside for SAVE, as the stock’s price is making a new high and it is still early in the cycle. As such, our projection is now $62-65 for the coming months.

Spirit Airlines Bumps Up Q4 Guidance

The low cost airline updated its Q4 guidance for a key sectoral metric, total revenue per available seat mile. Spirit now expects to revenue per seat mile to increase by 11% rather than its previous estimate of 6% year over year.

As well, the company reduced the range of its expectation for non-fuel costs per seat mile.

“The improvement is primarily driven by higher non-ticket revenue and higher load factor expectations,” Spirit explained in an SEC filing. In plain English, they figured out how to charge more for baggage and other items.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.