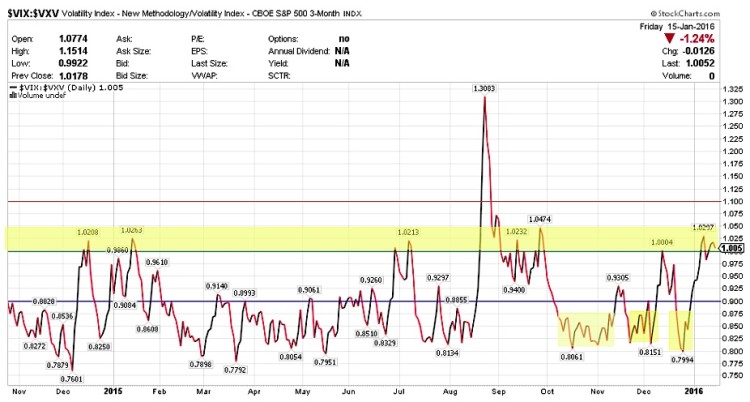

$VIX:$VXV:

$VXV is the 3 month volatility index. The relationship between $VXV and $VIX (30 day volatility) or the ratio between them if > 1.00 often spells trouble for stocks.

This ratio spiked again over 1.00 and finished the week at 1.005. It is still elevated so a reversal is possible. But if this goes higher, that can spell trouble for the stock market as a whole (while indicating a lot of fear).

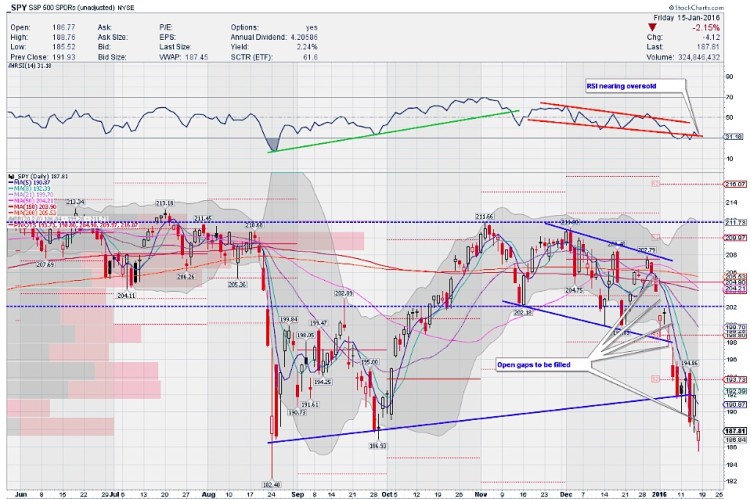

$SPY DAILY TIMEFRAME:

The S&P 500 (SPY) finished the week by printing a Doji candlestick (a classic sign of indecision). And volume for this stock market decline is running near the August stock market correction volumes.

$SPY is currently below all moving averages. I am watching 185 as a potential bounce level. Caution though. And do not over stay your welcome.

RSI is below the median in the bearish zone but just a tad above the oversold markets zone. MACD continues to fall and is well below median. Slow STO is embedded and seen crossing lower in the oversold markets embedded zone. Not a great sign either. More downside with a possibility of a dead cat bounce.

S&P 500 ETF (SPY) Chart – Will oversold markets become more oversold?

You can read more of my weekly analysis on my website. Thanks for reading and have a great week.

Twitter: @sssvenky

The author has a position in S&P 500 related securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.