Dow Jones Industrials

On the positive side, secondary indexes (like the small-cap Russell 2000 and the Dow Transports) are closing in on new highs of their own. After faltering in August, the Dow Transports have come surging back in September – both momentum and the relative price trend (versus the Dow Industrials) are on the cusp of breaking through down-trend resistance.

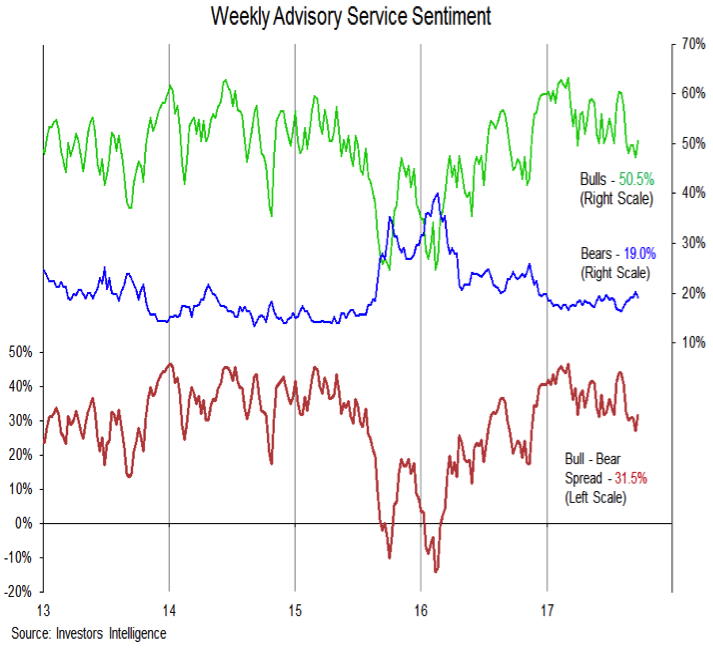

Investor Sentiment

The NAAIM exposure index (included on the previously shown weekly S&P 500) increased from 71% to 75% this week. The details of that data suggest bears are throwing in the towel – the most bearish positioning increased to its highest level since 2013 (even the most bearish investment manager is 40% net long equities, up from 0% the previous week). The Investors Intelligence survey shows bulls ticking higher and bears moving slightly lower. The trend in the Investors Intelligence data is similar to what is seen on the NAAIM data – excessive optimism which fueled gains earlier this year is now fading but pessimism remain scarce.

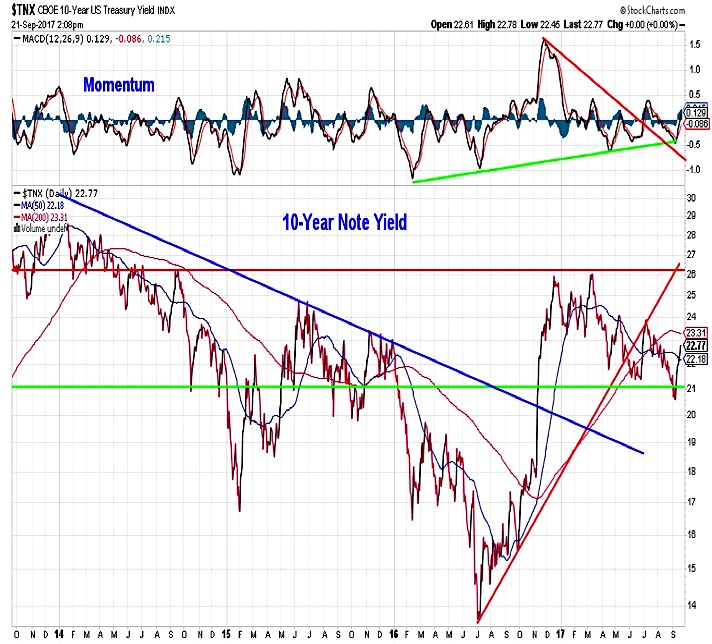

10-Year U.S. Treasury Note Yield (TNX)

Following what appears to have been a false breakdown to new lows for the year, the yield on the 10-year T-Note has been moving higher. Even as the yield has faltered this summer, the momentum up-trend that emerged last year has remained intact. While bond market sentiment nearing excessive optimism, yields could be set to drift higher over the remainder of the year, especially if German Bund yields continue to do so as well.

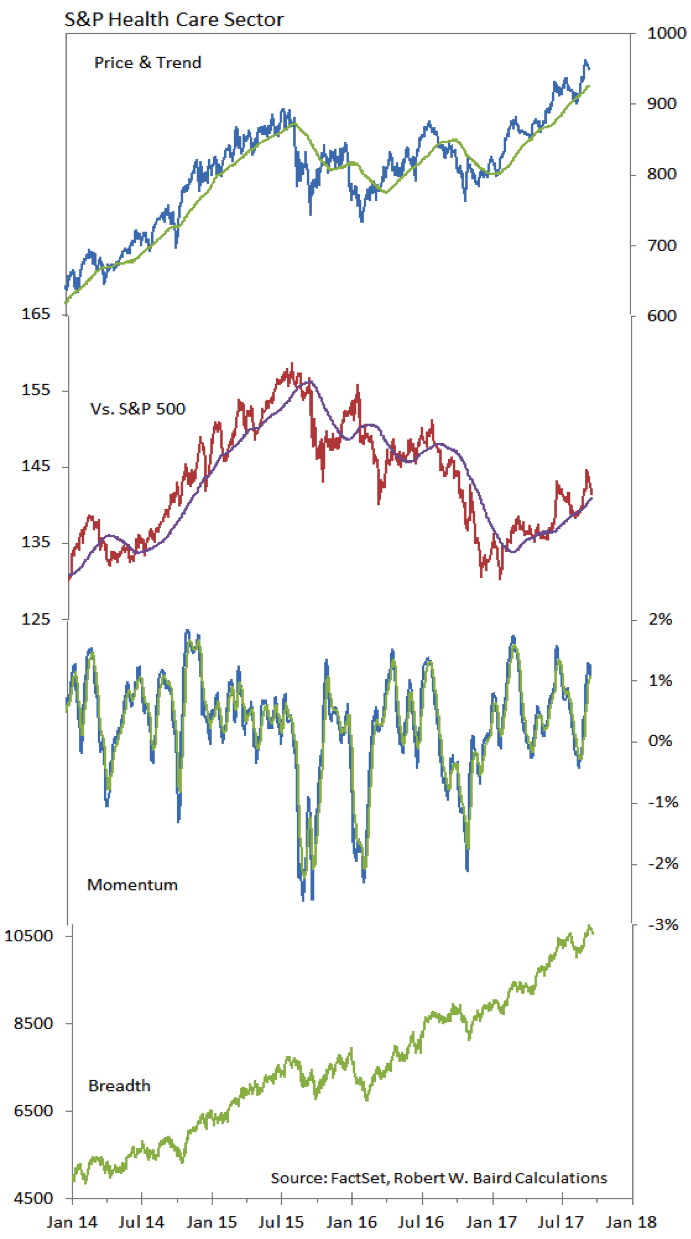

S&P Health Care Sector

The Health Care sector has somewhat quietly been a star in 2017. It has been in the leadership group based on our relative strength rankings since May and is the secnd best performing sector on a year-to-date basis (trailing only Technology, just ahead of Materials and Industrials). Breadth in the sector has been strong and the relative price line has moved steadily higher this year (following an 18-month period of relative underperformance).

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.