Last week played out exactly how the first week of November would have played out from a seasonality perspective. Quite strong despite the back and forth chop on the S&P 500. Despite being extended, stocks are looking good for another push higher towards All Time Highs (approximately 2% away on the S&P 500).

There are 2 sets of traders – 1. Leaning towards a breakout to All Time Highs and 2. Shorting and possibly playing from the hole waiting for a pullback. Many are leaning towards a pause and I too believe one is on cards before a year-end rally but all that we’re seeing so far is nothing more than 2-3 days of consolidation and up again.

Will this pattern play out again?

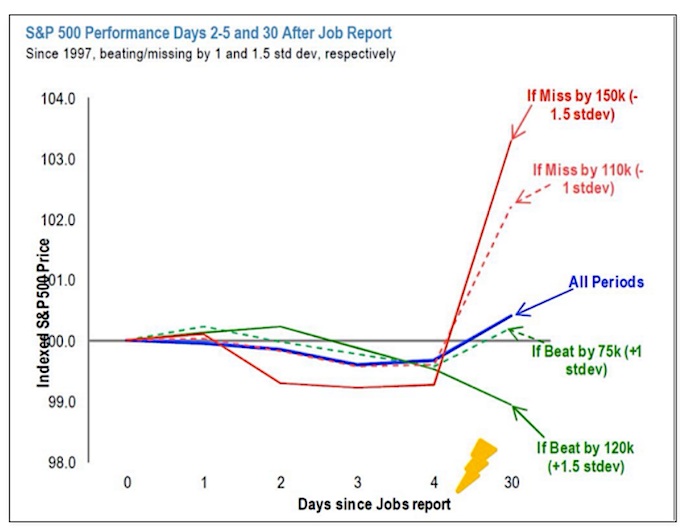

The NFP jobs numbers on Friday were way stronger than expected and the initial reaction was lower. However, it seemed as though the market was absorbing the chances of a rate hike and took this stride (finishing mixed). One caveat though and something that we need to take notice of is that strong “beats” in NFP have often been followed by weakness over the coming days on the S&P 500 (green lines). This is another potential headwind (chart per Urban Camel – @ukarlewitz).

The U.S Dollar has started to gain strength and that seems to be helping small caps stocks as there have been several seasonality calls for small caps to outperform in the next 2-3 months. With a Fed rate hike in the cards, financials are pre-running the announcement and outperforming while REITs, consumer staples and discretionary along with utilities are being crushed. While I think that Federal Reserve may not increase the rate, my take has always been that a rate hike is in line with the economy and the numbers out of various Economic reports show that economy is doing well enough to absorb a rate hike.

The Economic Calendar this upcoming week is very light. Banks are closed on Wednesday while stock markets are open for Veterans Day. Friday seems to be a little heavy with respect to reports coming out and they include PPI, Retail Sales, Business Inventories and Consumer Sentiment.

Market Breadth Indicators:

Stocks are extended and overbought and some divergences are showing up. Stock market momentum to the upside is certainly waning but still dip buyers are propping up the markets at key support levels.

That said, stock market breadth oscillators are clinging to the buy signals by whisker and Friday’s market breadth was certainly somewhat negative. CBOE Volatility Index ($VIX) saw a spike but could not sustain a move higher and any move higher will be bearish for the stocks. Overall, most stock market indicators are bullish however quite a few are overbought near term.

Below is an S&P 500 sector glance with Slow STO perspective. 6 out of 9 sectors are currently overbought. The Technology Sector (XLK), Energy Sector ETF (XLE) are certainly overbought while the Utilities Sector (XLU) and Consumer Staples Sector ($XLP) are near-term oversold – so a short-term reversal is possible here.

Note: Slow STO is a bound indicator. click charts to enlarge

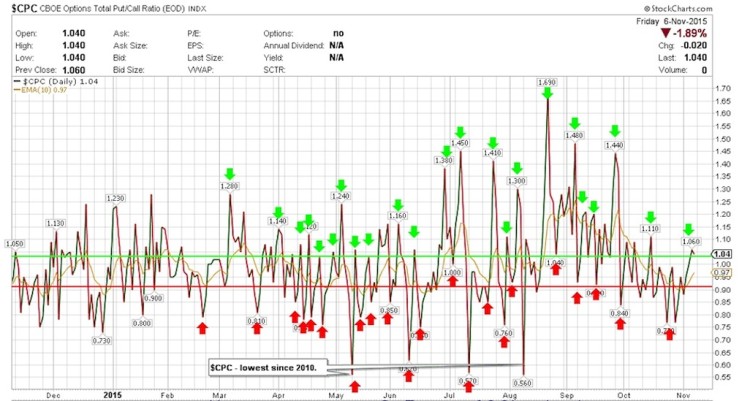

$CPCE – Equity Only Put/Call Ratio:

The Equity Only Put/Call Ratio continues to move lower and that is bullish for the stocks. However do note that stocks are in the lower range which often means that they are overbought.

$NYMO (McClellan Oscillator):

The McClellan Oscillator has moved below the zero line and is at -4.77. If there is any weakness in equites, $NYMO will go much lower. This is one of the key breadth indicators to watch closely for the upcoming week or two.

continue reading on the next page…