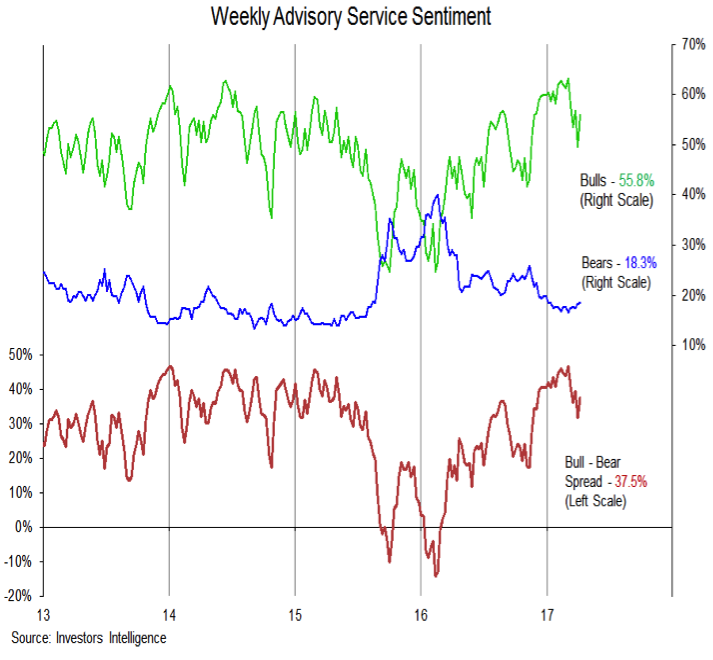

Investor Sentiment

It may not take an overall decline of that magnitude (7%) to get investors more cautious. The NAAM exposure index has already dropped from above 100% to below 70% (a reading below 60% would unwind all the post-election optimism). Likewise, the bull-bear spread on the Investors Intelligence survey of advisory services has begun to contract as bulls have retreated from their early-March peak. A further contract in bulls and, importantly, a rise in bears, could help move the spread back below 20%, which would also indicate an unwinding of the post-election surge in optimism.

XBD – Broker/Dealer Index

The broker/dealer index provided an early indication of the strength that emerged over the second half of 2016, but declining momentum and the failure to breakout to a new relative price high also provided a clue that a broader consolidation phase was emerging. While the sector has held onto support on an absolute price basis, both momentum and relative price trends are being tested. Renewed relative leadership from broker/dealers could be evidence that stocks overall are ready for a sustained rally.

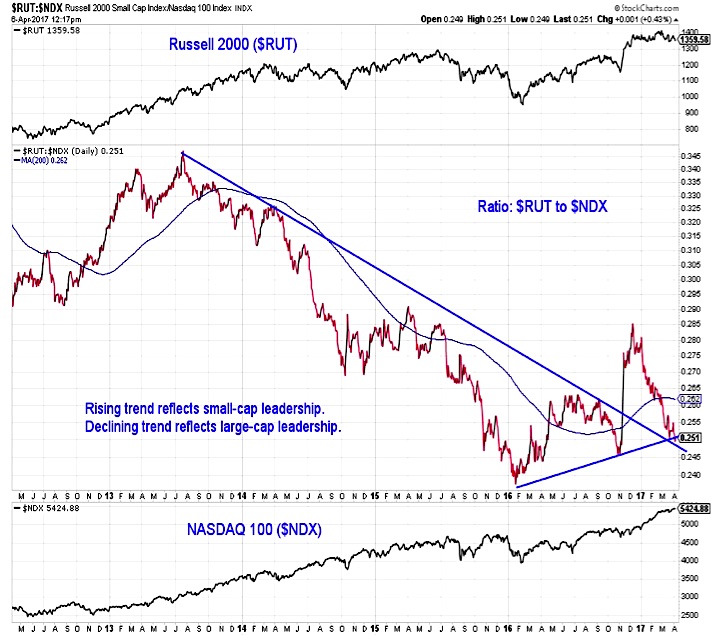

Small Caps Relative Performance

The Russell 2000 (INDEXRUSSELL:RUT) and small cap stocks were early leaders in 2016, seeing a dramatic surge in strength during the initial phase of the post-election rally. Since mid-December, however, small caps have yield leadership to large caps. The price ratio between the small-cap Russell 2000 and the mega-cap NASDAQ 100 reveals the shifts in leadership seen over the past five months. Small caps face an important test of support relative to large caps.

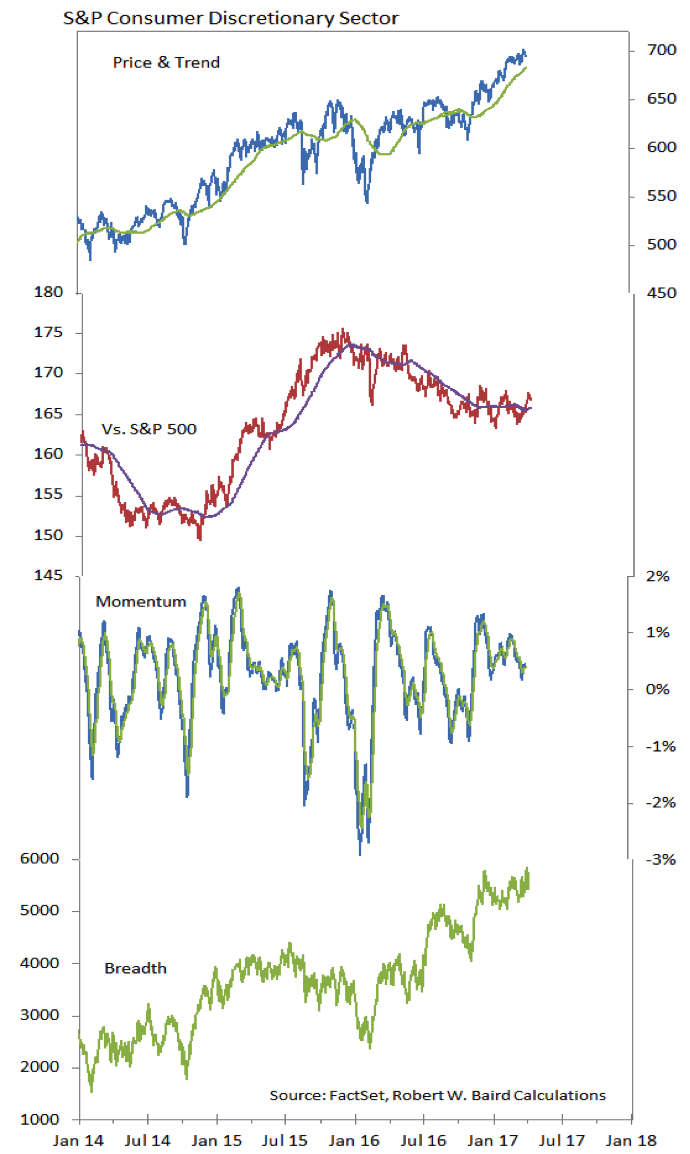

Consumer Discretionary Sector

The Consumer Discretionary sector slipped into the relative strength rankings leadership group in mid-February, but we have not called much attention to the sector because the multi-year relative price downtrend has been very much intact. That could now be changing as the relative price line is testing resistance. The upturn in momentum off of the early 2016 lows remains intact, and both price and breadth have been making new highs.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.