Energy Sector

Weakness in the Energy sector (down over 3% this week) can be attributed to weakness in the price of crude oil, which moved to its lowest level of the year this week. Rather than a cause for concern, the decline in the dollar-adjusted price of oil has historically been bullish for stocks.

In other words, while weakness in oil may be a headwind for the Energy sector, history suggests it is unlikely to be a catalyst for weakness in the stock market overall (source: Ned Davis).

International Spotlight – Euro Stoxx 50

The Euro STOXX 50 index has pulled back to support on both an absolute and relative price basis, suggesting the uptrend that emerged over the course of the second half of 2016 could be set to re-emerge in the second half of 2017. The caveat is that as price has consolidated, momentum has slipped out of gear.

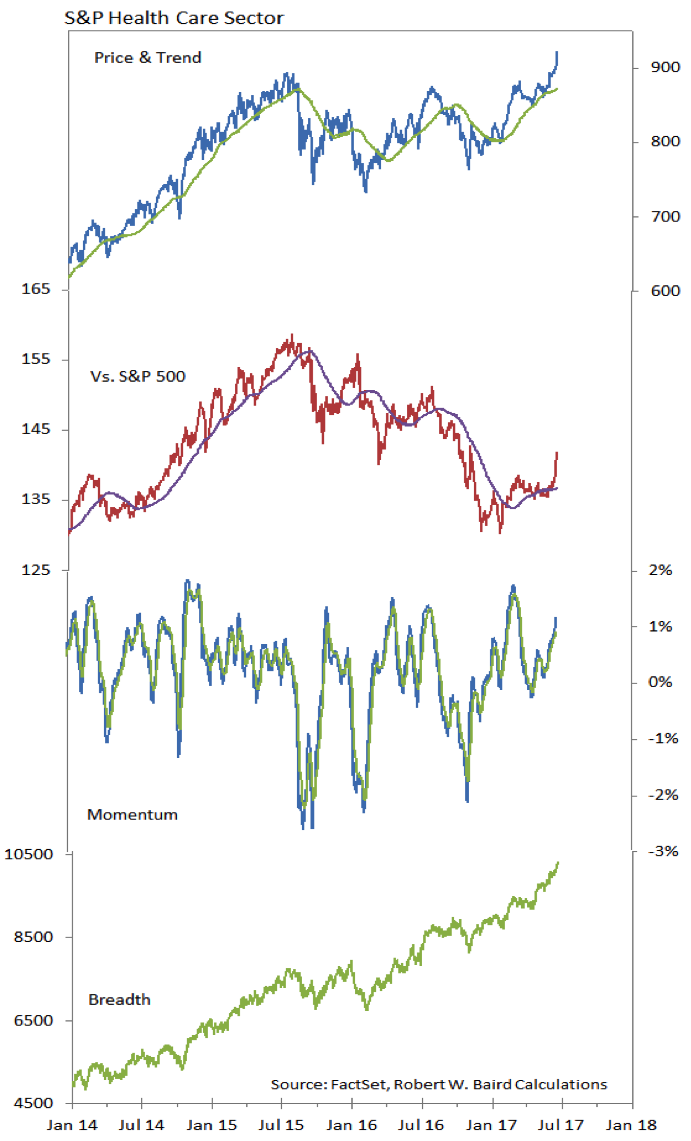

S&P Health Care Sector

At perhaps the point of maximum focus on the handful of large-cap technology companies that were purportedly holding up the entire stock market, the Health Care sector broke out to new highs and is now challenging Technology for the top-spot in year-to-date sector performance. Breadth in the Health Care sector is supportive and momentum is expanding. The relative price line is moving in a positive direction, although a longer-term downtrend line could be a source of resistance.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.