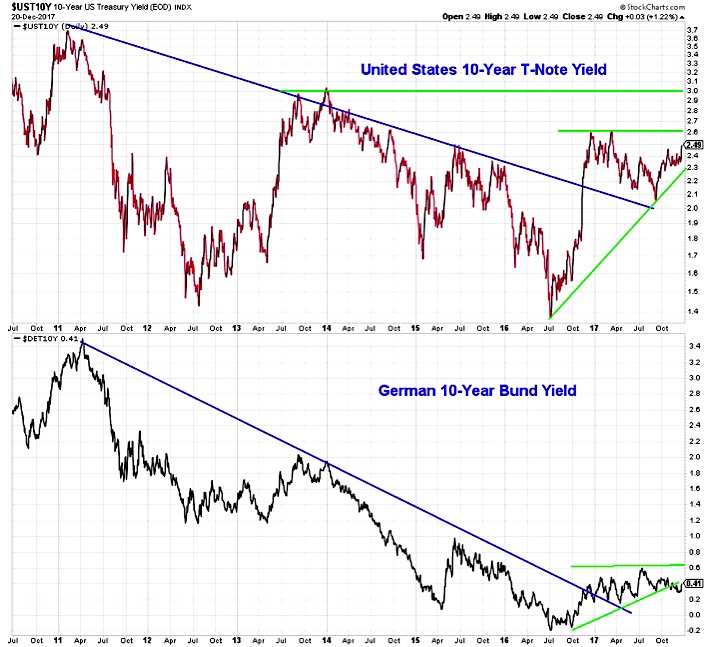

10 Year Treasury Yield

The yield on the 10-year T-Note has climbed since testing and holding support at the extension of the down-trend line near 2.1% in September. More recently it held support near 2.3% and has broken out to its highest level since the first quarter. Clearing resistance near 2.60% would be the next meaningful threshold. German Bund yields have also picked up, and if the T-Note is going to clear 2.60%, the Bund yield will likely have to exceed 0.60%.

Supporting the move higher in bond yields has been the recent rebound in copper prices. Copper had been leading yields higher, but has spent most of the fourth quarter consolidating between 3.20 and 2.90. Support has held and copper is now testing the upper end of that range. A fresh break-out could clear the way for bond yields to follow suit.

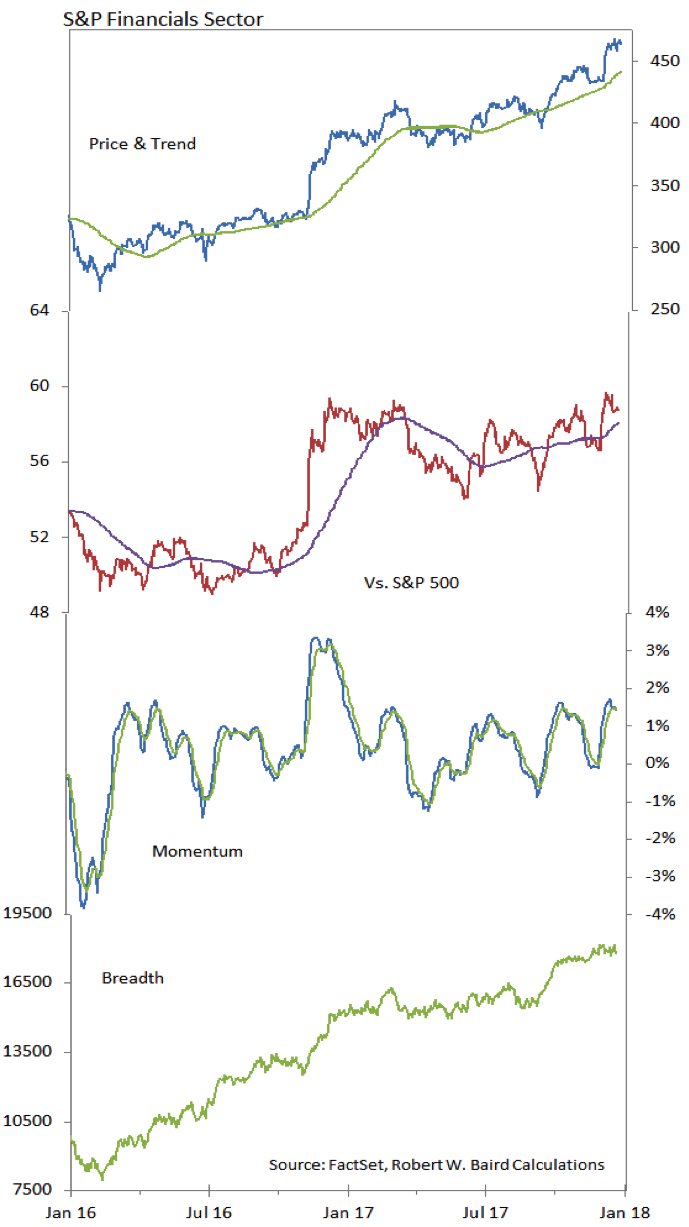

S&P Financials Sector

Also consistent with a rebound in bond yields has been the performance of the Financials sector. Momentum has improved in the sector and it has made new highs on both an absolute and relative price basis. Particularly encouraging has been the strength seen in the Broker/Dealer index (which has been making new absolute and relative price highs of its own). After slipping briefly in November, the Financials sector has been among the top two sectors in our relative strength rankings for the past three weeks.

Thanks for reading and happy holidays.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.