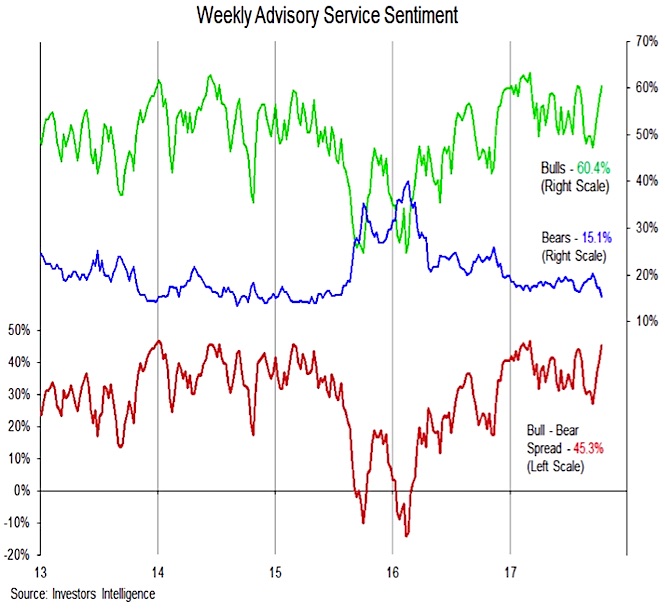

Investor Sentiment

On a one-week basis, the Investors Intelligence (II) data has moved opposite the NAAIM data. While the NAAIM exposure index dropped from 90% to 77% this week, the II showed a surge in bulls (to the highest level since March) and a decline in bears to the lowest level since May 2015. Stocks have struggled to make headway when optimism has been this excessive in the past. On a shorter-term basis, the NDR Trading Sentiment composite is in its excessive optimism zone as well.

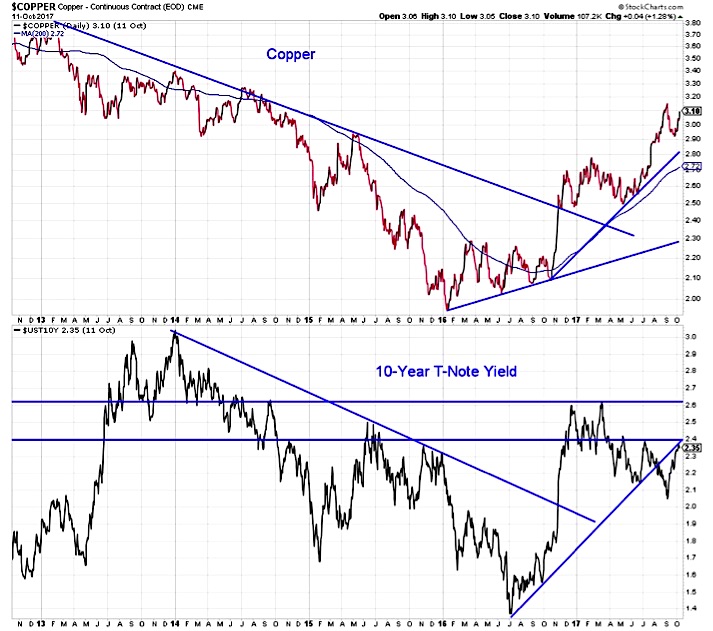

Treasury Bond Yields

The 10-Year U.S. Treasury Note Yield (INDEXCBOE:TNX) has moved higher off its August low, and is now approaching resistance near 2.40%. Over the past several years, the T-Note yield has moved in sync with copper prices, and copper is moving back toward its recent peak. This would seem to suggest the path for bond yields moving forward is higher.

Yields in the U.S., however, are also dependent on overseas bond yields. If Treasury yields are going to follow copper prices higher, they will likely have to bring German Bund yields with them. With the ECB continuing (for now) its QE programs, German yields could struggle to move higher, although the trend is modestly in that direction. Surprises out of the ECB or hints that Mario Draghi may be planning a more abrupt than expected shift from quantitative easing to quantitative tightening could put upward pressure on Bund yields. This would support the message of higher T-Note yields being put forth by copper prices.

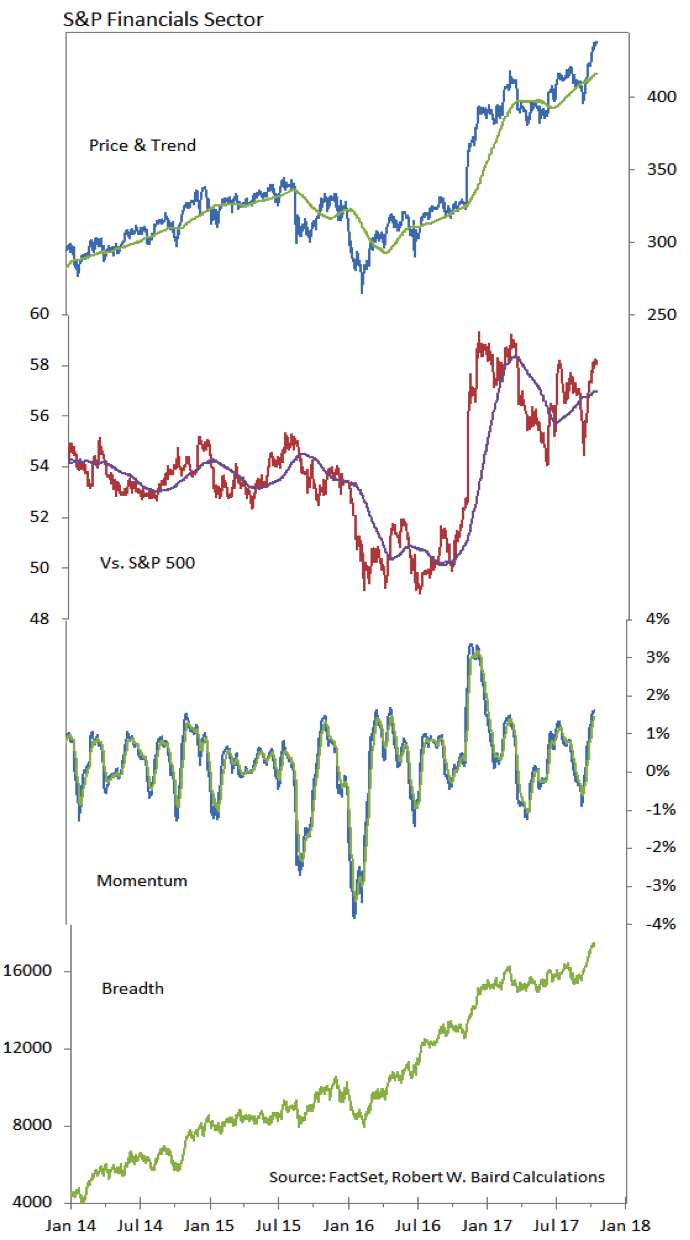

S&P Financials Sector

The area of the stock market to look for evidence that bond yields are poised to move higher could be the Financials sector (NYSEARCA:XLF). Breadth in the sector remains strong, momentum is expanding and the sector itself is seeing new price highs and is in the sector relative strength rankings leadership group. On a relative price basis, Financials are struggling with down-trend resistance.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.