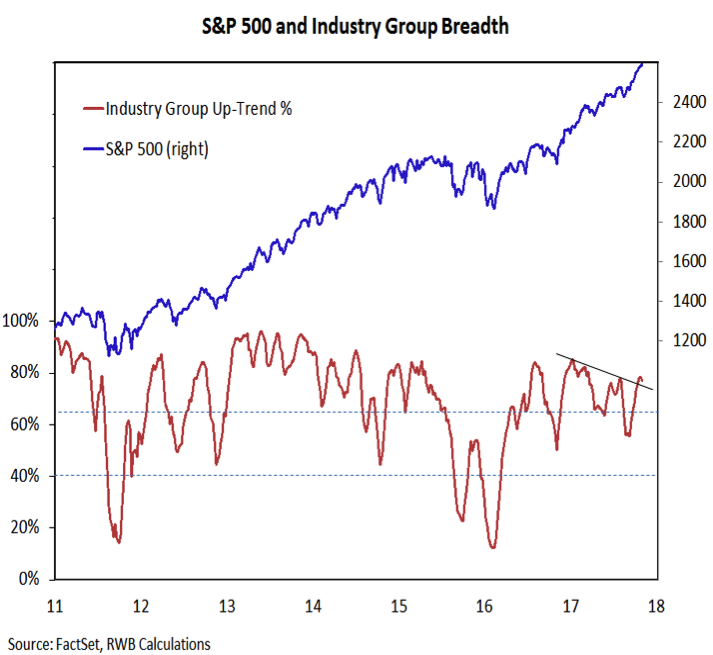

Market Breadth (cont.)

Our primary gauge of broad market strength is the percentage of industry groups in up-trends. This has rebound since the summer low but is still below its early year peak. If this indicator starts to roll over, it would be evidence that breadth trends are deteriorating. This could pose a heightened risk for stocks overall. Right now we are not seeing, and the divergence between the S&P 500 and the shorter-term breadth indicators may get resolved through broad market strength rather than index-level weakness.

US Dollar Index

The dollar has moved off its mid-year low, but it is too early to suggest definitive that it is seeing anything more than a counter-trend bounce. Momentum has turned higher, but the pattern of the past several years is largely unchanged and the yearly change has yet to turn higher.

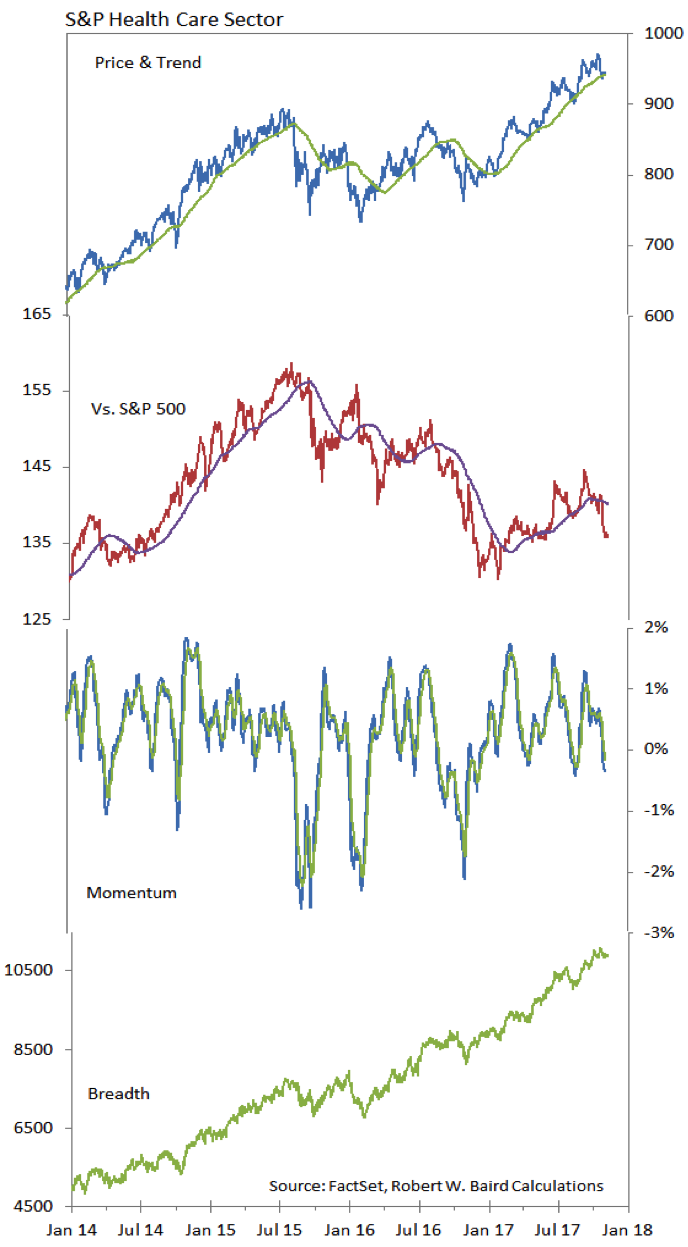

S&P Health Care Sector

The Health Care sector has been one of the top performing sectors in the S&P 500 in 2017, but recent weeks have seen a pullback to support. Accompanying this has been a pronounced deterioration in relative price and an expansion in downside momentum. The relative price breakdown comes after a false breakout to the upside. Breadth in the sector has remained generally robust.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

s&p