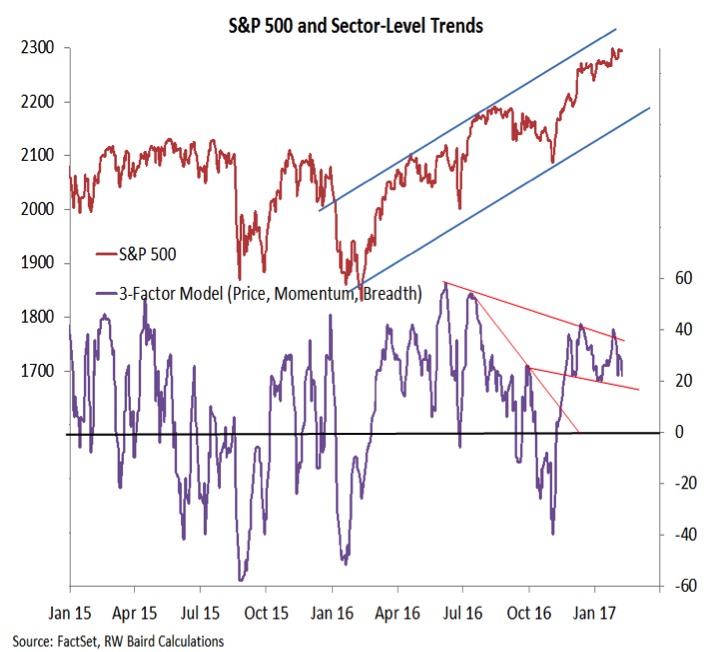

S&P 500 Sector Level Trends

We are also watching sector-level trends to provide more conviction that the new index-level highs are sustainable. Right now, the message at the sector level is one of near-term skepticism. Price, breadth, and momentum trends for the S&P sectors have deteriorated as the S&P 500 has moved to a new high. The list of sectors making new highs remains quite narrow. Only Information Technology has moved to a new 52-week high.

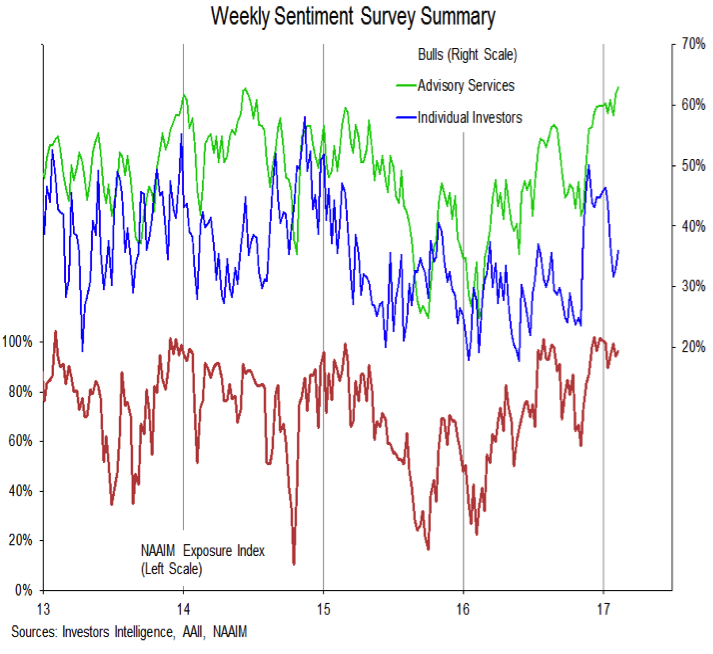

Investor Sentiment

All three of these primary sentiment surveys showed an up-tick in optimism this week. The Investors Intelligence survey of advisory services shows the most bulls in over a decade. The AAII survey of individual investors shows more caution and a fair amount of indecision (neutral got the most votes in this week’s survey) but optimism did tick higher and bulls are back to outnumbering bears. The NAAIM exposure index ticked up from 94% to 96%, as most active managers remain fully committed to equities. Optimism can stay elevated for extend periods of time (sentiment peaks tend to be more stretched out than sentiment troughs), but this data suggests risks are elevated.

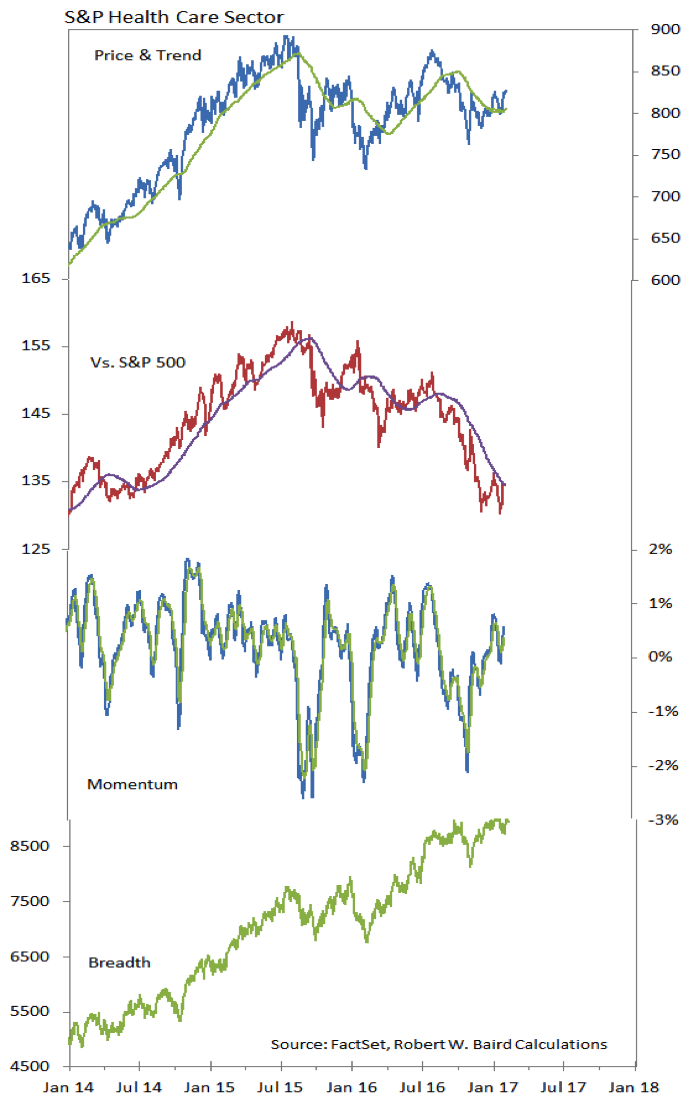

Health Care Sector

Health Care has moved out of the cellar in our relative strength rankings in recent weeks. We have yet to see sufficient follow through to suggest that a sustained period of leadership lies ahead. A new high in momentum and breadth as well as a higher high versus the S&P 500 would be important evidence that a sustainable up-trend may be emerging in Health Care.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.