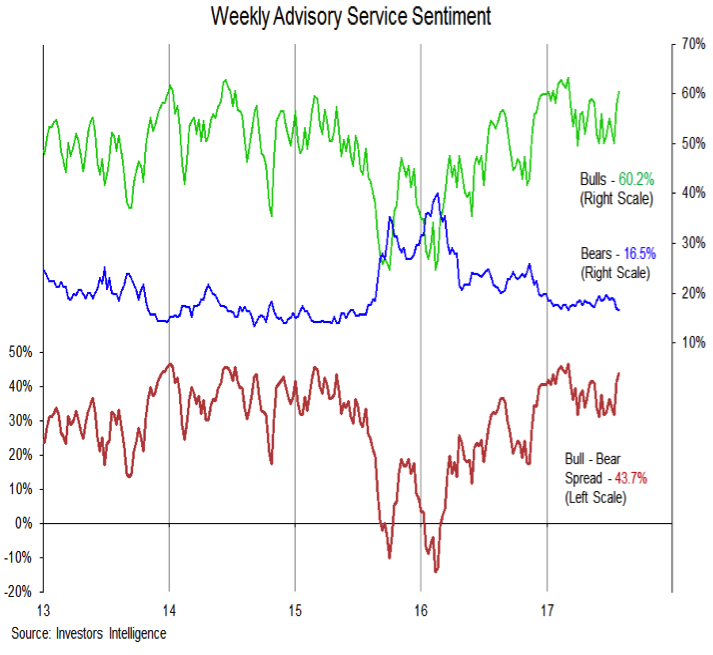

Investor Sentiment

Investor optimism has surged in recent weeks, and we now rate investor sentiment as a headwind for stocks. This week’s Investor’s Intelligence data shows 60% bulls, up from just 50% two weeks ago. Bears also drifted lower and have matched their lowest level since mid-2015. The NAAIM exposure index rose 10 points to 94%, and is just below the peaks that occurred in May and June (near 97%).

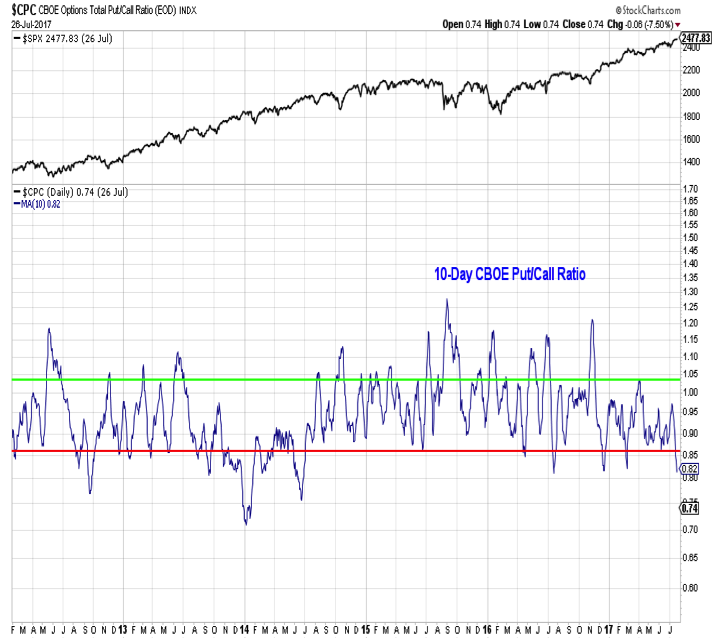

CBOE Put/Call Ratio

While this week’s collapse in the VIX (to an intra-day low below nine) has generated plenty of headlines, the more troubling near-term development from an options perspective is the collapse in demand for put options, as reflected in the 10-day CBOE Put/Call Ratio. This ratio has dropped to its lowest level of the year and is approaching levels not seen since the first half of 2014.

The NDR Trading Sentiment Composite, which aggregates a number of near-term sentiment indicators, is flashing a sell signal for the first time since March.

While excessive optimism and a potentially more suspect seasonal pattern could weigh on stocks in coming months, the macro backdrop has not turned unfavorable.

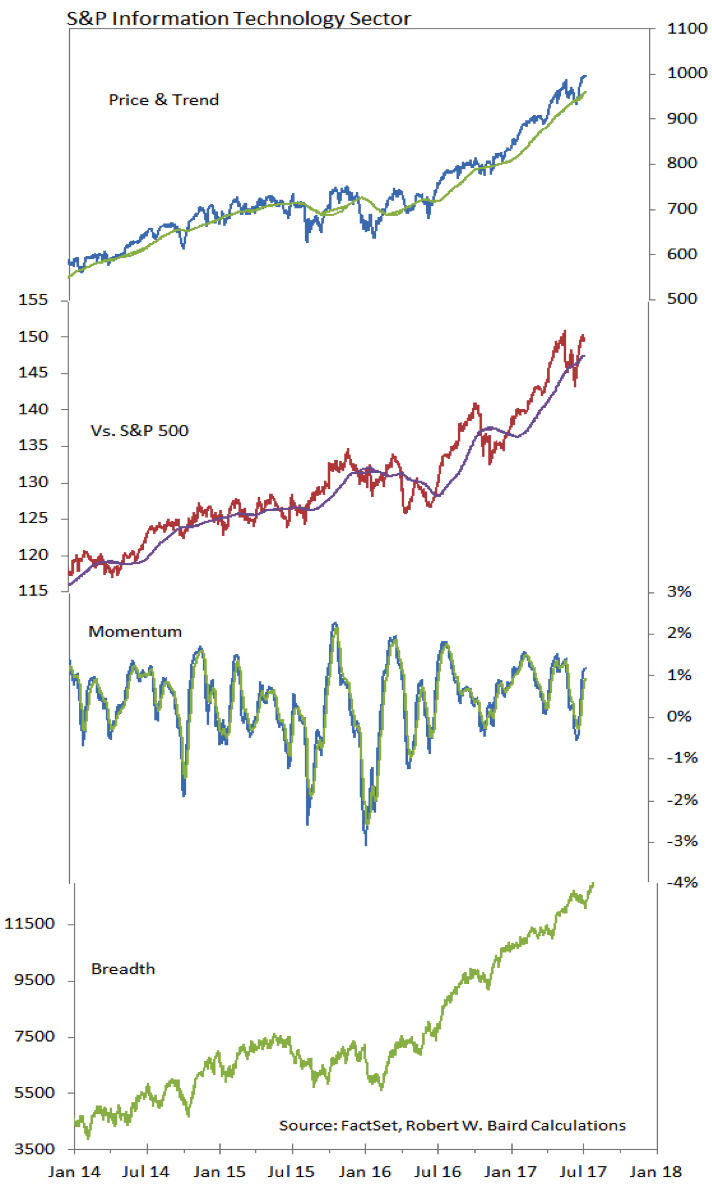

S&P Information Technology Sector

The Technology sector remains in the leadership group from the relative strength rankings and has been making new price highs. Momentum in the sector has turned higher, but has not broken the pattern of lower highs and the relative price line suggests Tech sector leadership may be waning. At the sub-industry level, relative strength trends are deteriorating and leadership has become more narrow.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.