S&P 500 Trading Outlook (3-5 Days): Mildly bearish

There’s an above-average possibility of the bounce attempt stalling out today.

A crash seems doubtful, however, given the spike in Put/Call ratio. Market breadth and momentum are in better shape than a few weeks ago as well.

The bottom line is that pullbacks into early next week should be buying opportunities, in my opinion.

Looking at the weekly chart, I see a true line in the sand at the 2600-22 price area. Any loss of that area would need to be quickly recovered. Until this occurs, it’s tough making too much of a larger bearish case for equities based on index prices alone. Individual stocks are down much more, and that’s a different story indeed.

As long as 2600 give or take is held, then the larger pattern/structure is neutral.

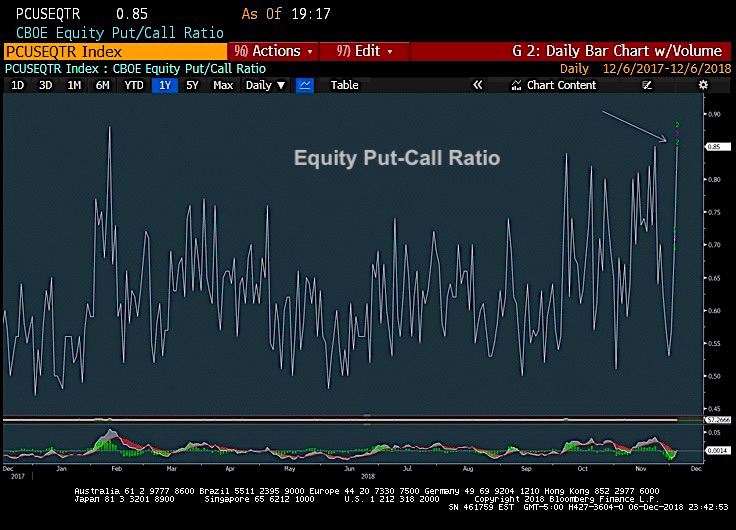

Put-Call Ratio

The put/call ratio on Equities has quickly gone from the lows of the yearly range to the highs in the matter of one week’s time. This is important for those looking for “trading” lows, as readings had been largely subdued of late. So the spike back to new highs indicates the start of real concern, and from a contrarian point of view, makes for an easier time buying dips during times of fear.

Overall, trading lows in stocks look likely sometime next week, and weakness back to the lows into next week should coincide with a chance to cover shorts and consider buying, as opposed to expecting a larger crash.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.comregading how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.