Stock Market Futures Considerations For December 12, 2017

The S&P 500 (INDEXSP:.INX) is holding near the highs today as the Federal Reserve kicks off its two day meeting. Buyers look emboldened and the price action is still bullish. In the commentary below I break down the trading setups for S&P 500 and Nasdaq futures indices along with crude oil.

Note that you are invited to join us tomorrow at the Schwab Live trading conference (in Dallas). We’ll be on a live show there – “It’s a Trader thing”.

You can access today’s economic calendar with a full rundown of releases.

S&P 500 Futures

New highs yesterday and a hold of price into quiet morning trading. Buyers have resumed power and continue the march up under prevailing bullish momentum. Stronger support now sits near 2655 with 2640 below that. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 2667.75

- Selling pressure intraday will likely strengthen with a failed retest of 2663.5 (countertrend).

- Resistance sits near 2667.5 to 2672.5, with 2677.75 and 2685.5 above that.

- Support holds between 2663.5 and 2655.25, with 2648.5 and 2637.5 below that.

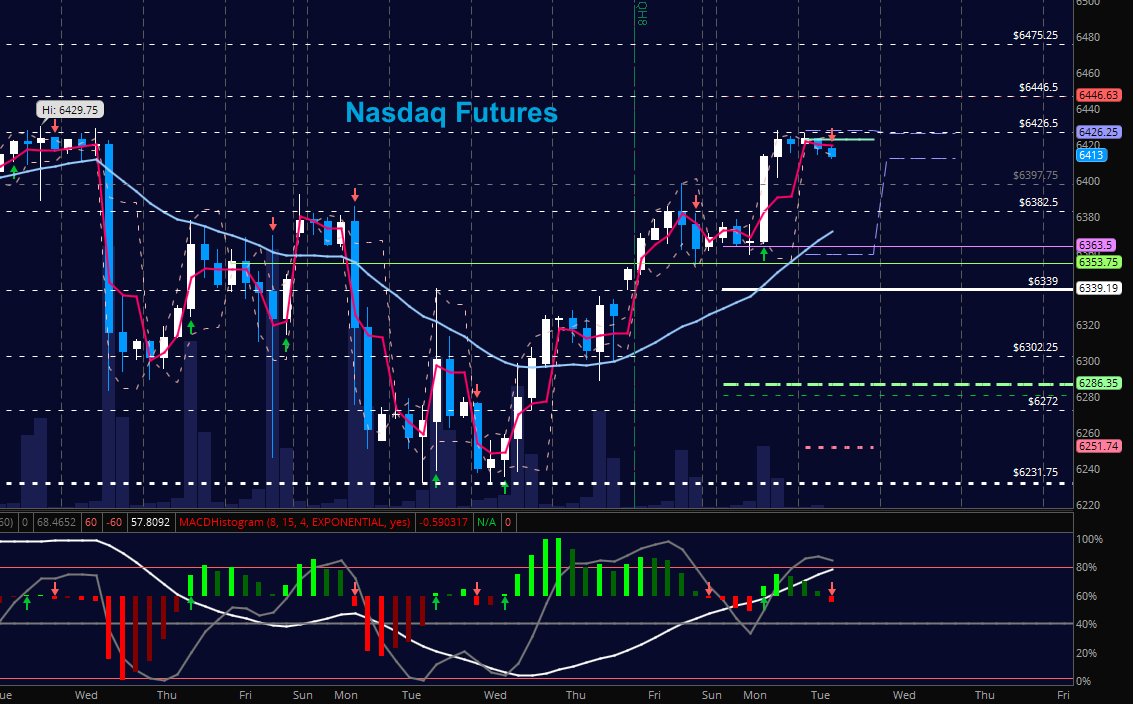

NASDAQ Futures

Buyers took us very close to new highs but could not breach the levels before sellers came in. We did have a support retest but to the higher level noted yesterday near 6353 after which we rolled through 6397 in a press to our current levels. Formations are still messy but bullish, so the current fade we see is likely to find buyers above 6380. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6397.5

- Selling pressure intraday will likely strengthen with a failed retest of 6362.5

- Resistance sits near 6424.5 to 6446.5 with 6475 and 6503.75 above that.

- Support holds near 6412 and 6397.75, with 6382.25 and 6360.75 below that.

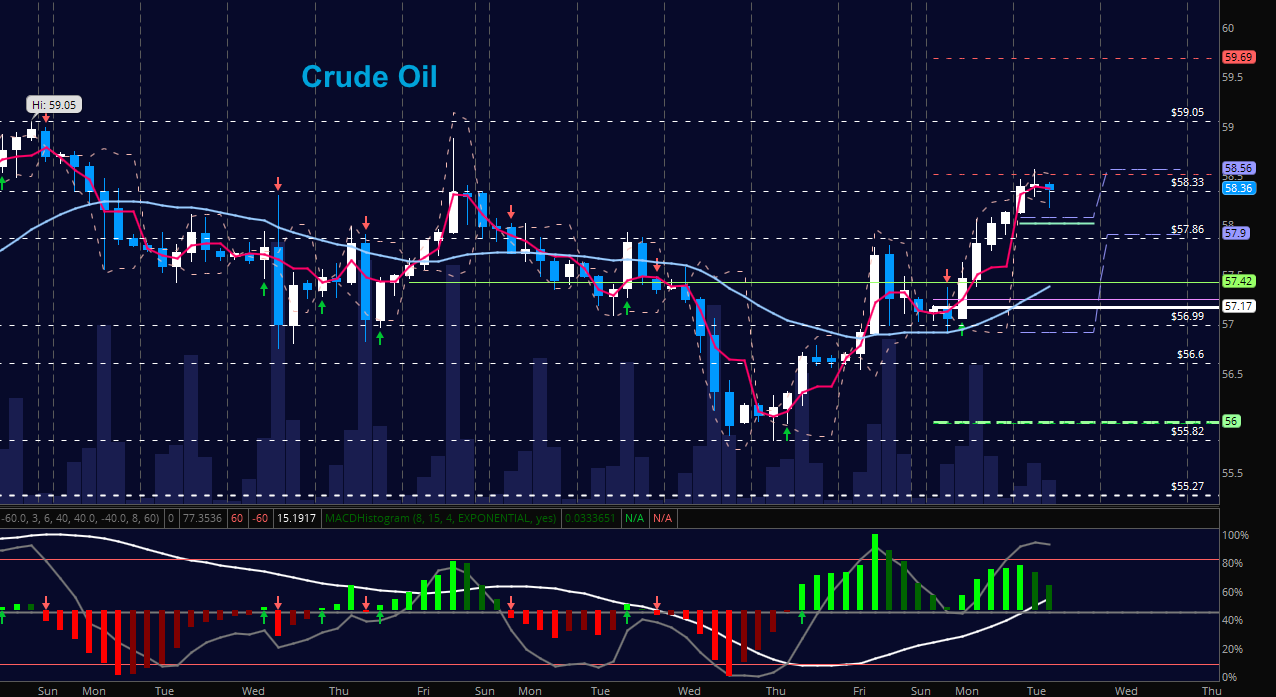

WTI Crude Oil

As traders held 56.8 as support, we moved right into the target at 58.36 – not a place to short until it fails the retest. Momentum is messy so dips could be sharper – but buyers are very likely to win this battle. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.6

- Selling pressure intraday will strengthen with a failed retest of 57.78

- Resistance sits near 58.56 to 59.05, with 59.7 and 60.05 above that.

- Support holds near 58.12 to 57.86, with 57.65. and 57.3 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.