Just as traders were readying for some follow through to the downside, stocks put in a strong performance Thursday, erasing all of Wednesday’s losses. The S&P 500 now finds itself back near 1800. And the price action has all the markings of a classic bull-bear battle. Its S&P 500 technical support vs resistance. Toe to toe.

Just as traders were readying for some follow through to the downside, stocks put in a strong performance Thursday, erasing all of Wednesday’s losses. The S&P 500 now finds itself back near 1800. And the price action has all the markings of a classic bull-bear battle. Its S&P 500 technical support vs resistance. Toe to toe.

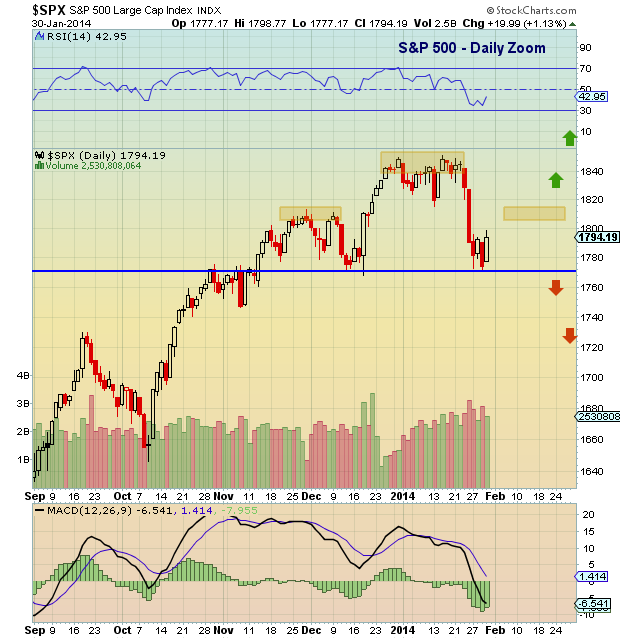

Okay, a bit dramatic, but it’s late and I’m overdue for some cheesiness. Point is, as traders we have to be aware of important levels. So let’s take a look at the technical landscape to determine where the lines in the sand are being drawn. This will provide a roadmap to discovering if the pullback is over (and new highs are coming), or if this move higher is a backtest destined to fail (setting up for a deeper move lower).

Let’s start with S&P 500 technical support. Pretty simple: 1770. This is Wednesday’s low and within a couple points of the December low as well. It’s also a support level marked by the upper wedge line from which it broke out. Furthermore, as you can see from the picture, this could quickly turn into a head and shoulder’s pattern. So the Bulls will need to defend 1770 while the bears will be looking to pressure the action lower. Should 1770 give way, support lies below at 1730, followed by 1700. Traders should also be alert for the possibility of a quick shakeout (fakeout) as well.

Now for the resistance. Although 1800 is a big round number that could give the index some trouble, more meaningful resistance comes into play around 1810-1815. This level marks the 50 day moving average, the 50 percent Fibonacci retracement level, and the November highs (which could be a left shoulder). Look for the bears to heavily defend this level, while the bulls will look to up the pressure as the index moves above 1800. Any move above 1820 will likely evolve into a retest of the highs (or new highs).

S&P 500 Daily Chart

S&P 500 Daily Chart – ZOOM

Trade safe. Trade disciplined.

No positions in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.