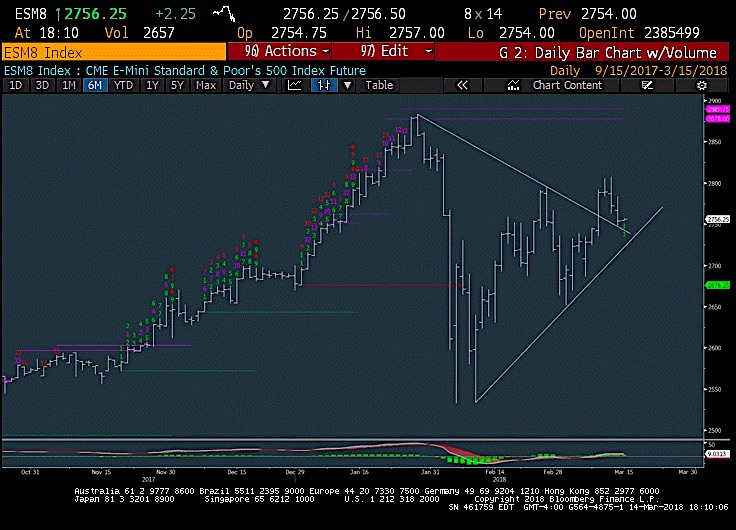

S&P 500 Trading Outlook (2-3 Days): BULLISH… unless 2740 in June Futures is broken.

Pullbacks have held where they needed to, and should now lead to a “final” rally up to former highs just above 2800 before a pullback into April.

Price structure remains sound, for now, despite a few days of selling – there’s been no real technical damage. Market breadth came in better than expected for yesterday’s decline at a mere 3/2 negative.

Overall, it’s right to favor some stabilization to this mild pullback and a rally into early next week before the possibility of a peak.

Technical Comments

Yesterday’s Equity decline proved to be fairly benign, with breadth not too extremely negative, while prices managed to hold where they needed to (the former area of the breakout). Provided that support at 2739 for S&P June Futures and 2732 for SPX cash holds, this pullback is just a back and fill consolidation. And it should lead to a “final” rally up to challenge 2800 and slightly higher into end of week/early next before a potential larger top.

The reasons for this were outlined in this past week’s Weekly Technical perspective and largely hinge on breadth, momentum, negative divergence, sentiment and cycles. The Bottom line is that until there is more evidence of price weakness, it’s right to use recent pullbacks to consider covering some shorts and going long for a “short-term” trade that brings a couple days of rally.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.