With another impressive October now in the books, US equity markets enter the final two months of 2013 with the wind at their back in the form of ebullient sentiment, continued record equity fund inflows, celebrated technicians providing reassurances, the ironic market affirmation that comes with one too many bullish Barron’s covers, broad (greater-fool-creating?) Mom & Pop articles confirming broad market breadth, strong market seasonality (now that all the 1929 and 1987 crash analogs are put to bed) and of course the inexhaustible plenary market indulgence that is the Fed’s $85 billion per month in asset purchases.

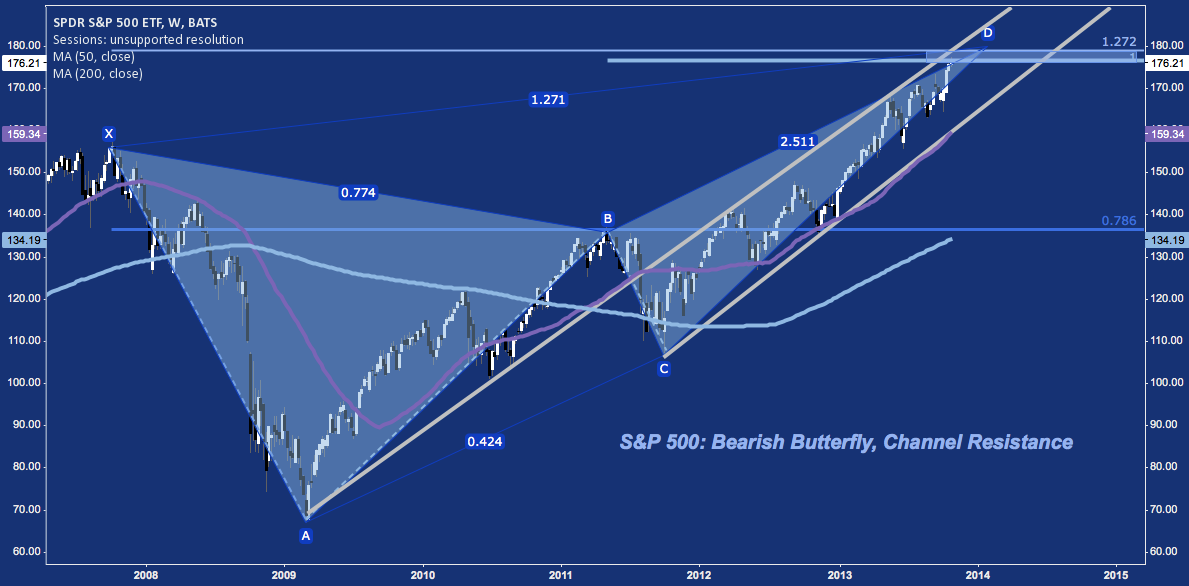

The S&P 500 (SPX) – broken down sector-by-sector – doesn’t contradict this optimism; but it does suggest it warrants a skeptical eye.

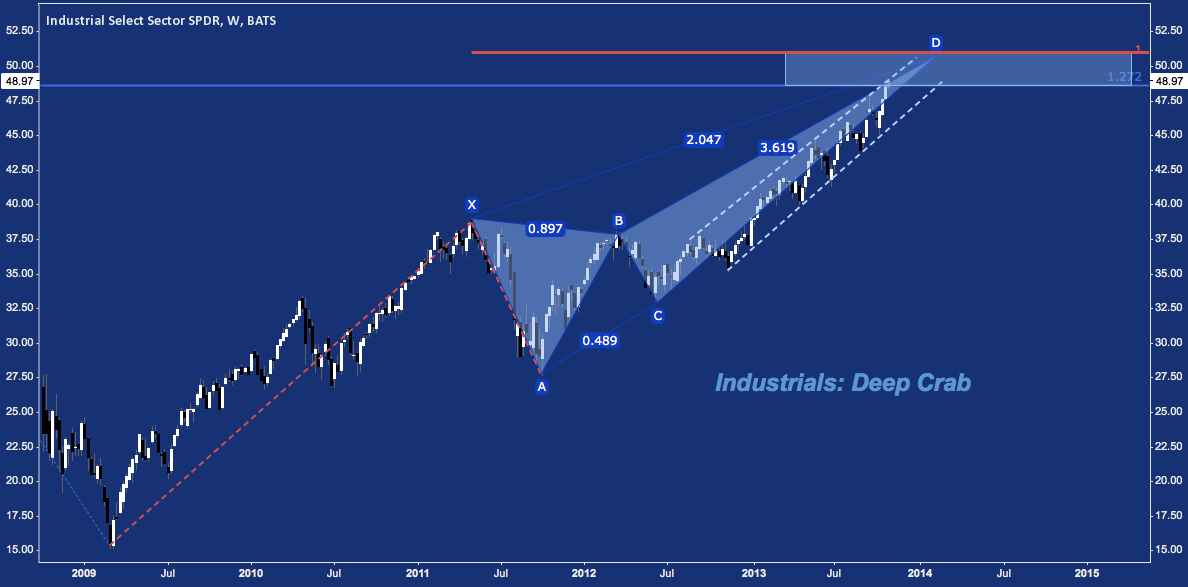

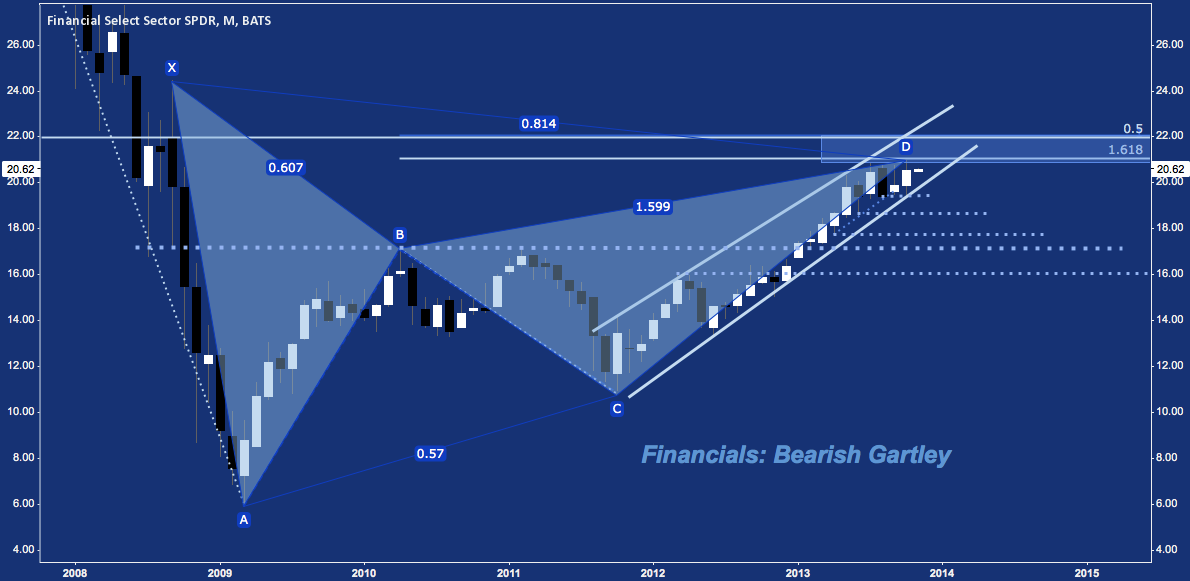

Below the S&P’s nine sectors are presented in order of their relative strength thus far in 2013. With one exception – oddly, in the defensive Consumer Staples (XLP), which is just above a 6-month consolidation pattern – whether leader or laggard the SPX sectors are at major long-term resistance. In every case the ceiling just above is structured resistance, usually in the form of harmonic pattern Potential Reversal Zones, or PRZs.

Consistent with previous installments, there are no short-term setups in this sector update: the charts are long-term – weekly and monthly – and carry significant cyclical implications. The broad coincidence of potential reversal zones across the sectors suggests the next major directional move will be widely support. Whether that move is a breakout above these PRZs or a substantial decline is anyone’s guess until it unfolds; but with the proximity of stocks (best illustrated by the SPY chart at bottom) right on top of resistance, the time to shore up by moving stops, locking in profits, managing hedges and scanning for opportunities providing optimal R (long and short) is here.

S&P 500 Sector Review: Consumer Discretionary (XLY) – Weekly (click image to zoom)

S&P 500 Sector Review: Healthcare (XLV) – Weekly (click image to zoom)

S&P 500 Sector Review: Industrials (XLI) – Weekly (click image to zoom)

S&P 500 Sector Review: Financials (XLF) – Monthly (click image to zoom)

S&P 500 Sector Review: Consumer Staples (XLP) – Weekly (click image to zoom)

S&P 500 Sector Review: Energy (XLE) – Weekly (click image to zoom)

S&P 500 Sector Review: Materials (XLB) – Weekly (click image to zoom)

S&P 500 Sector Review: Technology (XLK) – Monthly (click image to zoom)

S&P 500 Sector Review: Utilities (XLU) – Daily (click image to zoom)

S&P 500 Sector Review: S&P 500 (SPY) – Weekly (click image to zoom)

Twitter: @andrewunknown and @seeitmarket

Author holds no exposure to securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.