Last week the equity markets rallied for the third week in a row carrying the S&P 500 Index just fractionally underneath the record high set in September.

Support for the rally was better-than-expected third-quarter earnings and late week revelations that the U.S. and China are getting closer to completing the initial phase of trade negotiations.

There is also growing evidence that the global economy is stabilizing, which is being reflected in many foreign stock markets hitting new 52-week highs in October.

Could we have a repeat of the stock market debacle that occurred in the fourth quarter of 2018?

Although there are lingering concerns that stocks could see a repeat of the fourth quarter decline in 2018, this appears unlikely.

This time last year the Federal Reserve and foreign central banks were raising interest rates and foreign equity markets were hitting new cycle lows.

In the present example, 85% of central banks, including the Federal Reserve, are in an easing mode and foreign equity markets are in close proximity to new highs.

If a resolution is made regarding trade between the U.S. and China, how will it impact the markets?

It is likely that some form of a resolution will occur next month in Santiago, Chile at the Asia Pacific Summit when the two leaders of the world’s largest economies will meet.

The Administration has stated that the two sides have come to an agreement on intellectual property, financial services and a deal for American farmers and, although a lot of ill will has been bred and there is more work to do, Trump has referred to Phase 1 of this deal as a “love fest.” Should some form of agreement transpire, it would likely lessen business uncertainty, restore capital spending and be a positive for the stock market.

Are recession risks increasing?

The U.S. economy is clearly slowing with indicators such as the September ISM Manufacturing and Non-Manufacturing surveys weaker than expected and CEO confidence falling all likely due to the U.S. China trade war and geopolitical concerns surrounding Brexit, Hong Kong, and the Middle East.

On the positive side, home sales building permits and the unemployment rate have beaten estimates. I do not believe we currently have enough indicators to point to a recession. History has shown that the economy can slow and not fall into a recession. The Federal Reserve’s commitment to “act as appropriate” to sustain growth, as well as solid consumer spending backed by a strong labor market and rising wages, should continue to promote slower but moderate growth in the year ahead.

Where to invest?

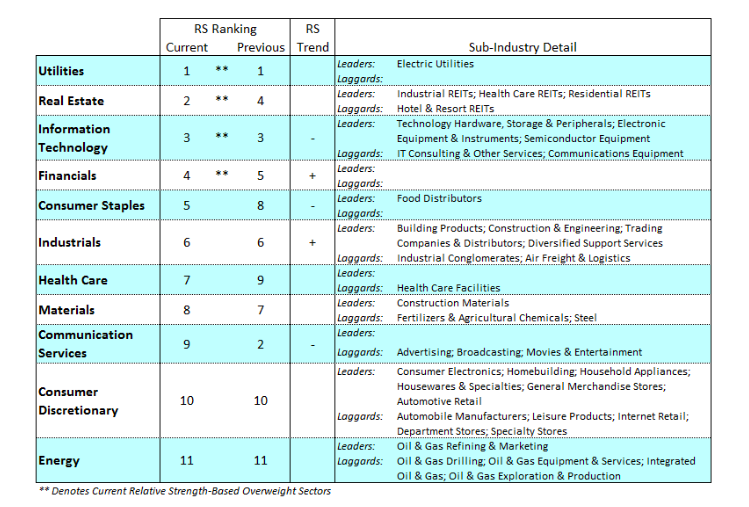

The latest S&P 500 sector rankings continue to show defensive sectors at the top of the relative strength leaderboard. Under the surface, however, there has been a movement toward technology and cyclical areas of the market. We anticipate that this could continue.

There is growing evidence that world economies, that had been dependent on monetary policy (many in negative interest rate territory) are considering fiscal measures to rejuvenate growth. This is showing up in the potential bottoming of global interest rates and the recent outperformance of global stocks relative to U.S. equities.

While we continue to think its wise to stick with the strongest sectors, including utilities and real estate, we suggest investors consider the strengthening areas such as financials, industrials, and information technology, we also think U.S. Treasury notes and short and medium-term corporate bonds could help buffer portfolios against volatility.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.