S&P 500 Trading Outlook (3-5 Days): Bullish

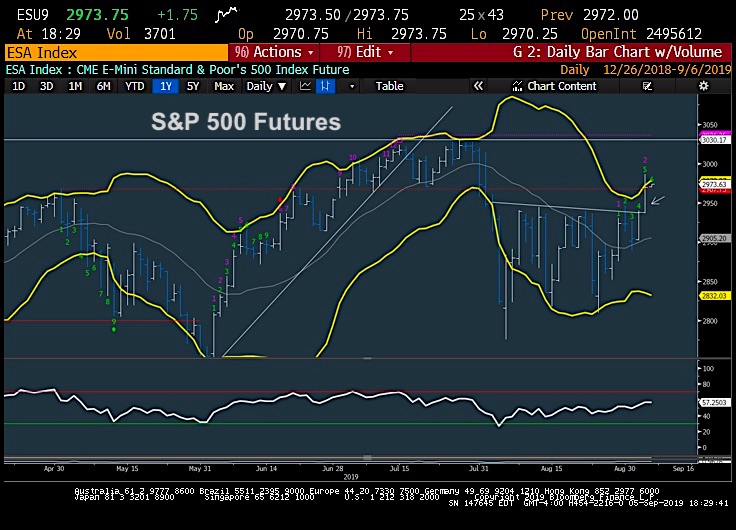

The S&P 500’s INDEXSP: .INX above 2940 will likely jumpstart a rally back to all-time highs.

We are near-term bullish here, looking to buy dips with movement up to 3025-8 likely.

The pattern and technical structure has now improved in a big way with Thursday’s breakout above 2940.

As shown in chart below, little lies in the way technically before this reaches former highs made in late July near 3027.

It’s thought that this could be likely ahead of the Federal Reserve meeting without much needing to be resolved, purely based on improvement in structure and breadth alone.

Technology has moved back to new multi-week highs, while Financials and Discretionary and Industrials have followed suit.

Meanwhile, the defensive groups are being sold, just a time that yields have started to turn back higher. Overall, technical trends in the short run are bullish and look poised to retest/exceed this Summer’s highs before any top.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.