What’s next for the S&P 500? We’ll explore four scenarios in my latest video, ranging from very bullish to very bearish, charting a course between now and early September.

Reflecting on late April, we projected four scenarios for the S&P 500, with the very bullish prediction actually playing out due to a resurgence in growth stocks, especially the ‘magnificent seven. You can read my articles and analysis here.

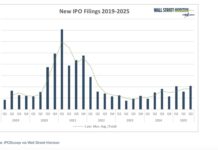

Now, as we stand in late July, let’s consider what might happen next, taking into account key factors like Fed rate cuts and typical seasonal trends that usually influence market behavior around this time.

The very bullish scenario would mean a resurgence in mega-cap growth stocks, pushing the S&P to new highs. A mildly bullish outcome could see the market stabilizing without major upward movements while value sectors gain traction.

The mildly bearish scenario would extend the current pullback slightly, while the very bearish scenario could mean a continued decline that breaks all the key support levels. Let’s think about these four possibilities and decide which seems most plausible!

- How likely is the very bullish scenario where mega-cap stocks push the S&P to new highs in August?

- What might drive a mildly bullish trend, stabilizing the market without significant upward movement?

- What factors could lead to a very bearish scenario, breaking key support levels and causing accelerated declines?

Video: S&P 500 Index Price Forecast Possibilities

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.