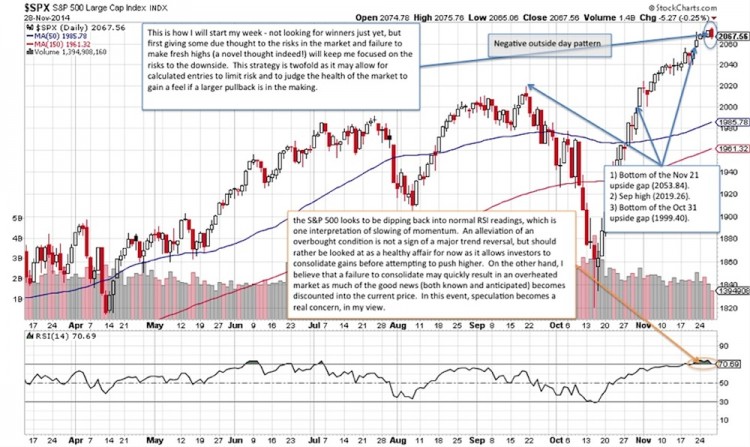

We ended last week with some kind of distribution forces in the S&P 500 (SPX – Quote) as a negative outside day pattern developed. This pattern is an engulfing pattern in which the daily high was above the prior day’s high, the daily low was below the prior day’s low, and the closing price was towards the low end of the daily trading range. There are some varying interpretations of distribution patterns, but this is certainly one such interpretation. True this is only a daily pattern, but it is a subtle sign of at least some profit taking. I couple this with the fact that another negative outside day pattern formed this past Wednesday (11/25), and this suggests that there may be some hesitancy to push the market higher just yet.

With that said, this is how I will start my week – not looking for winners just yet, but first giving some due thought to the risks in the market and failure to make fresh highs (a novel thought indeed!) will keep me focused on the risks to the downside. This strategy is twofold as it may allow for calculated entries to limit risk and to judge the health of the market to gain a feel if a larger pullback is in the making.

What I am also noting is that the S&P 500 looks to be dipping back into normal RSI readings, which is one interpretation of slowing of momentum. An alleviation of an overbought condition is not a sign of a major trend reversal, but should rather be looked at as a healthy affair for now as it allows investors to consolidate gains before attempting to push higher. On the other hand, I believe that a failure to consolidate may quickly result in an overheated market as much of the good news (both known and anticipated) becomes discounted into the current price. In this event, speculation becomes a real concern, in my view.

S&P 500 Daily chart: Near-term distribution patterns are emerging

Follow Jonathan on Twitter: @jbeckinvest

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.