Thus far, April has been pretty good to the stock market bulls. Seasonal tailwinds and a Dovish Federal Reserve have helped to push both stocks and commodities higher. But there’s still a sense of unfinished business:

The bulls have yet to see new all-time highs.

Like it or not, that’s a major point of contention between bulls and bears. Bulls say new highs are coming and bears say not so fast.

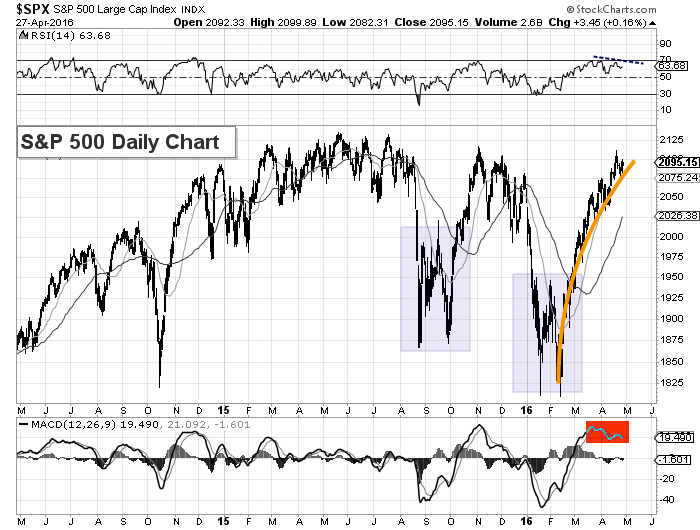

Either way, it’s a silly argument without any sense of timing or discipline. But even with that said, I would argue that the recent recovery highs (2111) on the S&P 500 are pretty important for both traders and investors alike… and macro run-of-the-mill bulls and bears.

So why does 2111 matter so much? Because price is what pays.

Traders: 2111 on the S&P 500 is the recent high that lead to a modest reversal (1.5 percent). 2111 is also just 1 percent off the all-time highs, so it’s kind of like a “last chance” for the bears. If broken meaningfully, the odds are very high that new all-time highs will be made for the S&P 500 (and major stock market indices). Currently, traders can short against this level (give or take a couple points).

If you are bullish, you want to see follow through higher in the next 2-3 days. The arc of the rally (see orange line) is started to show slowing momentum. Time to get it in gear. As well, notice that the 50 day and 200 day moving averages haven’t been very good proxys for support and resistance over the past 2 years.

Although a break higher wouldn’t necessarily mean that this “leg” higher isn’t nearing its end… but traders would have to wait for a new setup to develop before going short.

Investors: This is where it likely matters the most. A break above 2111 would signal a retest of the highs, and likely new highs. It would also change the dialogue, as market breadth has improved considerably – see Dana Lyons post on the NYSE A-D line making new highs – “Why The S&P 500 May Be Headed To New Highs“. So a move toward (or to) new highs with expanding market breadth would tilt the deck back in favor of the bulls and put a “mental floor” in for equities (i.e. make pullbacks interesting again)

Ultimately, new highs will settle the score. And eclipsing 2111 makes that a much greater possibility over the near-term.

Here’s the chart:

Lastly, it is important to note that our time frames are important (and they are dictated by the setup that we are using). Staying focused and avoiding home runs and “big calls” will keep you in the game (see Jake Huska’s “Trading Conviction Is A Good Thing… Just Tune Out The Big Calls“).

Take reasonable risk, and define where your positions are wrong. It’s an interesting year – embrace it. Best to your trading.

Look for another update on market internals by week’s end. Thanks for reading.

Twitter: @andrewnyquist

The author has a trading position in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.