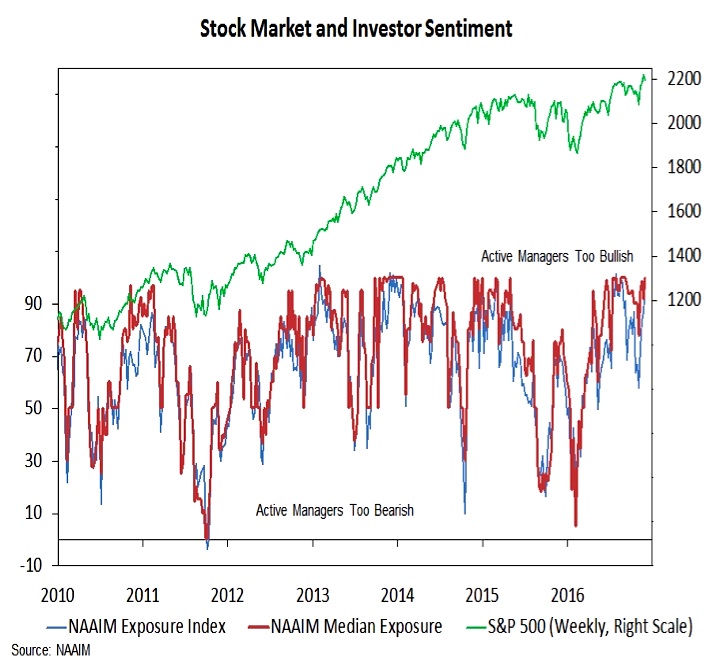

Investor Sentiment

Accompanying the overbought conditions has been increased evidence of excessive optimism. The latest data from the NAAIM shows that active investment managers have turned more aggressive on stocks, with equity market exposure at the highest level since August. The short-term NDR Trading Sentiment Composite also shows sentiment at elevated levels. Optimism tends to be elevated heading into year-end, but this is offset by the recent rise interest rates (which tends to lower the threshold for signaling excessive optimism). Also at play is evidence in the fund flow data that the longer-term trend in equity fund outflows and bond fund inflows has started to reverse. Overall, optimism is probably elevated enough that, from a contrarian perspective, sentiment is more neutral than it was just a few weeks ago.

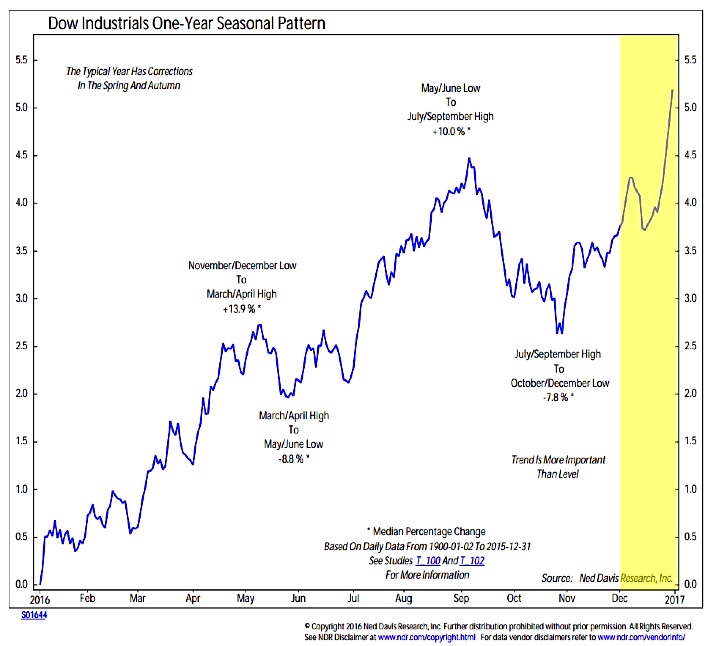

Dow Jones Seasonality Pattern

Investors looking for seasonal strength in early December have historically been disappointed. The typical pattern is for stocks to be choppy over the first half of the month with all the gains coming in the second half. A useful guide may be to watch for stories questioning whether a year-end rally will appear this year. And almost without fail, Santa tends to appear as the month (and quarter and year) works toward its conclusion. The chart below highlights the seasonal pattern for the Dow Jones Industrial Average (INDEXDJX:.DJI).

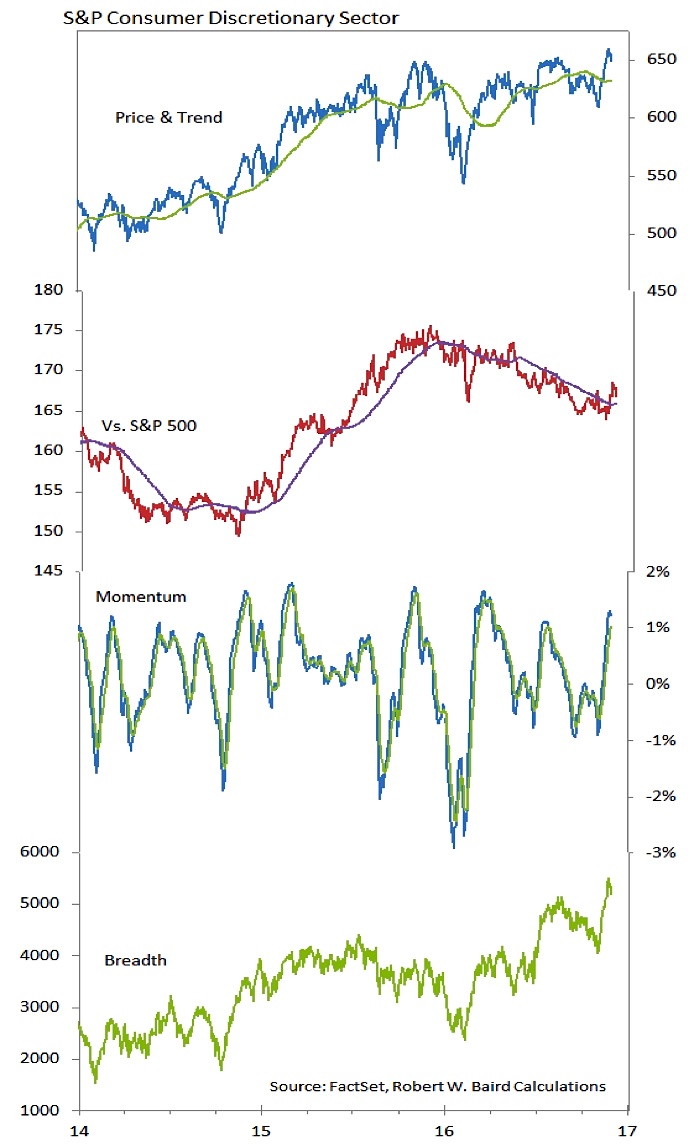

Consumer Discretionary Sector

While the Consumer Discretionary sector has broken out to new highs, the relative price trend suggests it may be pre-mature to move the sector back into the leadership group. The relaitve price line has moved steadily lower since mid-2015, and while the recent relative strenght is encouraging it has yet to break the down-trend. Both momentum and breadth have turned sharply higher, and this could provide further fuel for the price rally and potentially help the sector continue to rise in our relative strength rankings.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.