The S&P 500 Index (INDEXSP: .INX) rose 18 points last week to 3013, an increase of 0.6%.

The stock market continued its upward drive last week, as investors remained jubilant about a new round of easing by the Federal Reserve, as I pointed out in the latest Market Week show.

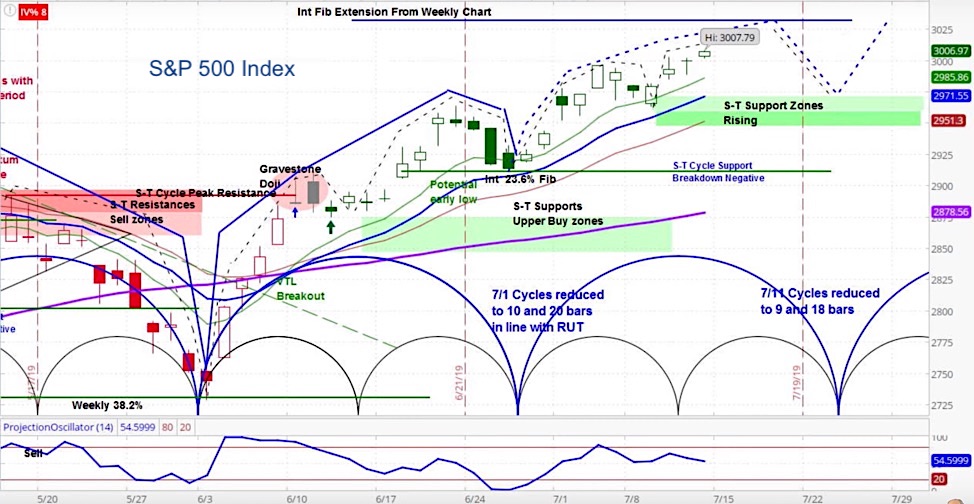

Stock Market Forecast

Our projection is for the S&P 500 to chop around this week, and then move lower as the current short-term market cycle moves in to a small corrective period.

During the previous week, “good news was bad news,” as hopes of a large rate cut were dashed by strong payroll data. But Federal Reserve Chair Jerome Powell flipped this around in his testimony to Congress.

He continued to voice concerns about weakness in the world economy and trade relations, ultimately hinting at the possibility of new rate cuts.

S&P 500 (SPX) Daily Chart

Our approach to technical analysis uses market cycles to project price action. Our analysis of the S&P 500 is for choppy price action that may rise as high as 3032 but is likely to slip lower with the dominant larger cycle. Our short term support zone is between 2950 and 2971.

Stock Market Weekly Outlook Video – week of July 15

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.