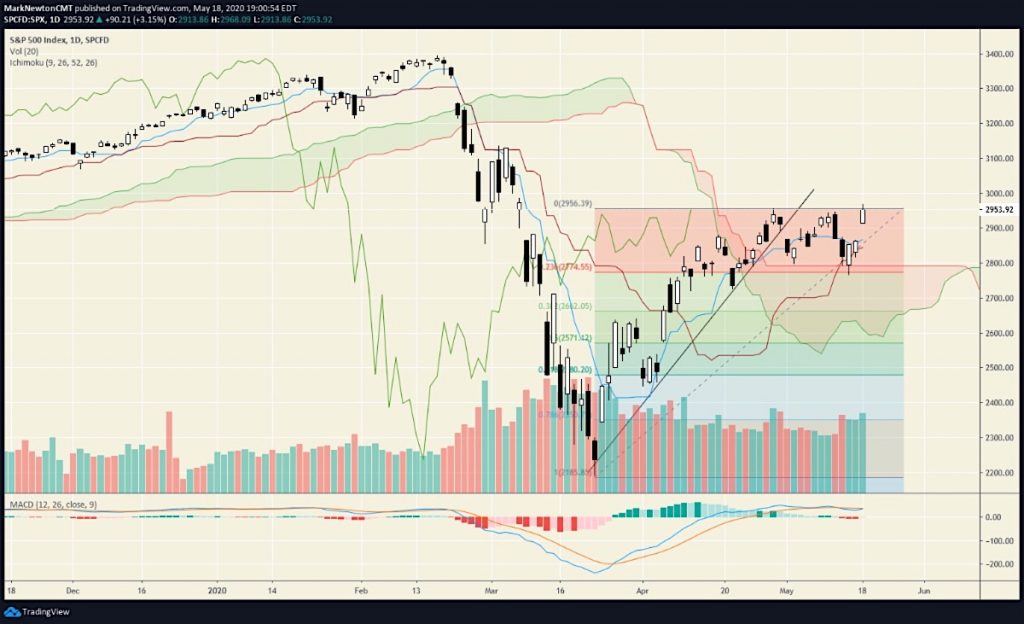

S&P 500 Index Trading Outlook (3-5 Days): Bullish

Monday’s rally to the highest levels since early March exceeded the peak of the consolidation and did so on very good breadth.

This turns the near-term trend from neutral to bullish.

And it is now thought that a push higher to 3030 is underway. 2860 is the support level to watch below.

Market breadth registered a very bullish reading of more than 11/1 positive on Monday. And given that Financials, Industrials and Energy all snapped back, this is thought to be a bullish.

Though the rally may not be long lasting, these sectors could lead stocks even higher in the short run.

Dips should be contained at 2865 which is a stop for longs.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.