The January rally is taking a step back as investor concerns perk up.

The stock market pullback has been triggered by fears surrounding the coronavirus outbreak in China and its potential impact on the world economy.

Although the degree of China’s health issues is uncertain, past history of viral outbreaks have not had sustainable long-term impacts on the global economy or financial markets.

Even so, the stock market has demonstrated great resiliency in the face of negative news.

The S&P 500 Index is up 2.18% this year (through January 24) amid impeachment proceedings, Australian forest fires, a virus pandemic in China and tensions in the Middle East – all in January!

Investor confidence continues to be strong due in part to the trade truce with China, the accommodative Federal Reserve (pledging not to raise rates unless there is significant inflation), low interest rates, muted inflation. We don’t expect these factors supporting investor confidence and consumer spending (backed by unemployment at a 50-year low) to change anytime soon. The stock market should continue to move higher in the current slow but steady growth environment with the occasional reactions to factors outside the economy.

With the stock market at all-time highs and valuations stretched, it is reasonable to expect short-term pullbacks. Should we experience a correction, it would likely be limited in duration and not the end of the bull market. The economic environment boosting the stock market remains healthy with the Federal Reserve accommodative and corporations reaping the rewards of lower tax rates and a lower regulatory environment.

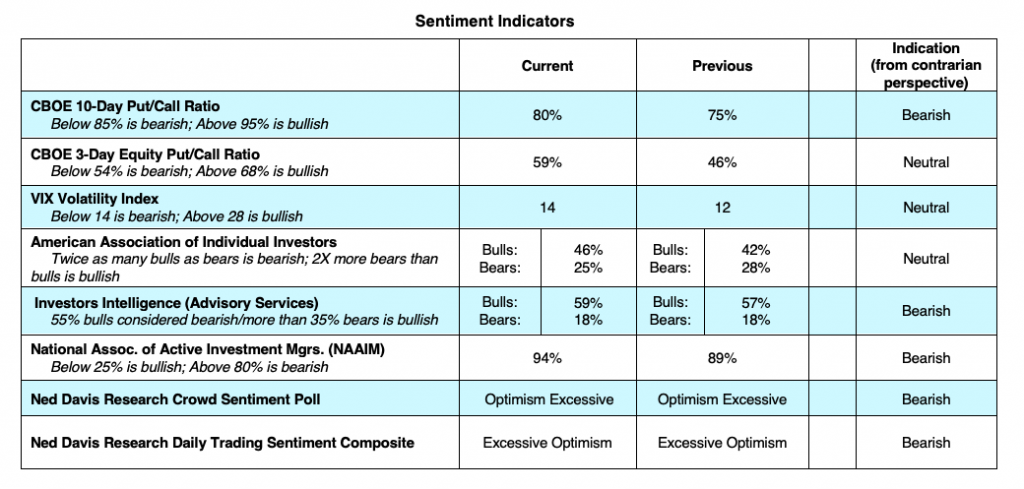

Investor optimism a short-term headwind?

Most sentiment surveys are exhibiting widespread optimism in the current market. The American Association of Individual Investors (AAII) currently showed bulls approaching 45.6% this week, a 15-month high which suggests expectations for stock prices will rise over the next six months. The Investors Intelligence Survey (measures sentiment of Wall Street letter writers) reported 59% bulls this week.

Both surveys are used as contrarian indicators and suggest too much optimism. When you get a high level of optimism, the idea is that people have already bought, so who is left to buy? Then you need to be concerned about selling. When the level of optimism or pessimism is excessive, the stock market almost always does the opposite of what individual investors are expecting.

In spite of this optimism, Willie and I have kept our Weight of the Evidence indicator at neutral. While the excessive optimism in the current market raises a yellow flag short term, we do not see the euphoria found at important market tops. We believe that the momentum in the market is enough to support stocks at this current level of optimism. But this level of complacency does make the market more vulnerable to short-term volatility.

Will the market react to the conclusion of the presidential impeachment trial? Last week I suggested that the impeachment trial will not move the economy or markets in any direction. No one in either political party believes the President will be removed from office. Since the impeachment in the House of Representatives began on 12/18/19, the Dow Jones Industrial Average is up 3.20%; the S&P 500 is up 4.20% and the NASDAQ is up 6.00%.

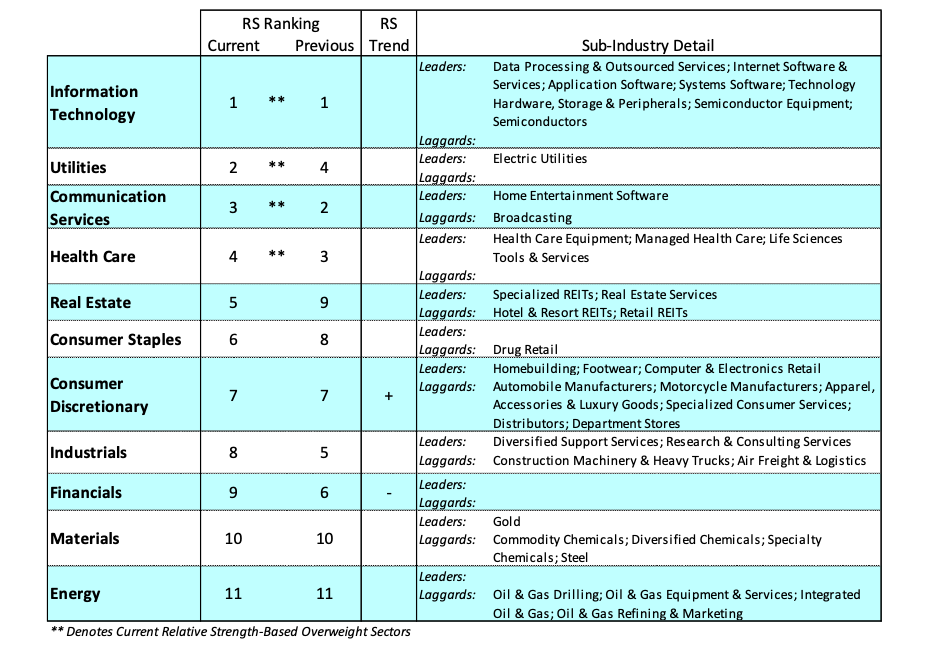

Stock Market Sector Rankings:

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.