The stock market continued its climb into record territory last week, as I pointed out in the latest Market Week show.

The S&P 500 (SPX) displayed strong upward momentum as it rose 52 points to 3221, an increase of 1.6%.

This occurred despite the impeachment of President Trump. As well, we have seen mixed macroeconomic performance, including higher than expected housing permits and jobs data, lower manufacturing and existing home sales, and in line third quarter GDP.

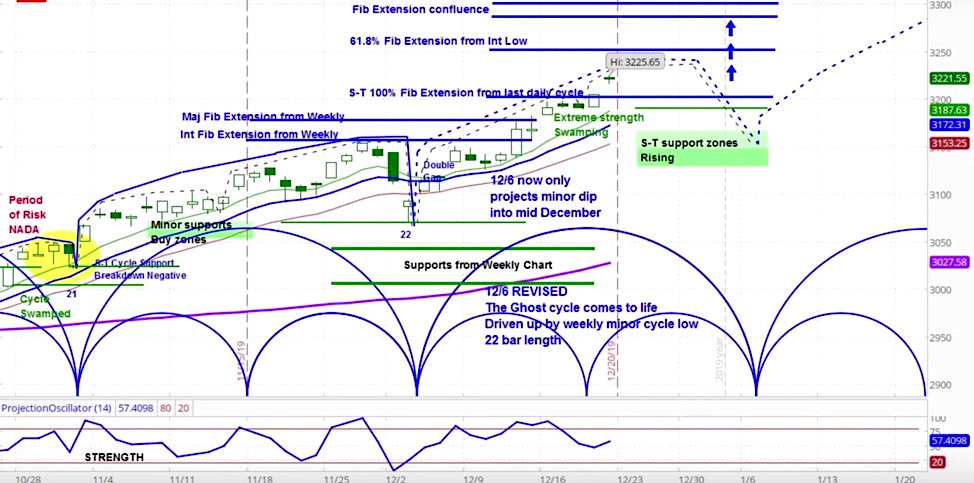

Our approach to technical analysis uses market cycles to project price action.

Our analysis is that price action in the S&P 500 has been “swamped.” This means that momentum is so strong that the corrective phases have resulted in limited downside.

Nonetheless we believe that stocks will begin to roll over in the coming weeks, as shown on the chart below. This period of risk will likely last into the first week of the new year, with a short term support zone between 3130-3170.

S&P 500 (SPX) Daily Chart

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.