The NYSE advance-decline line closed at a new all-time high Wednesday; will that breathe new life into the bull market, or is the bull still gasping for air?

Some days are more important than others in the stock market…

Wednesday may have been one of those days as we saw a number of potentially positive developments. For one, many of the lagging sectors in the market (e.g., growth, international, small-caps, financials, etc.) demonstrated seeming breakouts of some magnitude. A rotation into – or at least contributions from – these areas will be necessary to sustain a more durable rally. We will closely monitor these areas for signs of follow through.

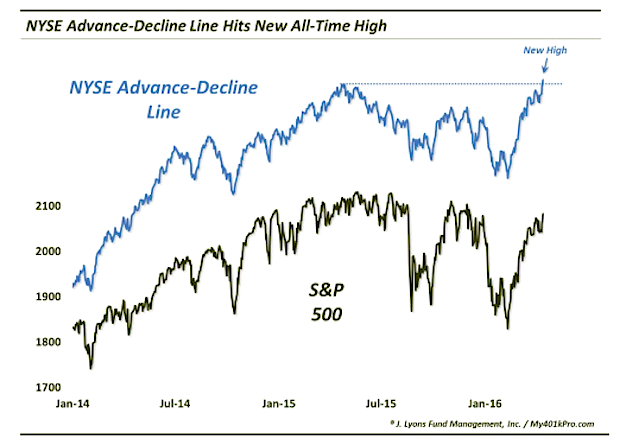

The most significant development on Wednesday though, in our view, was the new all-time high in the NYSE advance-decline line.

For the uninitiated, the NYSE advance-decline line is a running cumulative total of the daily difference between advancing issues on the NYSE and declining issues. If this “A-D” Line is moving upward along with the stock indexes, it represents strong participation within the broader market. And as we have said many times, the better the participation, the healthier the market. Since the mid-February stock market low, the A-D Line has indeed been moving upward, hitting its first new high yesterday in 355 days.

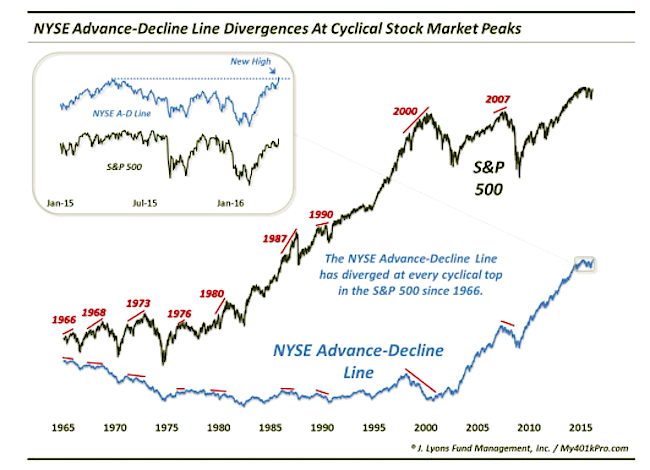

So what is the significance of the new high? Let’s revisit a post from May 21 of last year (In it, we discussed the topic of the NYSE Advance-Decline Line hitting a new high along with the S&P 500 – or rather, not hitting a new high. As it happened, the S&P 500 had in the days prior reached a new all-time high, slightly above the level reached on April 24. Meanwhile, the A-D Line was negatively diverging, i.e., it was unable to surpass its own high from April 24.

Why was that important? As we noted in the post, the NYSE Advance-Decline Line has negatively diverged at every cyclical top in the S&P 500 in the last 50 years (by the way, that day, May 21, marked the precise all-time high close in the S&P 500 to date…golf clap).

Now does this mean the market has to top every time there is a divergence? No. Furthermore, the A-D Line can, and has, diverged for prolonged periods before any ill effects are felt in the stock market. Still, given the plethora of concerns we had regarding a possible cyclical top at the time, and given the fact that this mere 1-month divergence was the first real divergence during the course of the 6-year bull market, this was a development that demanded recognition. It was an important piece of the “topping” puzzle that had been missing, and was now in place.

continue reading on the next page…