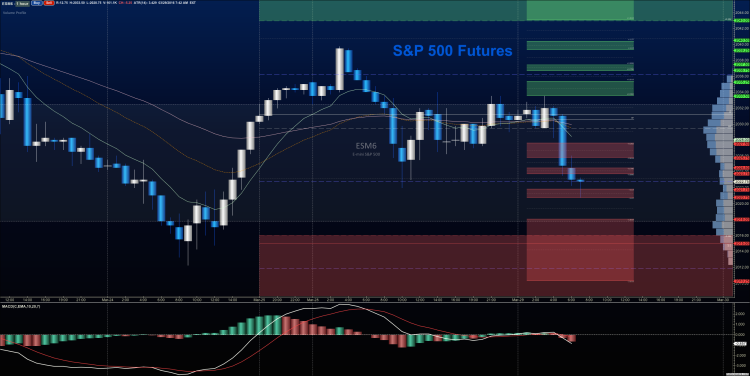

We are seeing coiled moving averages as a result of sideways action in front of Yellen’s comments and economic releases. Price support near 2021 on the S&P 500 futures is being tested once more today (March 29). Resistance still sits above 2038.5-2041.5.

Momentum in the short term has shifted to bearish since 10am eastern yesterday. However support is still likely to be defended, especially near 2009-2011. A breach and hold of 2033 is likely sends us back into resistance above; break of 2021 is likely to send us back into the 2012 area.

The Morning Report: The Market Is Coiling…

Momentum on the four hour chart of S&P 500 futures is neutral, as it was yesterday– sideways trading ahead –slope of trend on longer time frames suggests buyers will still show up at key support levels. Continue to watch for lower highs to continue, if sellers hold momentum and fail price bounce off resistance. The failed retest of the 2020 area will signal more bearish momentum.

Shorter time frame momentum indicators are bearish and falling – however, we are sitting at near term support near 2021. Buyers and sellers will struggle there for dominance – buyers still fighting to hold levels, so downside motion should stall at support zones.

See today’s economic calendar with a rundown of releases.

THE RANGE OF THURSDAY’S MOTION

Crude Oil Futures (CL_F)

The API Report comes after the close today. Downward motion continues for crude oil prices as buyers take profit and sellers resume intermediate control of the oil charts. The level for buyers to recapture is still 40 for bullish action to continue – but yesterday’s attempt to retest the area after 8am failed, and that motion brought the sellers out in force. Support action is likely to be tested near the 38.2 region, and buyers should actively try to defend this area.

Today, the trading ranges for crude oil are between 37.9 and 39.75. Breaks of these levels are likely retrace as the lower number is strong support for now, and the overall trend is still bullish on the daily time frame.

Moving averages in oil show tight coiling, and slightly negative momentum on longer intraday time frames. Resistance is now lower between 40.24 and 39.65; deeper support is likely near 37.91 and 37.68.

Intraday long trade setups for crude oil suggest a long off a 39.43 positive retest (check momentum here), or 38.65 positive retest bounce into targets of 39.15, 39.44, 39.78, 40.1, 40.3, 40.47, 40.74, 41.28, and if buyers hold on, we’ll see 41.74 to potentially 42.1, and 42.46.

Intraday short trading setups suggest a short below a 38.56 failed retest with negative divergence, or the failed retest of 39.4 sends us back through targets at 39.15, 38.94, 38.40, 38.09, 37.7, and 37.36, if sellers hang on.

Have a look at the Fibonacci levels marked in the blog for more targets.

E-mini S&P 500 Futures (ES_F)

Below is a S&P 500 futures chart with price support and resistance trading levels for today. Click to enlarge.

Buyers and sellers battle near 2021 on the S&P 500 futures after rejecting 2033 for the fifth time again in six trading days. The levels between 2038-2041.5 serve as front line resistance, with 2012-2019 now as support. Stretches north could see 2044.5, and deep support could be as far south at 2009 at this point. I suspect we have a greater chance of continued downside movement into support as the charts continue to look heavy, but buyers have been persistent, particularly near 2016-2019. I’ll be watching for the lower high potentially setting up today to signal the continued move into deeper support below near 2001-1997.

Upside motion has the best setup on the positive retest of 2033.75 or a bounce off 2021.75 with positive momentum (careful here). I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2021.75 are 2024.75, 2027.5, 2029.5, 2031.5, 2034.5, 2037.5, and if we can catch a bid there, we could expand into 2041.75, 2044.25, and 2047.5. A hold there could bring the buyers back in force. Longs are still trending over the bigger picture for now, but we are still in a short-term cycle of negative price action.

Downside motion opens below the failed retest of 2027.5 or at the failed retest of 2022.5 with negative divergence. Retracement into lower levels from 2027 gives us the targets 2024.5, 2021.75, 2018.75, 2016.5, 2014.25, 2012.75, 2009.75, 2007.25, 2005.5, 2001.75, and perhaps 1997.5 if selling really takes hold (clearly possible if buyers lose their footing, or lower highs continue to develop).

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as traders remain aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Thanks for reading.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.