Broad Stock Market Futures Outlook for June 12, 2018

Trading is quiet this morning as traders prepare for news as it relates to North Korea and the Federal Reserve. This tension on the tape makes the market prone to quick moves this week.

Bullish undercurrents prevail but that does not mean that breakouts will hold. In fact, they should not do so without a retest of higher lows – that’s where we sit this morning, so holding support is important for the intraday trader today. Trading sentiment is getting pretty bullish, so I expect traders to engage on dips to support (possibly prematurely). A choppy trading week continues…

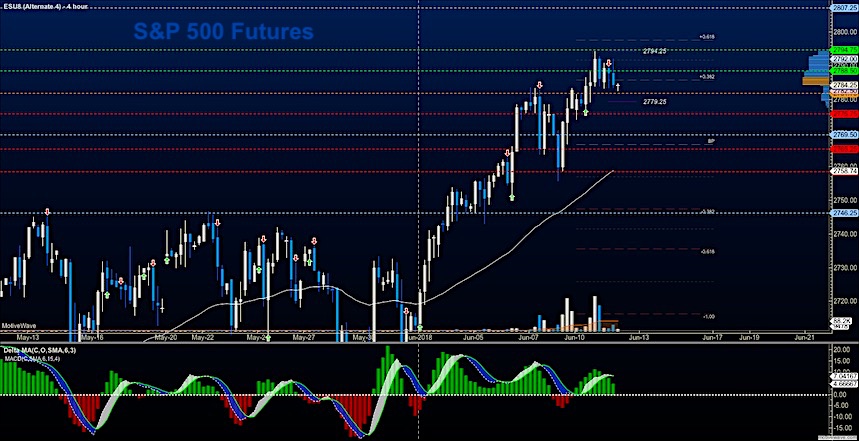

S&P 500 Futures

Intraday support levels remains near 2781. As yesterday, first tests of this level should find buyers but continued testing will be a fair signal that we will break lower into deeper support levels. Cautiously long is my approach today. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2786.50

- Selling pressure intraday will likely strengthen with a bearish retest of 2780.5

- Resistance sits near 2788.5 to 2792.25, with 2794.5 and 2806.75 above that.

- Support sits between 2782.25 and 2775.75, with 2769.25 and 2758.75

NASDAQ Futures

Higher support holds near 7175. Formations are bullish on larger time frames so deep dips remain buying opportunities but divergent momentum beneath reminds us to use caution trading breakout action. The intraday balance of power can shift easily in these environments. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 7194.5

- Selling pressure intraday will likely strengthen with a bearish retest of 7175.5

- Resistance sits near 7197.75 to 7209.25 with 7226.5 and 7243.5 above that.

- Support sits between 7181.5 and 7149.5, with 7129.5 and 7094 .75 below that.

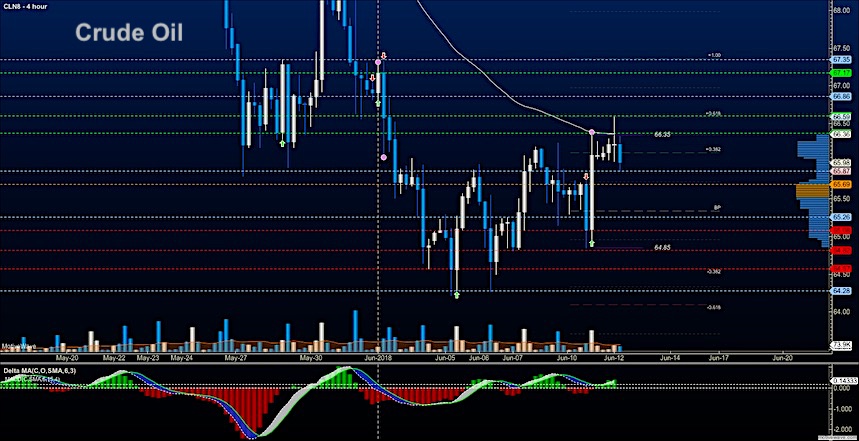

WTI Crude Oil

Traders continue to form a rounding formation and hold support near 65 for several days. Holding the 65.5 area will be important as we go into the API report and the EIA report over the coming days. Mixed bag here as emerging markets, OPEC, and sanctions all weigh in on the price of oil right now. The bullets below represent the likely shift of trading momentum at the successful or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 66.27

- Selling pressure intraday will strengthen with a bearish retest of 65.35

- Resistance sits near 66.17 to 66.36, with 66.59 and 66.87 above that.

- Support holds near 65.26 to 64.84, with 64.57 and 64.26 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.