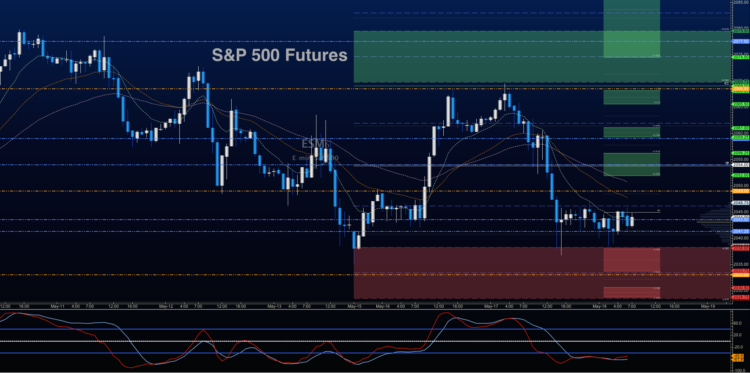

S&P 500 Outlook for May 18 – A battleground at 2041 rages with sellers looking as if they will be the victors based on momentum for the short term. Much longer time frame charts show a chart with the power to bounce on a deep pullback.

We’ll be watching the edge of support here- set by the weekly range assessment of 2027.5. If we lose 2038 with strength, then we’ll need to look nearly a dozen points below to find support. Buyers appear weary here, and for the first time in a while, it may be difficult for them to push stock market futures higher today.

But, as long as S&P 500 futures hold 2038, we will keep the sellers at bay.

If we are able to keep the 2045.75 price retest, buyers are more apt to the retrace upward back into resistance near 2053-2055, and 2057.5, before sellers try to force buyers back down again. Lots of overhead supply exists, and the charts are starting to look very heavy.

Momentum on the four-hour chart is now negative. That means potential negative trending behavior. The very big picture still remains bullish – with the key support action near 2027, but the drift to deeper support appears to be on the horizon.

See today’s economic calendar with a rundown of releases.

THE RANGE OF TUESDAY’S MOTION

E-mini S&P 500 Futures (ES_F)

S&P 500 futures outlook for May 17, 2016 – Trading is once again range bound, though at lower levels. Support range looks like it extends from 2038 to 2046.5. Heave resistance sits near 2052.5- 2055. If we bounce off this level, it will be into resistance, and we’ll be very apt to retest the middle of this range unless the balance tips. Lots of uncertainty here: I see bottom pickers, but they do not have the strength of momentum in their favor.

Upside trades for S&P 500 futures: Favorable setups sit on the positive retest of 2046.75, or a bounce off 2038.25 with positive momentum (of which there is none, at present). I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2038.25 are 2041.25, 2043.5, 2045.25, 2046.75, 2052.5, 2055, and if we can catch a bid there, we could expand into 2057.5 and 2061.75.

Downside trades for S&P 500 futures: Favorable setups sit below the failed retest of 2038 or at the failed retest of 2053.25 with negative divergence. It is important to watch for higher lows to develop with the 2053.25 entry as much consolidation would sit below if that occurred. Retracement into lower levels from 2053.25 gives us the targets 2051.75, 2047.75, 2045.5, 2042.25, 2038.75, 2034.5, 2031.25, 2029.5, 2026.5, and perhaps even 2021.75, before bouncing.

Crude Oil Futures (CL_F)

Outlook for crude oil for May 18 – EIA report expecting a draw today – yesterday, I suspected that spike into 49.4 and higher would be unlikely, but indeed, with the contract roll, here we are with a test into 49.4 in the recent past. Crude oil (and traders) sit in an interesting space.

Everyone can see the resistance area for crude oil futures, so we know there is some overhead supply, but buyers continue to carve out higher lows. Trend is King, as we know so it would not be good to stand in the face of trend without strong evidence of weakness. And so far, we see that pullbacks in crude oil prices continue to create buy zones. It would be most imprudent not to note that we are at significant resistance and realize a very controlled and deliberate group of traders will try to participate in this reversal zone.

The trading range for crude oil suggests support action near 48.34, and resistance behavior near 49.8.

Upside trades on oil can be staged on the positive retest of 48.7, or a breach above 49.3, but watch for resistance after the breach of 49.3, near 49.5, and 49.8. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 48.7 are 48.98, 49.12, 49.34, 49.48, and if we can catch a bid there, we could expand into 49.78, and 50.03 to 50.92. Next week’s API report and EIA report may likely be affected by Nigeria disruption, and will certainly add fuel to the upward frenzy we see for now.

Downside trades on oil continue to setup well below failed retests – Today, I’m looking for the failed retest of 49.2, or at the range expansion into 49.78 with negative divergence – careful to watch for higher lows at the short on the resistance level. Retracement into lower levels from 49.78 give us the targets 49.56, 49.24, 49.08, 48.9, 48.7, 48.49, 48.36, 48.17, and perhaps 47.85, 47.62, and 47.26.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.