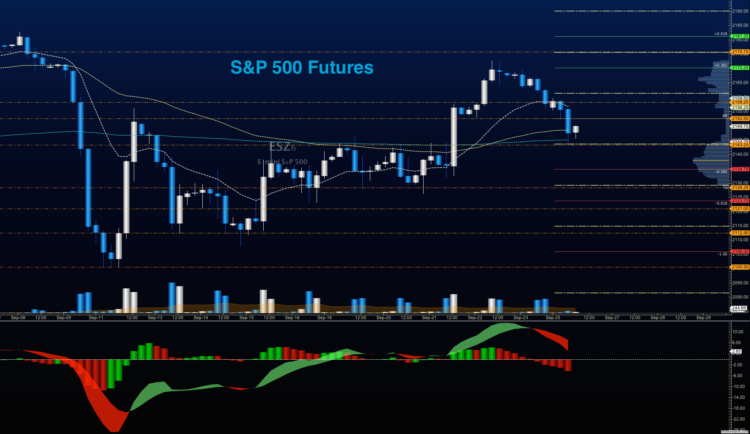

Stock Market Futures Overview & Trading Outlook for September 26, 2016

It’s good to be back after 12 days off – but the passage of time has had little effect on the overall resolution of the market and S&P 500 (INDEXSP:.INX). The first week in September brought a big dip and subsequent weeks have done their best to see S&P 500 futures recover. We still sit below the critical price level of 2167, and this level will hold as key resistance for now. Closing with a successful retest above this level on the week, or the day, may give us the catalyst we desire to try another breakout above to test those old highs once more. Key support level today is 2140, and a failed retest here will give sellers a shot at running the chart lower. That said, buyers will be first to likely show themselves near the key support, as overall momentum still holds bullish.

See today’s economic calendar with a rundown of releases.

RANGE OF TODAY’S MOTION

S&P 500 Futures Trading Outlook For September 26

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2152.5, or a positive retest of the bounce off 2141 with upward momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2141 are 2146.5, 2149.75, 2152.5, 2156, 2159.75, 2162.75 and 2167.75. As always, additional targets will be in the Members only portion of the morning blog.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2143, or at the failed retest of 2147 with negative divergence. Retracements into lower levels from 2147 give us the targets 2144.5, 2141.25, 2140.25, 2137.5, and 2134.75. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Nasdaq Futures

The NQ_F began a march to new highs four trading days ago and between Friday and this morning, we have retraced the entire breakout, though still holding positive momentum above support. We are in the process of the retest of the breakout at this writing, so I expect buyers to move into a perceived value territory near 4824. This is the positive retest of the breakout area, with deeper support near 4812. Resistance sits at 4860.75 this morning, and the first pass test should find sellers ready to move the chart down.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4832.5, or a positive retest of 4812.25 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4812.25 are 4824.75, 4828.5, 4832.5, 4840.5, 4844.75, 4849.5, 4852.25, 4854.75, 4860.75, and 4874.5. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4811, or at the failed retest of 4852.5 with negative divergence. Retracements into lower levels from 4852.5 are 4840.75, 4835.75, 4829.5, 4824.5, 4820.75, 4818.5, 4811.5, 4802.5, 4797.5, 4794.5, and 4789.75. See the blog for additional targets.

Crude Oil

The West Texas Intermediate Crude chart we follow had a 3.49 point range last week, bouncing from a low congestion point of 43.06. Today, we’ll watch 43.65 as lower support, and 46.28 as resistance. News is mixed in the midst of OPEC meetings and conclusions – for me, it is best not to pay much attention to what I might believe might move the market, and instead just watch the candles for direction. We hold mildly bullish formations, in general.

Trading ranges for crude oil futures should hold between 44.o4 and 46.28 in the current pattern.

Upside trades on crude oil futures can be staged on the positive retest of 45.49, or at a positive retest off 44.59 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 44.59 are 44.77, 44.94, 45.16, 45.47, 45.57, 45.82, 46.13, and 46.28. See the blog for more details on the chart action.

Downside trades on crude oil futures can be staged on the failed retest of 44.47, or at the failed retest of 45.25 with negative divergence. Targets from 45.25 are 45.04, 44.96, 44.62, 44.47, 44.24 and 44.04. Additional targets will be in the Members only portion of the morning blog, and in the live trading room.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day.

Visit TheTradingBook.com for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.