Stock Market Outlook for October 21, 2016 –

The chart is at the base of price support, but in the short term appears that it will drift lower before bouncing. Another range bound day is likely ahead for the S&P 500 (INDEXSP:.INX), so use caution trading on the edges of support. Price resistance is still 2144- 2151 on the S&P 500 futures chart October 21. Price support has fallen to 2125-2122, and the retest of 2120 might be what is on the horizon.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

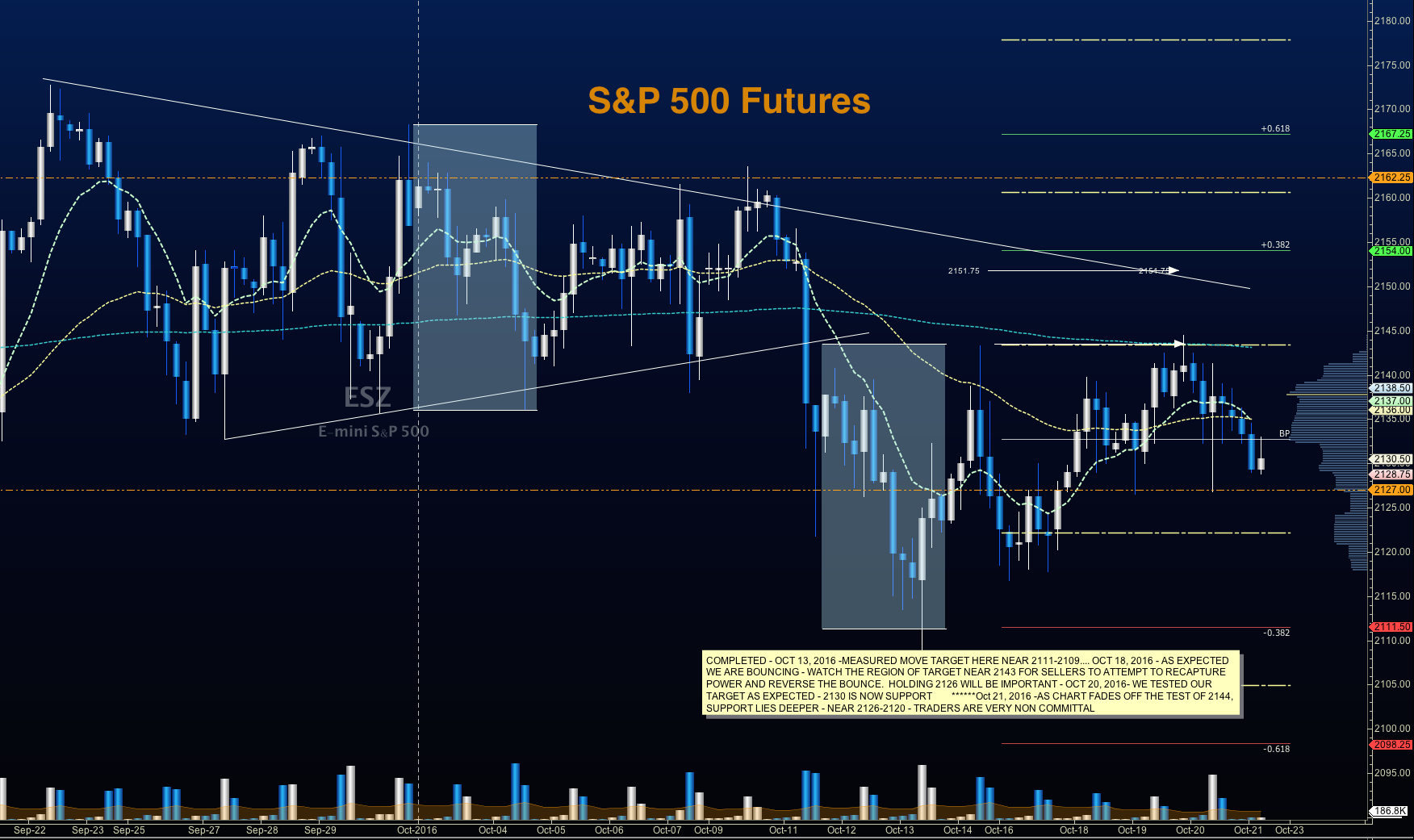

S&P 500 Futures Trading Chart – October 21

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2133.5, or a positive retest of the bounce off 2126 with upward momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2126 are 2128.5, 2130.75, 2133, 2136.25, 2138.5, 2142.50, 2144, 2147.25, 2150.5, and 2153.5.

Downside trades – Favorable setups sit below the failed retest of 2125.5, or at the failed retest of 2139.5(watch for the higher low if this is attempted) with negative divergence. Retracements into lower levels from 2139.5 give us the targets of 2136.5, 2134.25, 2130.75, 2126.5, 2123, and 2120.

Nasdaq Futures

The NQ_F continues to hold its breakout levels, but still sits in a range. This range is approximately between 4822 (support) and 4849 (resistance is now stretched above). Today’s support sits in the region between 4827 and 4833. Another group of sellers sit near 4851 to 4854.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4842.5, or a positive retest of 4833 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4833 are 4836.75, 4839, 4842, 4845.5, 4848.75 and 4851. Above there, and we could see 4854-4861 before sellers exercise control once more.

Downside trades – Favorable setups sit below the failed retest of 4837.5 (needs negative momentum here for continuation), or at the failed retest of 4847 with negative divergence. Retracements into lower levels from 4847 are 4845.5, 4842.5, 4838.5, 4835.25, 4833, 4827.75, 4824.75, and 4815.75 to 4812.5.

Crude Oil

Oil faded most of the day yesterday and began a bounce overnight near 50.3 – There is a breakout formation within the chart, and many are calling for oil to drift higher. My suspicion is that it will remain range bound until after the OPEC meeting next month. Big spikes in either direction will likely drift back into the region between 50.6 and 51.2

Trading ranges for crude oil should still hold between 50.11 and 52.42 in the current pattern.

Upside trades on crude oil can be staged on the positive retest of 51.27, or at a positive retest off 50.3 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 50.3 are 50.6, 50.94, 51.2, 51.45, 51.65, 51.82, 52.02, and 52.24 to 52.42.

Downside trades can be staged on the failed retest of 50.6 (watch for higher lows with this test), or at the failed retest of 51.81 with negative divergence. Targets from 51.81 are 51.64, 51.46, 51.32, 51.15, 50.92, 50.64, 50.38, 50.24, 50.11, and 49.94.

Visit TheTradingBook.com for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.