Stock Market Outlook November 17, 2016 –

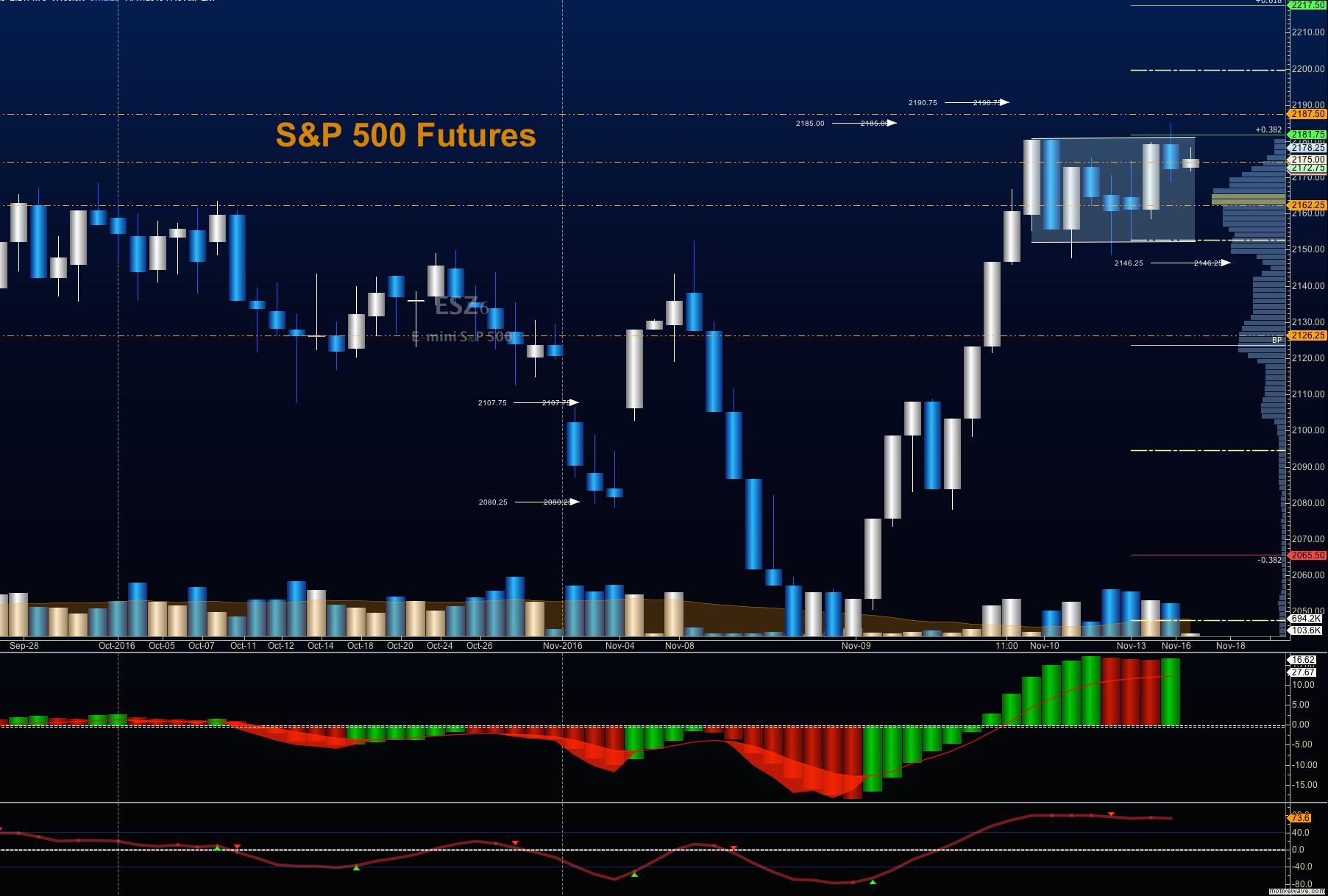

For a second day, the S&P 500 (INDEXSP:.INX) knocked on the doors of chart resistance only to fail at the highs. My suspicion is that higher highs will not hold today, even if we make them. The line in the sand for buying support intraday will be 2168 on S&P 500 futures. As long as we hold above that level, buyers will command more power. Below that, 2160 -2156.5 sits as secondary price support.Price resistance still holds at 2182.5 – 2187.5, but if buyers can spend enough time carving out new support at 2176, the higher targets near 2190 hold as new upside over the cycle.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

S&P 500 Futures Trading Chart – November 17

Upside trades for S&P 500 futures – Two options for entry

Positive retest of continuation level – 2176

Positive retest of support level – 2168.5

Opening targets ranges: 2171.50, 2174.50, 2178.50, 2182.25, and 2185

Downside trades for S&P 500 futures – Two options for entry

Failed retest of resistance level – 2178.50

Failed retest of support level – 2167

Opening targets: 2175.50, 2171.75, 2164.50, 2161.50, and 2156.50

Nasdaq Futures

The NQ_F broke higher and is holding a bullish break. However, it is quite disjointed from the ES_F, so fades to support levels are likely in a choppy ride to the north. The levels near 4760-4765 are likely to hold as frontline support today. Momentum is still relatively neutral, but slightly bullish. Resistance has moved up to 4804 to 4817.75

Upside trades on Nasdaq futures – Two options

Positive retest of continuation level – 4804.50

Positive retest of support level – 4780.25

Opening targets ranges for non-members –4783.50, 4792.25, 4797.5, 4803.75, 4811.50, and 4821 if the chart breaks out again

Downside trades on Nasdaq futures – Two options

Failed retest of resistance level – 4796

Failed retest of support level – 4779

Opening targets: 4791.75, 4786.5, 4780.5, 4774.75, 4765.50, and 4760

WTI Crude Oil

Oil continues to be ruled by OPEC chatter even as the EIA report another build. We are testing resistance at 46.35, but this marks a channel that I suspect will yield negative momentum if we cannot breach and hold that level. Overall motion still seems bullish, but the better bet would be a long off a pullback to support. Resistance is now 46.40 to 48.85. Pullbacks are likely to see buyers as OPEC continues to dominate the headlines

Upside trades on crude oil – Two options

Positive retest of continuation level – 46.6

Positive retest of support level – 45.74

Opening targets: 46.02, 46.3, 46.55, 46.8, and 47.04

Downside trades on Crude Oil – Two options

Failed retest of resistance level – 46.19

Failed retest of support level – 45.67

Opening targets: 45.93, 45.74, 45.57, and 45.27

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.