Stock Market Futures Outlook for September 28, 2016 –

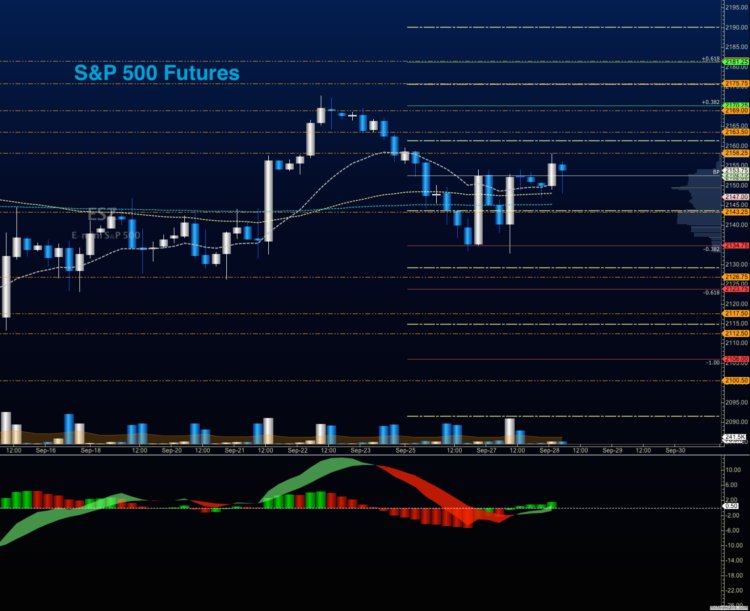

After the initial fade into the morning yesterday, the S&P 500 (INDEXSP:.INX) lifted off the lows. S&P 500 futures now sit just below the open of the week. If futures can breach 2159, we’re likely to hold gains today. We will need to pay attention to sellers at the top of the range near 2167-2169, though. Above there, S&P 500 futures could see 2176 as the next potential test north. Key price support level for yesterday broke again, and was quickly recaptured. That level remains support for today for the third day – 2140, and a failed retest here will give sellers a shot at running the chart lower into additional congestion near 2133, then 2126, if 2133 does not hold as it has the prior two days. Traders are still using range bound formations to determine their intraday movement.

See today’s economic calendar with a rundown of releases.

TODAY’S RANGE OF MOTION

S&P 500 Futures Trading Outlook For September 28

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2156.75, or a positive retest of the bounce off 2140.5 with upward momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2140.5 are 2145, 2149.75, 2152.5, 2156.25, 2159, 2162.75, 2166.5, and 2169. As always, additional targets will be in the Members only portion of the morning blog.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2145, or at the failed retest of 2151.5 with negative divergence. Retracements into lower levels from 2151.5 give us the targets 2148.5, 2145.5, 2140.75, 2136.5, and 2133.75. As always, additional targets will be available in my live trading room.

Nasdaq Futures

The NQ_F did well yesterday fueled by lots in the tech sector holding gains. The value area I suggested yesterday at 4609 held nicely after a brief loss of the level, a confirmation of the breakout in this cycle. Today’s support to watch is much higher at 4635. Resistance now sits at 4875.25 this morning, with the first pass test finding sellers who have pushed the chart back to 4865.5 at this writing. The NQ_F is in a breakout pattern, so pullbacks are likely to find buyers into prior highs of last week. Because momentum is damp, pullbacks could be wide, 15-20 points, or wider.

Upside trades on Nasdaq futures – Favorable setups sit on the positive retest of 4870.25, or a positive retest of 4835.5 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 4835.5 are 4839.5, 4844.5, 4849.75, 4854.75, 4857.75, 4860.5, 4865.25, 4870.25, 4874.75, and 4883.5. As always, additional targets will be in the Members only portion of the morning blog, and in the live trading room.

Downside trades on Nasdaq futures – Favorable setups sit below the failed retest of 4835, or at the failed retest of 4849.5 with negative divergence. Retracements into lower levels from 4849.5 are 4845.5, 4840.75, 4835.75, 4829.5, 4824.5, 4820.75, 4818.5, 4811.5, 4802.5, 4797.5, 4794.5, and 4789.75.

Crude Oil

News in the oil space has charts moving sharply up and down over the prior days, and this morning is no different. The API showed a draw, and now we wait for the EIA report at 10:30am ET. Today, we’ll watch 44.05 as support, and 46.6, as resistance. We hold neutral momentum, in general, but price action still remains a bit sideways.

Trading ranges on crude oil futures should hold between 44.05 and 46.6 in the current pattern. Breaks at the edges of price noted will likely run into traders trying to reverse the motion, but failure to recover quickly will force charts in the direction of the break.

Upside trades on crude oil can be staged on the positive retest of 45.49, or at a positive retest off 44.78 with positive momentum. I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 44.78 are 45.04, 45.49, 45.92, 46.16, and 46.35 to 46.69. See the blog for more details on the chart action.

Downside trades on crude oil can be staged on the failed retest of 44.54, or at the failed retest of 45.44 with negative divergence. Targets from 45.44 are 45.24, 45.09, 44.86, 44.65, 44.52, 44.28 and 44.14 t0 43.86.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.