Broad Stock Market Futures Outlook for May 1, 2018

The upward intraday cycle of the ES_F, NQ_F, and YM_F is fading into a test of lower support. As well, gold futures collapsed and Gold is late in its own cycle.

The undercurrents are still weak for S&P 500 futures but the index is at broad support. Bounces are likely to fail as we are still in the midst of a compression event/triangle. Watch the edges noted below for continuation.

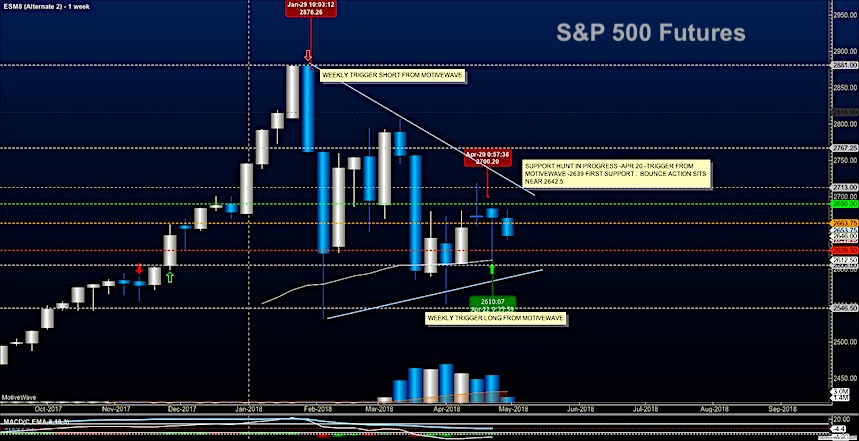

S&P 500 Futures

Resistance fails and support sits now near 2640 presenting potential value areas for traders. As this is a news-heavy week, my thought is that moves are not at risk of catching fire in either direction – another ‘slinky‘ event. Price compression continues (though it might not feel like that from an intraday perspective). The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 2652.75

- Selling pressure intraday will likely strengthen with a bearish retest of 2638.50

- Resistance sits near 2651.75 to 2659.75, with 2667.25 and 2679.75 above that

- Support sits between 2642.5 and 2626.5, with 2619.5 and 2606.50

NASDAQ Futures

The wedge also exists here in the NQ_F as price compression is also a characteristic here. Weak bullish undercurrents are present so we are likely to see wicks here as well. The line in the sand for buyers to hold is 6589. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 6624.75

- Selling pressure intraday will likely strengthen with a bearish retest of 6589

- Resistance sits near 6621.5 to 6646.25 with 6674.25 and 6717.5 above that.

- Support sits between 6594.5 and 6559.5, with 6522.5 and 6465.75 below that.

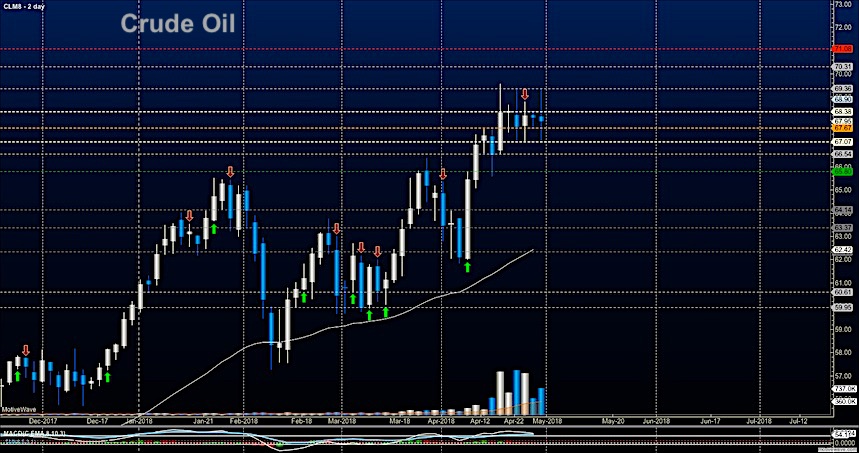

WTI Crude Oil

Deep support held and traders forced price into the edge of resistance. If we sit below 67.6, we are more susceptible to further selling. Above it, we can press towards congestion near 68.9 and higher. The API and EIA reports are set to release over the next two days. Hedge funds are still bullish but buying has slowed. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a bullish retest of 68.34

- Selling pressure intraday will strengthen with a bearish retest of 67.60

- Resistance sits near 68.06 to 68.38, with 69.27 and 70.22 above that.

- Support holds near 67.6 to 67.24, with 66.54 and 65.94 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.