Stock Market Considerations For March 22, 2017

Momentum selling aggravated a move downward below key weekly support levels. The S&P 500 (INDEXSP:.INX) is trying to bounce… Check the support levels in the commentary below and on the charts. Check out today’s economic calendar with a full rundown of releases.

Note that the charts below are from our premium service at The Trading Book and shared exclusively with See It Market readers.

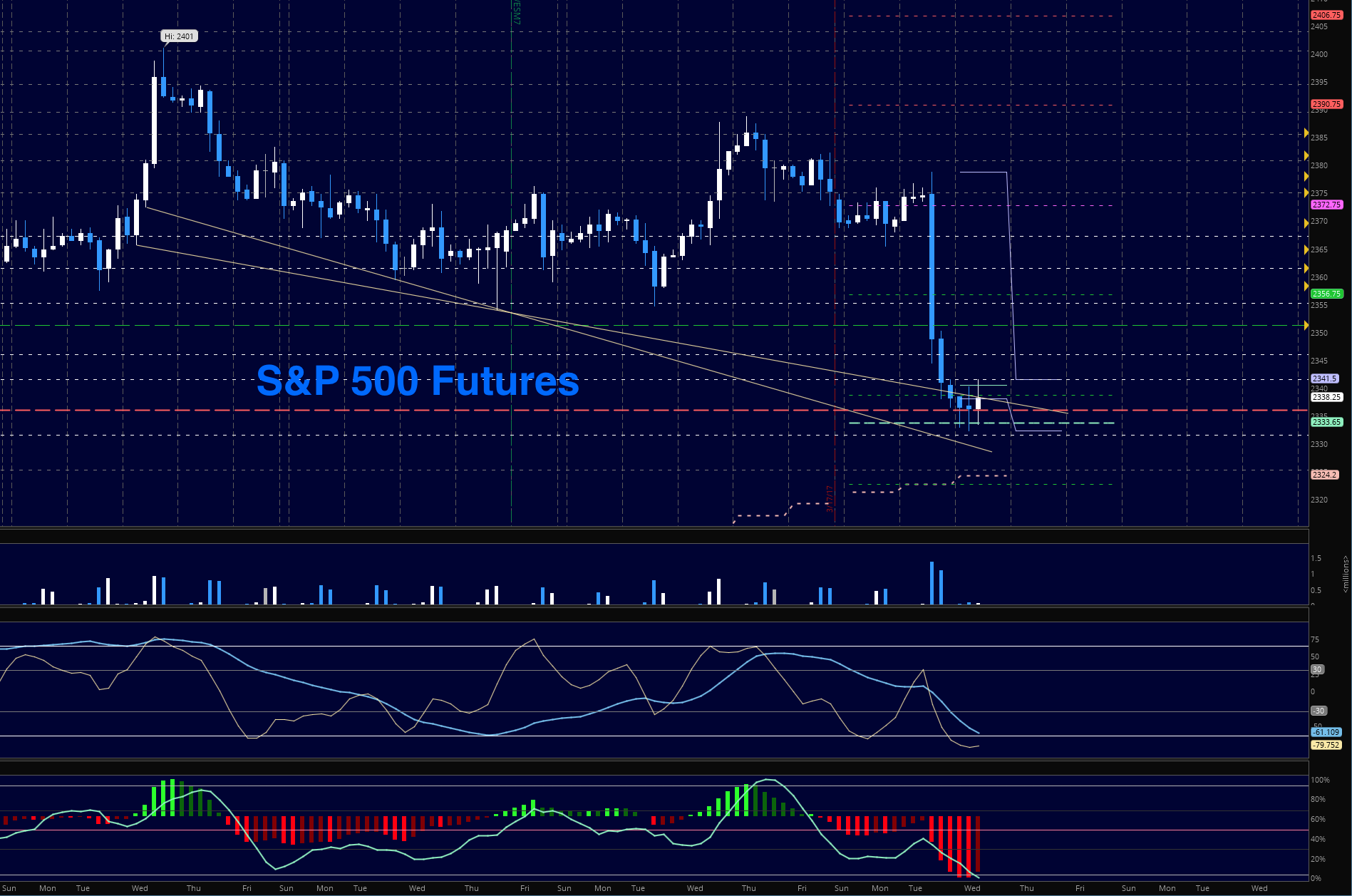

S&P 500 Futures (ES)

The level to watch for recovery is 2365 we seem quite far from those levels at this time. 2351 will be the level to watch today as buyers will become braver above this space. Support levels sit near 2331.5 and 2325.25.

- Buying pressure will likely strengthen above a positive retest of 2351.5

- Selling pressure will likely strengthen with a failed retest of 2336

- Resistance sits near 2341.5 to 2351.5, with 2355.25 and 2361.75 above that

- Support holds between 2336 and 2331.5, with 2325.5 and 2319.5 below that

NASDAQ Futures

Big momentum move during the day as supports were tested and failed continually into deeper support levels. Weekly levels of consequence sit near 5278.5, and 5299.

- Buying pressure will likely strengthen with a positive retest of 5349.5 (use caution-wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5318.25

- Resistance sits near 5349.5 to 5362.5, with 5376 and 5387.25 above that

- Support holds between 5318.25 and 5312.5, with 5299 and 5288.25 below that

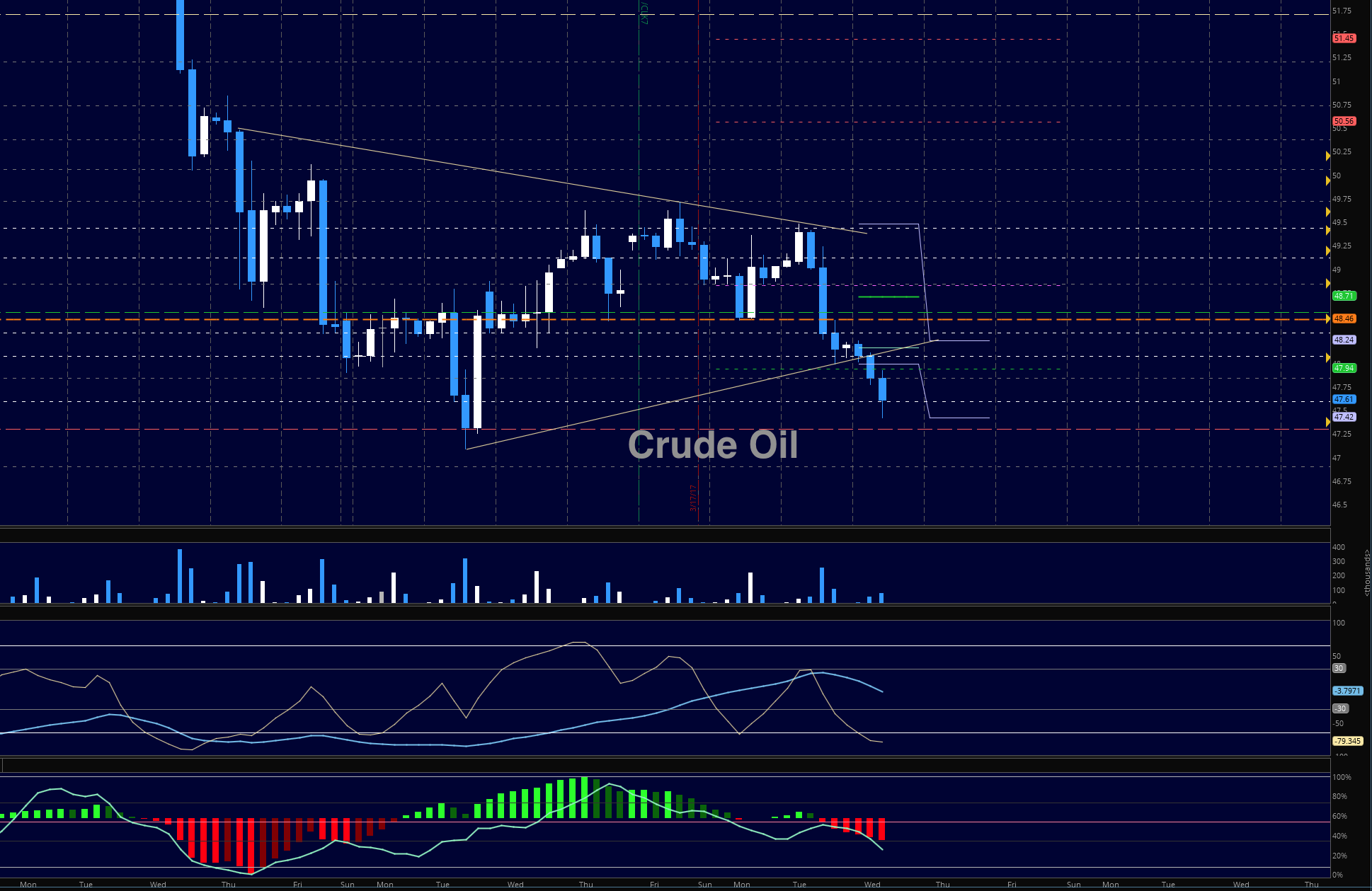

Crude Oil – WTI

Under the weight of the short hedge funds, charts have faded into recent deep support near 47.3 Tests near 48.54 will present as resistance at first pass, but the chart is currently struggling at 47.6. A broken wedge is showing which potentially gives us several targets below, 46.92, and 46.2.

- Buying pressure will likely strengthen with a positive retest of 48.07 (be careful here)

- Selling pressure will strengthen with a failed retest of 47.58

- Resistance sits near 48.15 to 48.32, with 48.54 and 48.86 above that.

- Support holds between 47.4 and 47.1, with 46.92 and 46.23 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.