Stock Market Futures Trading Considerations For July 24, 2017

The S&P 500 Index (INDEXSP:.INX) enters Monday’s trading session near overhead resistance. This may limit upside today. See futures trading levels for the S&P 500, Nasdaq, and Crude Oil below.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

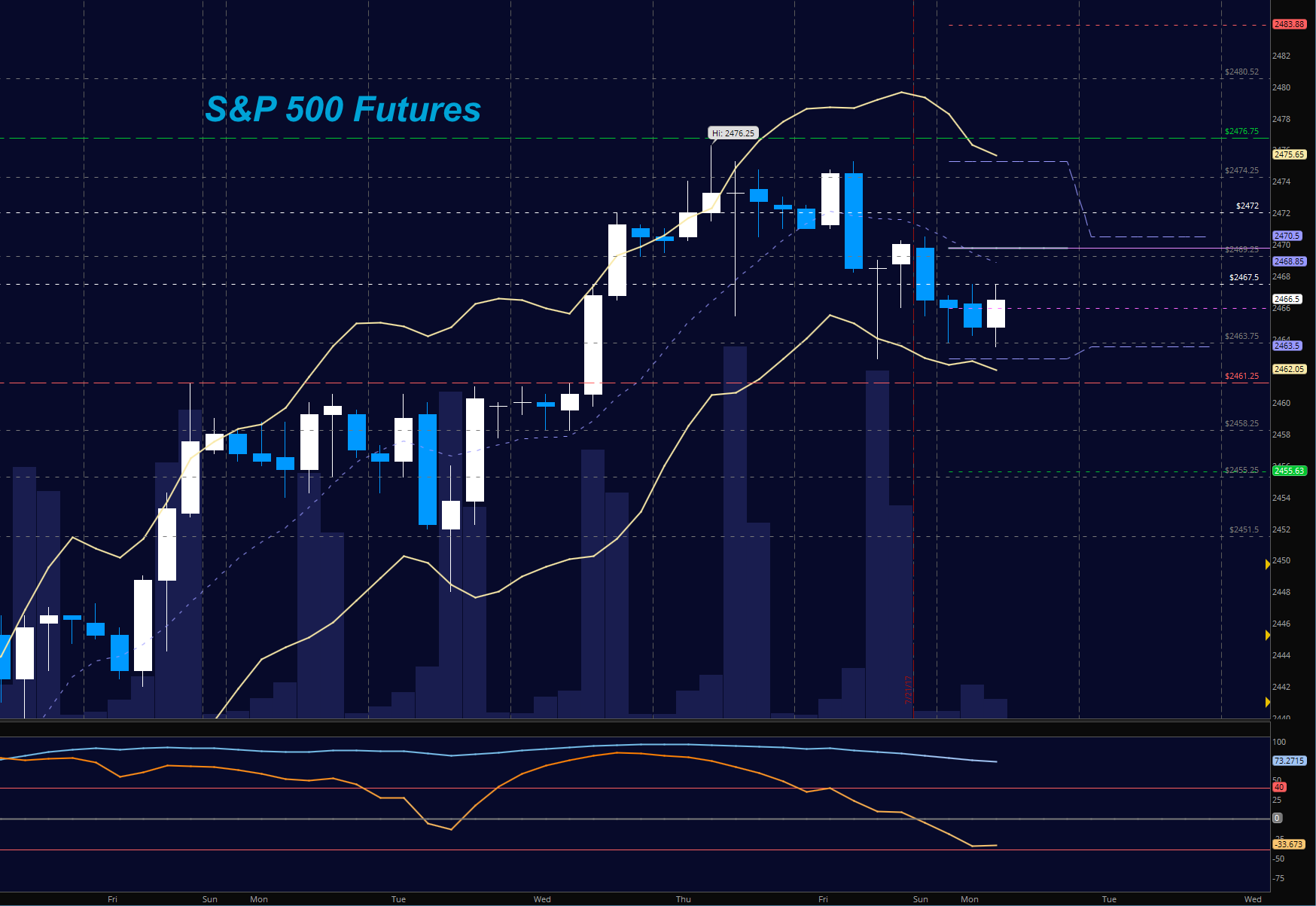

S&P 500 Futures (ES)

As the new week begins, buyers still hold control as sellers force lower highs. Support levels are lower and begin near 2463.75. A failed retest there will bring us more intraday selling into deeper support. Lower highs show buyers are struggling to command the environment. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2472 (careful again here with resistance)

- Selling pressure intraday will likely strengthen with a failed retest of 2465

- Resistance sits near 2470.5 to 2474.5, with 2476.75 and 2480.5 above that.

- Support holds between 2463.5 and 2461.5, with 2457.25 and 2452.5 below that.

NASDAQ Futures (NQ)

Buyers hold us above breakout levels near 5900, but the sellers continue to press lower highs into the forms present. Congestion is building at 5914 – even as we fade below it and quickly recapture the region. The failed bounce on bigger time frames will give us deeper support tests – near 5880. Formations still suggest deep pullbacks will be buy zones. I am on the lookout for lower highs and new lower support to tell me more selling pressure is building. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 5924.75

- Selling pressure intraday will likely strengthen with a failed retest of 5905

- Resistance sits near 5824.5 to 5932.5, with 5942.75 and 5958.75 above that.

- Support holds between 5905 and 5896.75, with 5883.5 and 5867.5 below that.

WTI Crude Oil

Sellers hold control in the wide band of motion we’ve been watching for several weeks, forcing price lower in each wave of the current short cycle. Buyers continue to defend important regions of support near 45.4. Momentum is mixed but buyers should gain footing above 46.4. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 46.4

- Selling pressure intraday will strengthen with a failed retest of 45.4

- Resistance sits near 46.3 to 46.8, with 47.2 and 47.74 above that.

- Support holds between 45.6 to 44.94, with 44.54 and 43.92 below that.

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.