Stock Market Considerations For August 1, 2017

As the Dow Jones continues to rip higher, other market indices like the S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are lagging. Knowing where to expect buyers and sellers is key with trading. See my trading levels below.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service and shared exclusively with See It Market readers.

S&P 500 Futures (ES)

Markets trace into higher congestion near 2477.25 in the early morning but fade into congestion – just as yesterday. We are holding support levels of interest near 2466. Resistance is near 2478 as earnings season continues. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intradaywill likely strengthen above a positive retest of 2478 (careful again here with resistance)

- Sellingpressure intraday will likely strengthen with a failed retest of 2466

- Resistance sits near 2474.75 to 2477.5, with 2480.75 and 2483.75 above that.

- Support holds between 2470.5 and 2466.5, with 2463.5 and 2458.75 below that.

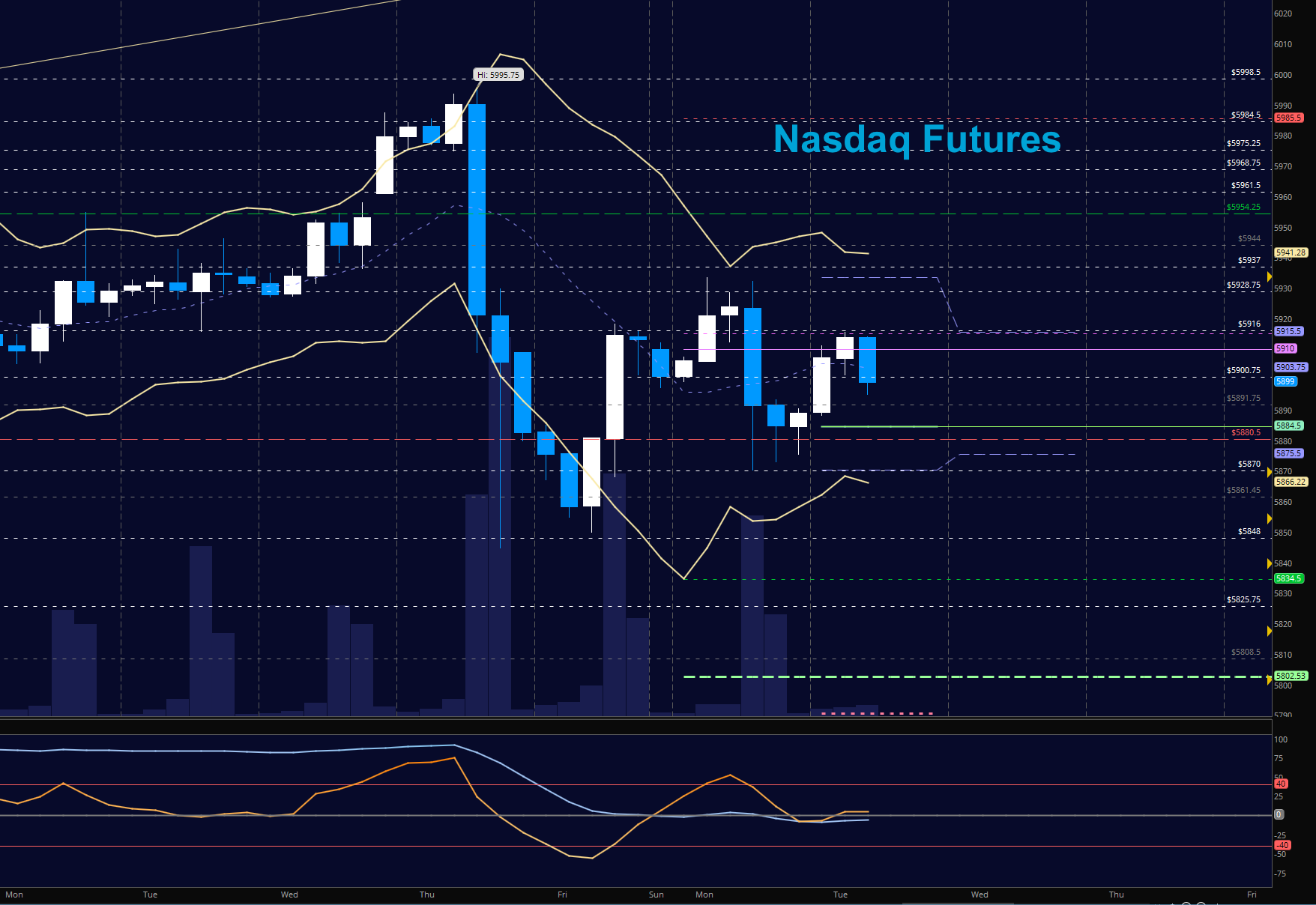

NASDAQ Futures (NQ)

Higher lows hold but so do lower highs leaving us with congested patterns and weakness not seen often this year in the NQ_F. The range between 5912 and 5928 is important for buyers to recapture. Below these levels, sellers hold more power in the overall intraday motion of the chart. Momentum is mixed. Big moves in either direction will find reversals. The support line in the sand is near 5870. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buyingpressure intraday will likely strengthen with a positive retest of 5916

- Sellingpressure intraday will likely strengthen with a failed retest of 5897

- Resistance sits near 5928.5 to 5936.5, with 5946.75 and 5961.75 above that.

- Support holds between 5897.5 and 5891.25, with 5884.5 and 5870.5 below that.

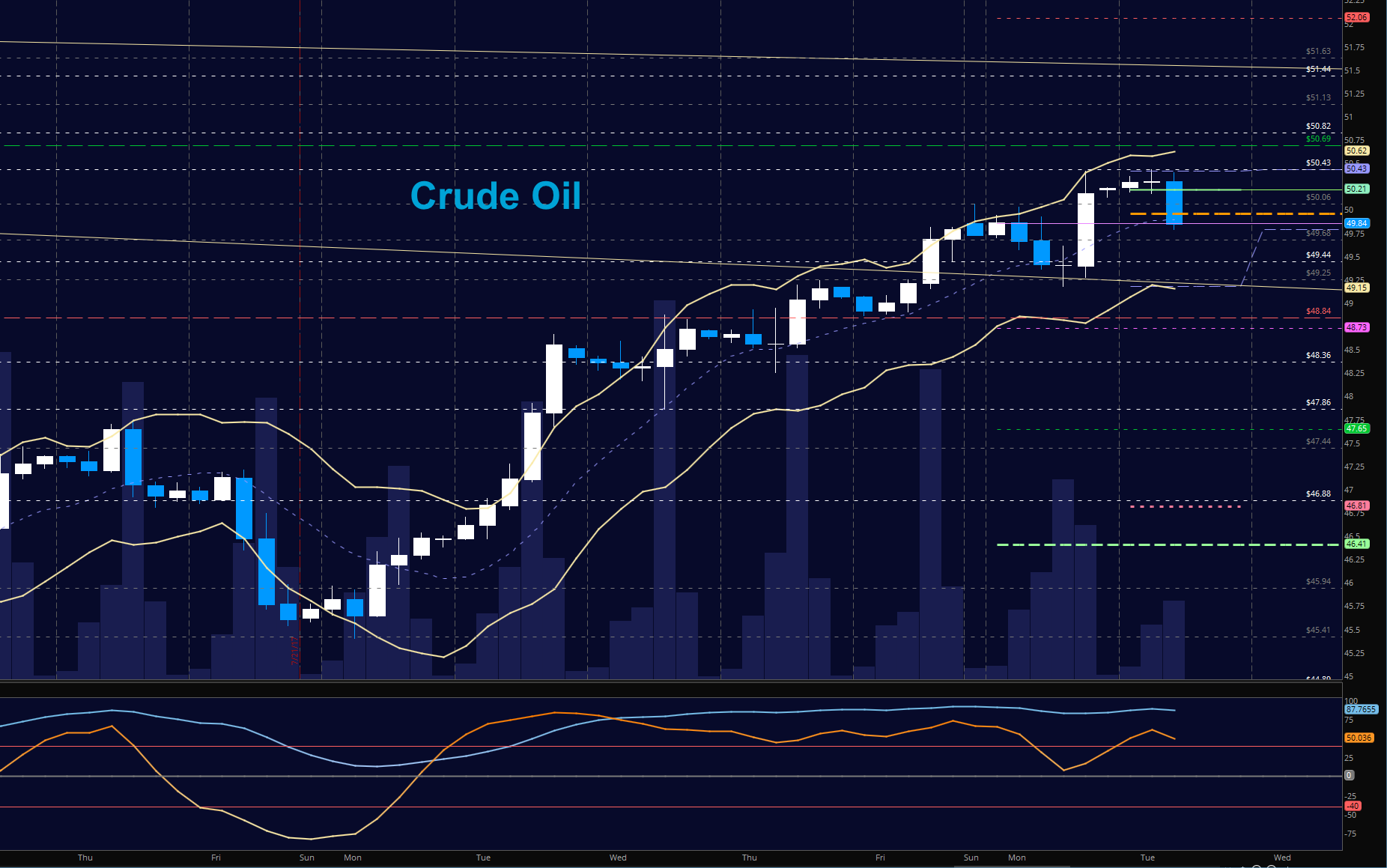

WTI Crude Oil

John Kemp, the Reuters commodities analyst, suggests that the rise here is from short covering and not from a building of positions. This leaves us vulnerable to deep fades, so keep an eye out for failed support to quickly bring selling to the charts. We did hit our target of 50.4e from yesterday’s projections. Bullish formations still hold here with the support zone to watch being 49.25. Pullbacks will continue to hold regions for buyers to engage. Momentum is mixed but still bullish, in general. Above 49.84, we’ll likely retest 50.06 and above that lies 50.44 and 50.82 to 51.13 as the next test areas. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buyingpressure intraday will likely strengthen with a positive retest of 49.68

- Sellingpressure intraday will strengthen with a failed retest of 49.2

- Resistance sits near 50.06 to 50.44, with 50.82 and 51.13 above that.

- Support holds between 49.44 to 49.15, with 48.84 and 48.32 below that.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.