S&P 500 Futures Trading Considerations For April 20, 2017

The edges of the range continue to deliver the best reversal trades intraday on the S&P 500 (INDEXSP:.INX). However, traders need to remain caution on these edges as they can stretch a bit before reversal, as they did yesterday in both the S&P 500 (ES_F) and Nasdaq (NQ_F) stock market futures. Gold and the 30-year bonds have been running ahead of themselves so seeing them fade yesterday was expected. They still holding bullish formations, as does the VIX.

Check out today’s economic calendar with a full rundown of releases. And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

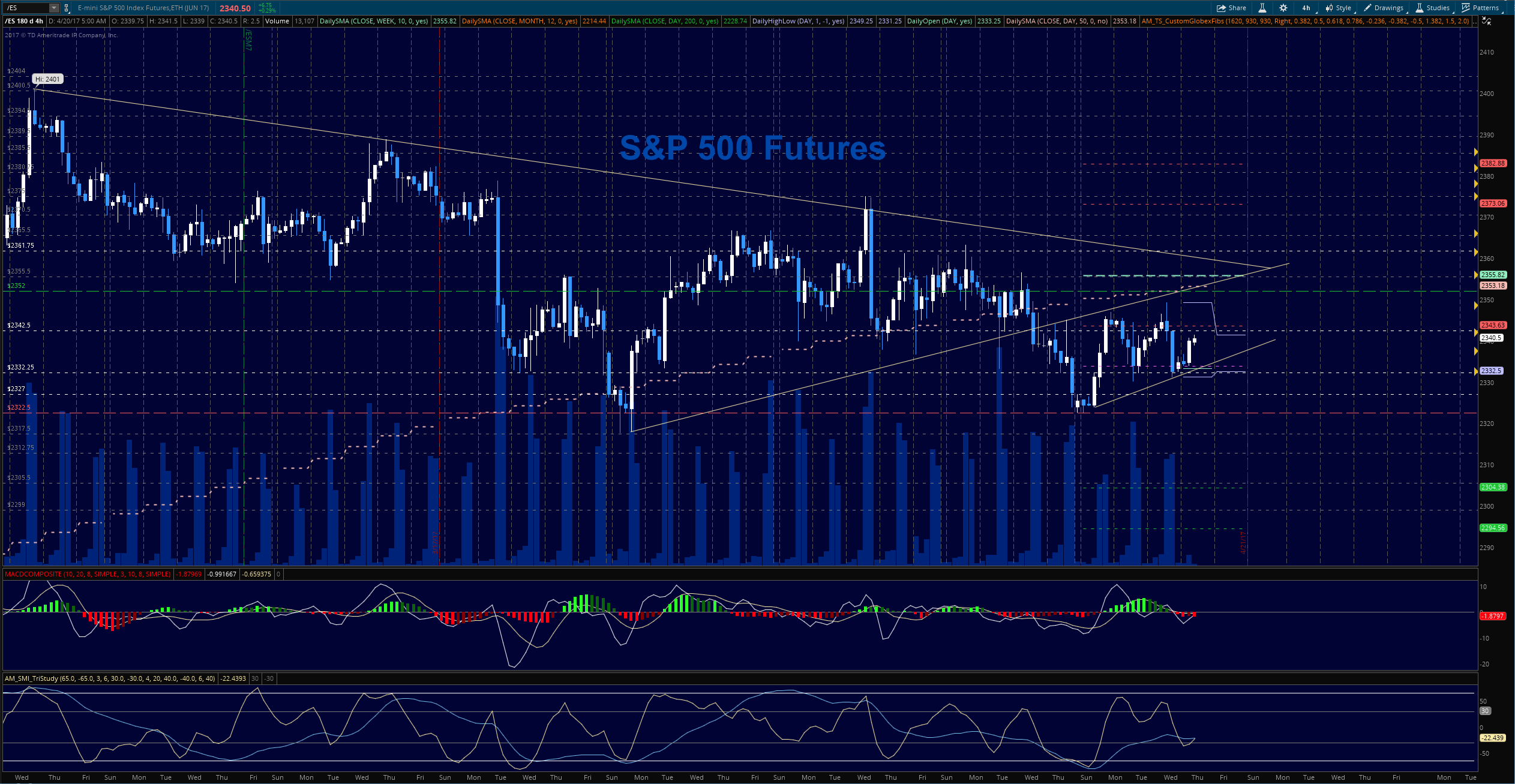

S&P 500 FUTURES (ES_F)

The ES_F, however, is not as strong as the NQ_F currently. Buyers keep support in a battle against the slopes of longer time frames and show that our range still remains intact. The levels near 2346 hold as resistance for now. A breach and hold of this level will shift the balance of motion. As it stands this morning, a break and hold below 2332 will give sellers more power while the breach and hold above 2347 will deliver power to the buyers.

- Buying pressure will likely strengthen above a positive retest of 2354.5

- Selling pressure will likely strengthen with a failed retest of 2332

- Resistance sits near 2347.5 to 2354.5, with 2361.5 and 2365.25 above that

- Support holds between 2332 and 2322.5, with 2317.75 and 2305.5 below that

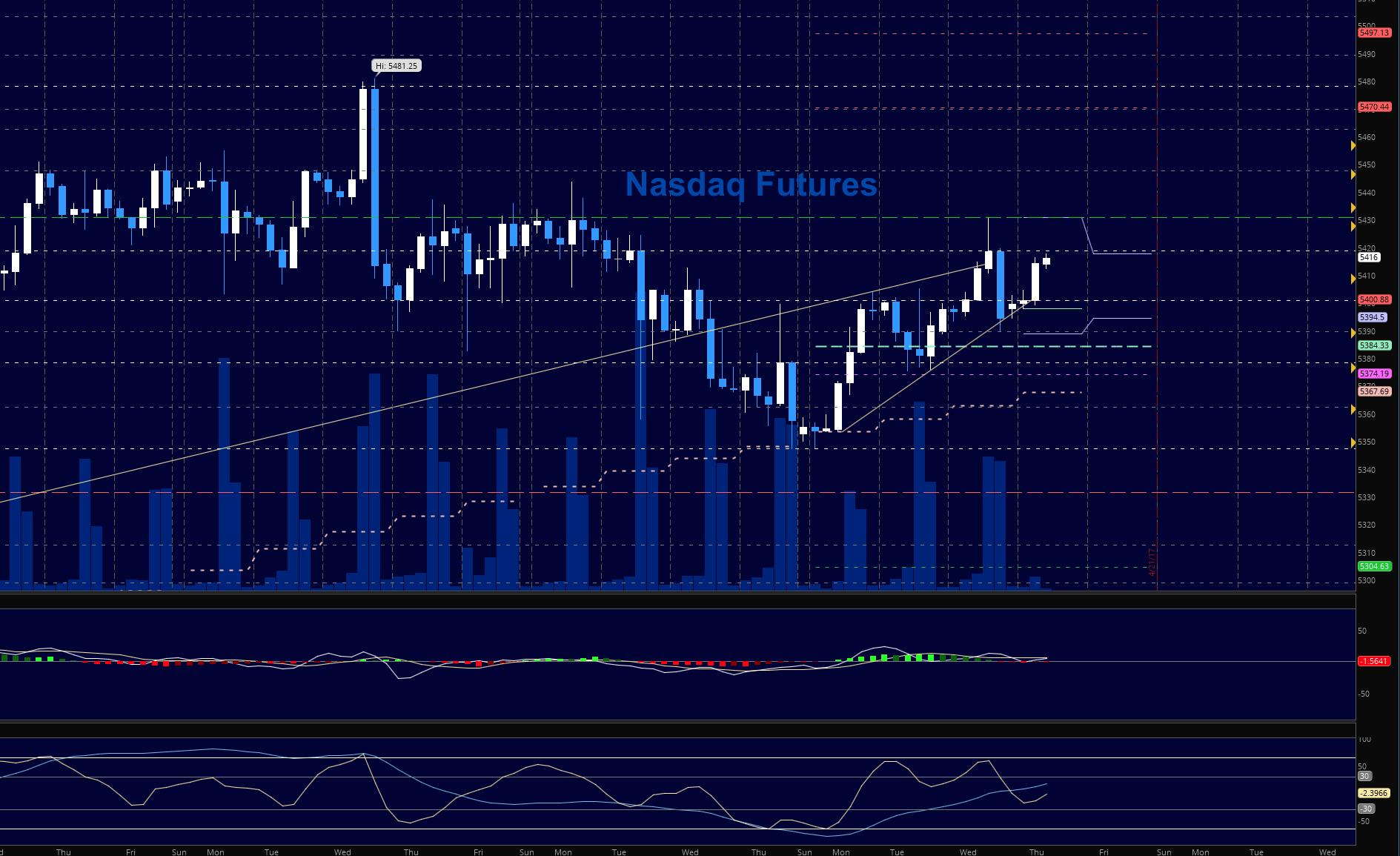

NASDAQ FUTURES (NQ_F)

Traders hold this chart with higher lows and higher highs over the last few days. The spikes higher did give us bigger motions as we expected yesterday, as did the reversals off the highs. To me, this clearly signals that short-term momentum traders get involved through the day. Support is now building at 5390. Above that level, we should keep buyers in charge and a break and failed retest below the 5390 area, sellers will resume the power. A potential riging wedge is in play – intraday momentum is mixed to bullish.

- Buying pressure will likely strengthen with a positive retest of 5430.5 (use caution as sellers sit near 5434)

- Selling pressure will likely strengthen with a failed retest of 5390.25

- Resistance sits near 5420.5 to 5427.75, with 5430.5 and 5434.5 above that

- Support holds between 5390.25 and 5374.25, with 5358.5 and 5347.5 below that

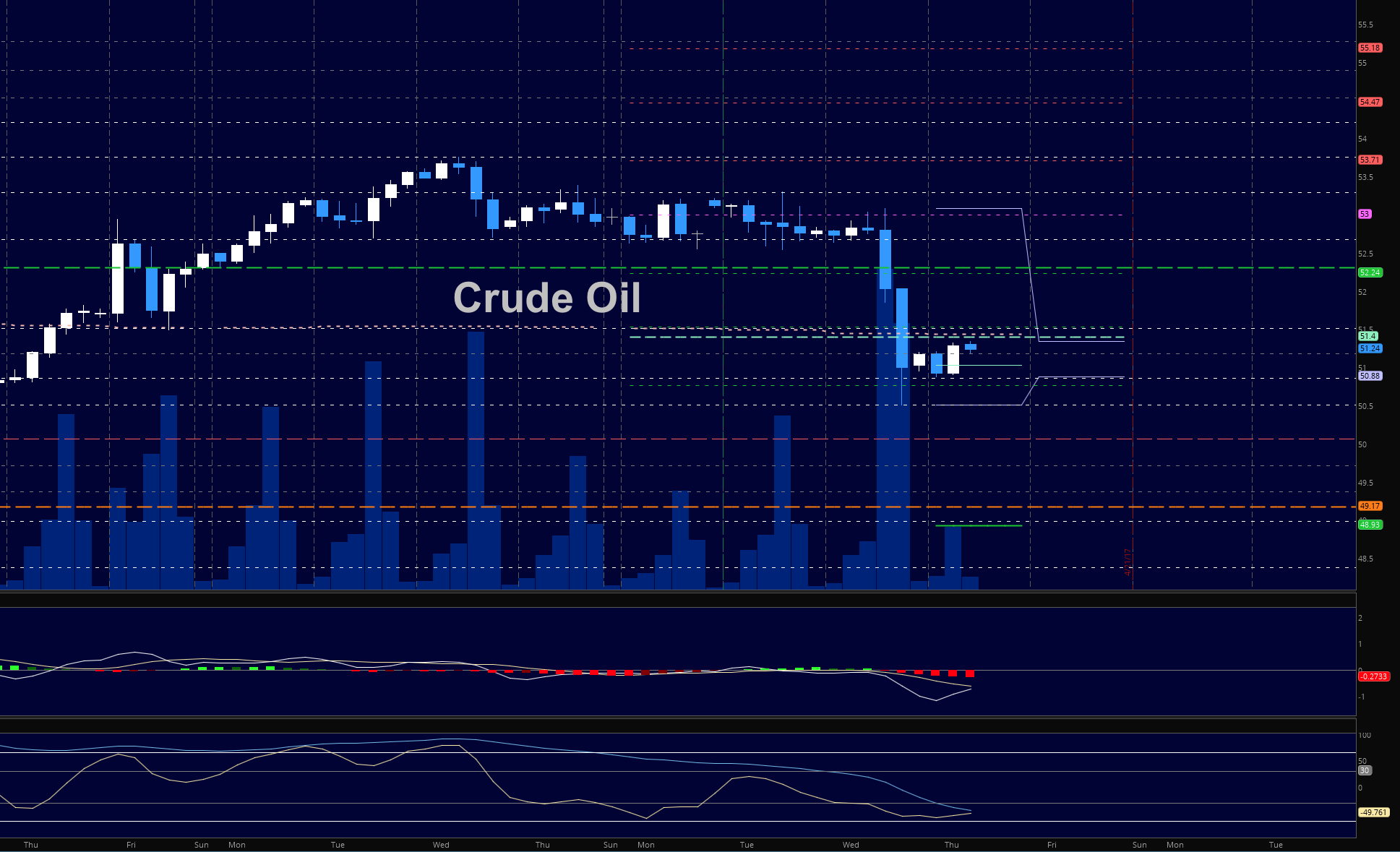

CRUDE OIL –WTI (CL_F)

Oil faded sharply yesterday, not catching support until much lower. This seems to have been a repeat of the last time that traders leveled themselves long near this level in early March. Bounces are likely to find sellers, particularly below 51.48. New support levels hold between 50.8 and 50.50. A failure to hold these levels sends us to the 50 region as a test of the round psychological level. Traders may choose to chop around today between 50.84 and 51.5 as they digest movement

- Buying pressure will likely strengthen with a positive retest of 51.8

- Selling pressure will strengthen with a failed retest of 50.74

- Resistance sits near 52.02 to 52.32, with 52.68 and 53.3 above that.

- Support holds between 50.8 and 50.51, with 50.04 and 49.36 below that.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.