News today is mixed as investors digest reports about Mexico and China trade talks / tariffs.

As I mentioned last week, bounces into resistance have turned lower so that is the theme to watch to see if traders get more of the same or a change in character.

Early morning behavior is bullish across the major stock market indices, with the S&P 500 (INDEXSP: INX) moving higher and the NASDAQ being the main laggard.

Gold (NYSEARCA: GLD), in particular, is making a very big bounce and crude oil is not far behind.

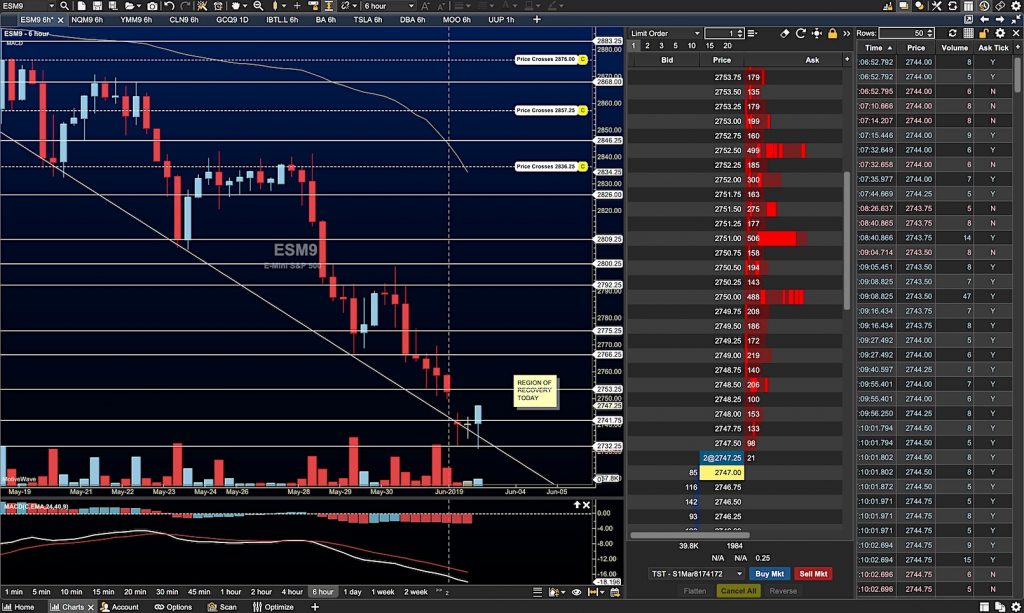

S&P 500 Futures (ES_F)

S&P 500 futures are within 6 points of weekly and monthly resistance. Frontline resistance gave us new territories to initiate new shorts and the breakdown overnight has brought us into another bounce zone. Our patterns look like the following so far – deep fades overnight – shallow morning bounces that yield deeper fades.

Lower highs and lower lows confirm to me that the overall pressure still looks negative but slipping into neutral which could deliver bounce patterns.

RECAP: S&P 500 futures (ES_F) buyers are stronger above 2746.75. Sellers want to push us below 2730.

For Gold (GC_F), key price resistance is near 1328 and new support is well below at 1302 but there is some noise at 1314

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.