Stock Market Futures Considerations For April 3, 2017

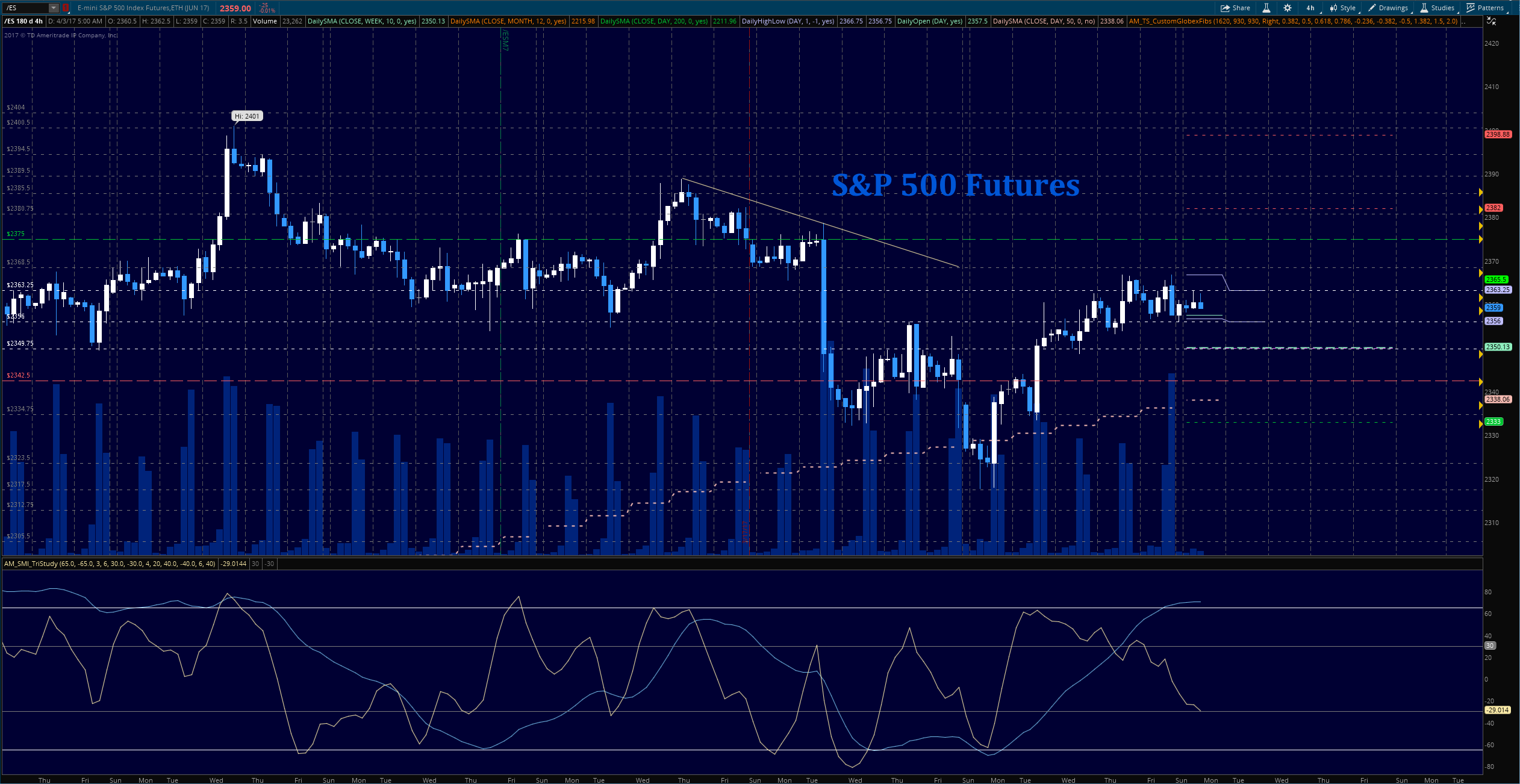

Higher support is holding for the second day near 2356 on S&P 500 futures but the failure to recover over the significant weekly level of 2365 remains troubling. Momentum on the S&P 500 (INDEXSP:.INX) was not strong enough on Friday to hold highs and the formations look much the same today.

That said, price action will be very important to watch near this 2356 area for support or at 2364 at resistance. Charts are a bit muddy, so we’ll need to watch for either group to take control and then follow along. Cautious trading is suggested as we are range bound but still without the necessary conviction to hold price.

- Buying pressure will likely strengthen above a positive retest of 2364.5 (but more resistance is ahead nearby)

- Selling pressure will likely strengthen with a failed retest of 2350

- Resistance sits near 2363.5 to 2366.5, with 2369.5 and 2374.25 above that

- Support holds between 2350.5 and 2342.5, with 2338.5 and 2330.5 below that

Check out today’s economic calendar with a full rundown of releases.

And note that the charts below are from our premium service at The Trading Book and are shared exclusively with See It Market readers.

TRADING SETUPS

E-mini S&P 500 Futures

Upside trades – Two options for entry:

- Positive retest of continuation level -2363.5

- Positive retest of support level – 2356.5

- Opening targets ranges – 2359.75, 2361.5, 2366.25, 2367.5, 2372.75, 2375, 2377.5, 2381.5, 2385.75, 2389.75, 2392.5, 2396, 2400.5, 2404, 2411.75, 2423.25

Downside trades – Two options for entry:

- Failed retest of resistance level -2362.75 (divergence needs to exist if you pick this one and watch for higher lows)

- Failed retest of support level – 2355.5

- Opening target ranges – 2359.5, 2355.5, 2352.25, 2348.75, 2344.5, 2341.75, 2336.25, 2332.75, 2328.75, 2325.75, 2320.5, 2317.75, 2313.75, 2307.75, 2304.75, 2299, 2293

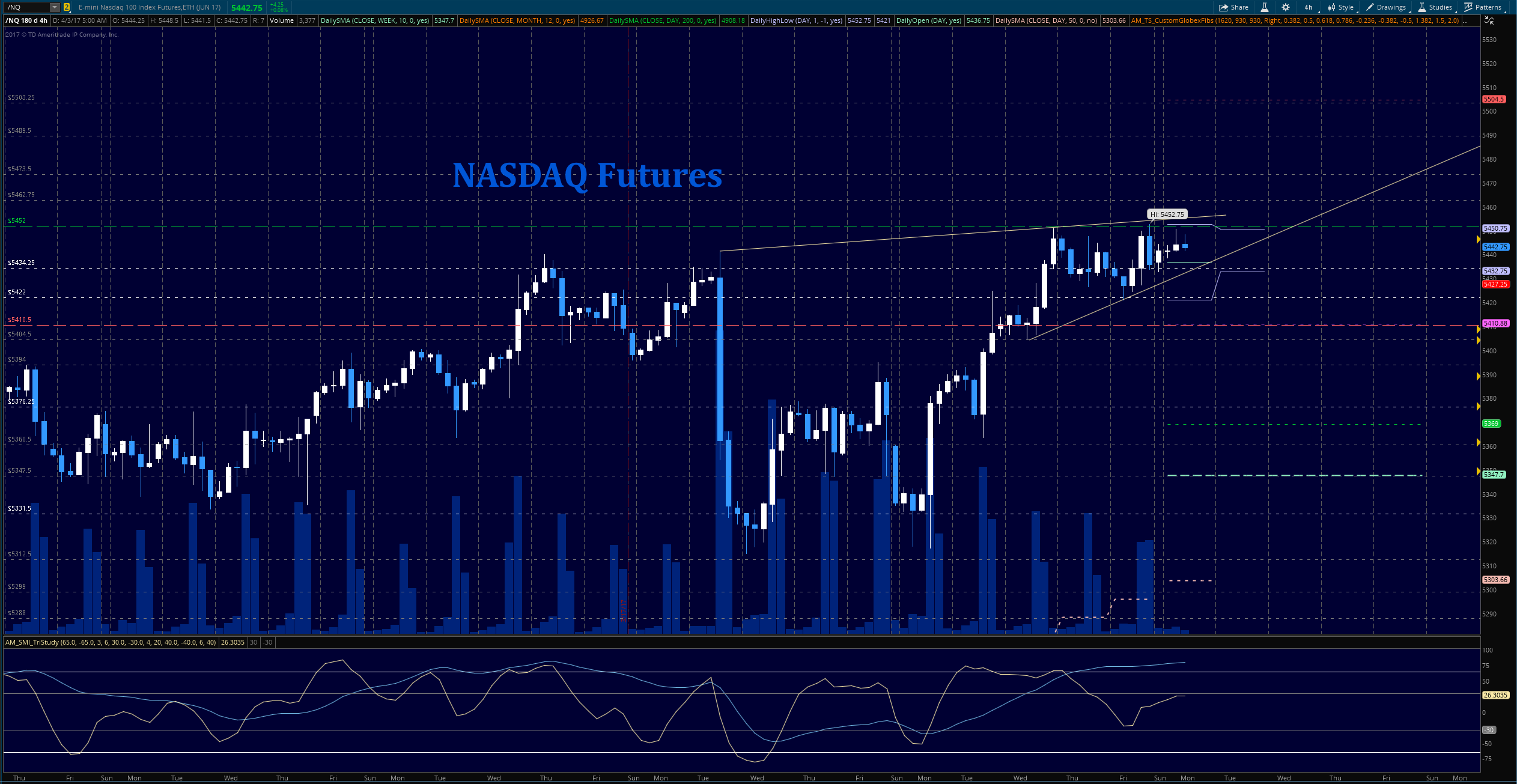

NASDAQ Futures

Momentum holds steady for a fourth day as buyers hold higher lows while sellers keep traders from advancing into higher highs. New support levels to watch are in the 5430 region and again, range expansions should not hold new highs under the current market strength. This chart is certainly slipping into a wait state as we enter the second quarter of earnings releases. Continue to use caution going long at the upper edge of the ranges, or going short on the lower edge of the ranges. Note the levels on the chart for price bounds.

- Buying pressure will likely strengthen with a positive retest of 5448.5 (use caution as sellers sit up here-wait for a retest)

- Selling pressure will likely strengthen with a failed retest of 5417.75

- Resistance sits near 5442.5 to 5452, with 5462.5 and 5473.5 above that

- Support holds between 5420.75 and 5404.25, with 5388.5 and 5347.5 below that

Upside trades – Two options:

- Positive retest of continuation level -5448 (make sure you have that positive retest)

- Positive retest of support level– 5434.5

- Opening target ranges – 5440, 5443.75, 5448.5, 5450.5, 5456.25, 5462.75, 5468.5, 5473.5

Downside trades- Two options:

- Failed retest of resistance level -5445.25 (watch for higher lows if chart tries to reverse and move upward)

- Failed retest of support level– 5432.5

- Opening target ranges –5442.25, 5436.5, 5432.5, 5427.75, 5422.75, 5417.75, 5410.75, 5404, 5398.5, 5388.25, 5376.25, 5369.5, 5361.5, 5356.25, 5347.75, 5341.5, 5331.5, 5324.5, 5318.75, 5312.75, 5306.5

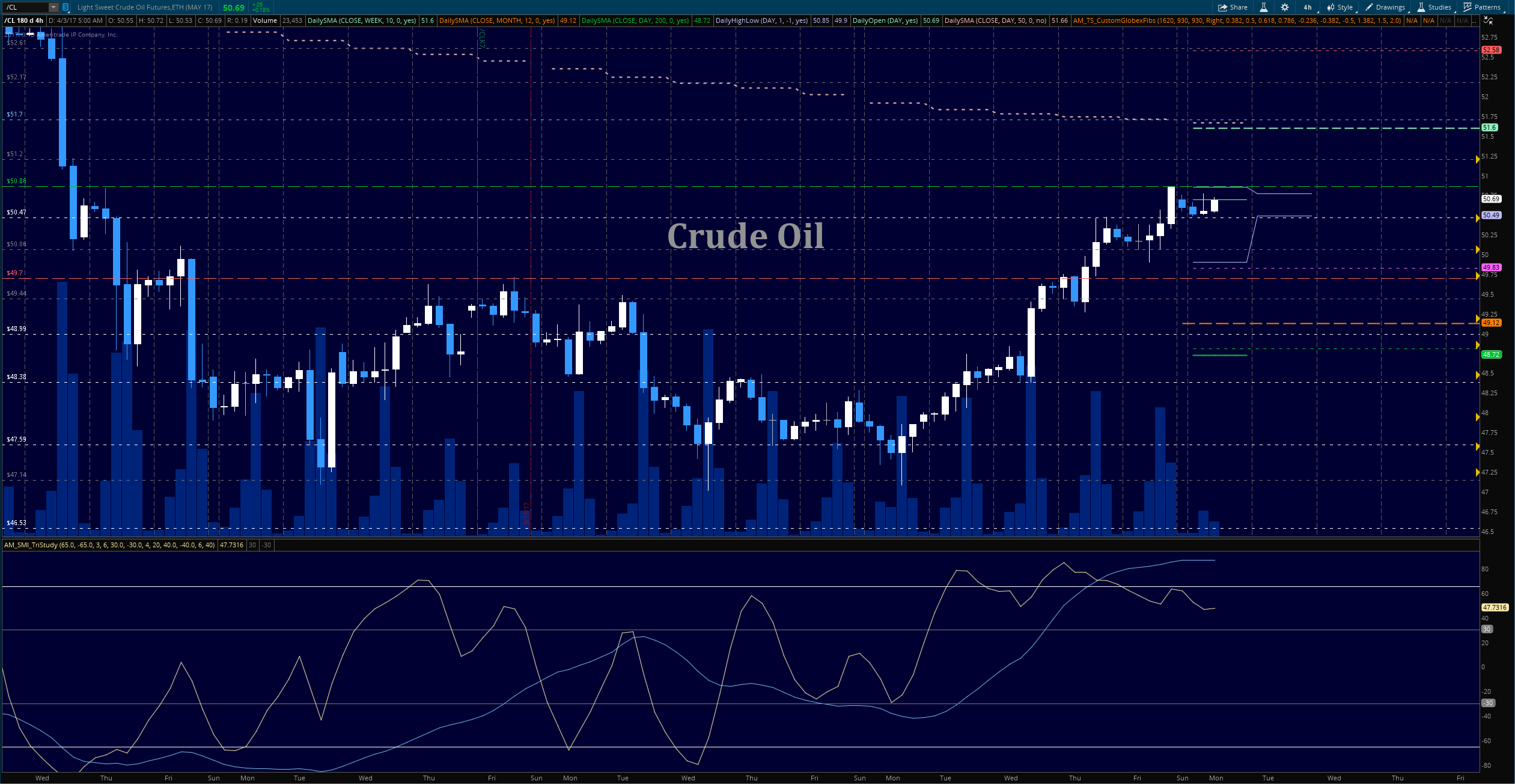

Crude Oil –WTI

Oil continues a rise against building inventories. There seems to be a magnet pulling price into 51.7, so this remains the terminal target for this cycle with 52.5 above that. However, current momentum reading suggests a fade before completion of that target. Traders are not pushing volume with the price increases and that is always a signal of limited participation in the move. A test of higher support is likely but the volume at higher highs in this cycle make me very cautious about holding longs into anything higher than near- term visible resistance.

- Buying pressure will likely strengthen with a positive retest of 50.88

- Selling pressure will strengthen with a failed retest of 50.06

- Resistance sits near 50.88 to 51.22, with 51.64 and 51.57 above that.

- Support holds between 50.49 and 50.2, with 49.78 and 49.12 below that.

Upside trades – Two options

- Positive retest of continuation level -50.86 ( could easily be resistance- use caution)

- Positive retest of support level– 50.34

- Opening target ranges– 50.52, 50.7, 50.85, 51.02, 51.2, 51.7, 52.14, 52.6, 53.05

Downside trades- Two options

- Failed retest of resistance level -50.54 (watch for possible support building)

- Failed retest of support level– 50.3

- Opening target ranges for non-members – 50.32, 50.08, 49.84, 49.47, 49.28, 48.86, 48.62, 48.19, 47.92, 47.64, 47.47, 47.26, 47.04, 46.9, 46.53, 46.21, 45.94

If you’re interested in watching these trades go live, join us in the live trading room from 9am to 11:30am each trading day. Visit TheTradingBook for more information.

Our live trading room is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.