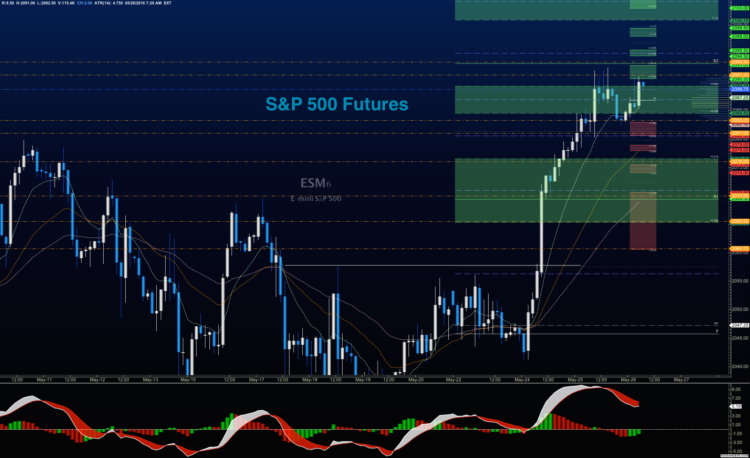

S&P 500 futures outlook for May 26, 2016 – With buyers still having much to prove, holding lower supports will be critical today. The move upward will be heavily contested, and upside motion into 2095-2097 should quickly fail, if the buyers get traction over 2091.

At this writing, we are holding just below 2089, with lots of support near 2082-2084. Failure to hold 2082, and we will likely see the region near 2078-2075 tested. There is still an auction vacuum below 2071.5, but lots of support until then.

Momentum on the four-hour chart is bullish, but flattening in trending spaces. Buyers are set to defend the regions near 2082, but a bad job number or other news release may shake the tree a bit and shift support lower.

My supposition yesterday was that we fail to keep our highs, making the spikes into resistance as fair shorting regions into frontline support. I suspect the same today, and do not expect breakouts to hold. I also expect bounces off support levels to provide good intraday long trades. We hold important breach levels of 2075, and that keeps buyers in control, in general. Below there, we are much more prone to sellers taking over.

See today’s economic calendar with a rundown of releases.

THE RANGE OF TUESDAY’S MOTION

E-mini S&P 500 Futures (ES_F)

S&P 500 futures outlook for May 26, 2016 – Momentum sits with the buyers for yet another day, and they are testing near resistance right now- much as yesterday, but with less momentum. Sellers hold control of the area between 2090 and 2092.5. However, if they are moved aside in the face of current momentum, we’ll see those upper targets on S&P 500 futures come into view: 2095.25 and 2097.5.

Upside trades on S&P 500 futures – Favorable setups sit on the positive retest of 2089, or a positive retest of 2082.5 with positive momentum. I use the 30min to 1hr chart for the breach and retest mechanic. Targets from 2082.5 are 2084, 2085.75, 2088, 2091.25, 2093.5, and if we can catch a bid there, we could expand into 2095.25, and 2097.5. A retest of these levels that hold will press the chart into resistance ahead near 2102.75, but that seems very unlikely at this juncture.

Downside trades on S&P 500 futures – Favorable setups sit below the failed retest of 2082.5 or at the failed retest of 2092.5 with negative divergence. It is important to watch for higher lows to develop with the 2092.5 entry, as strength of motion today sits very much with the buyers. Retracement into lower levels from 2092.5 gives us the targets 2090, 2088.5, 2084.75, 2082.25, 2078.75, 2075.75, 2072.5, 2070.5, 2068.25, and perhaps a retest near 2060 before bouncing- but that also does not seem likely here.

Crude Oil Futures (CL_F)

Outlook for crude oil futures for May 26, 2016 – Both API and EIA reports showed a draw of reserves as supply drifts lower in this cycle. The pattern is currently in breakout but jammed into resistance that everyone can see, so this becomes a game of power – and so far, that power game is in the hands of buyers who continue to move us above resistance. Momentum remains strong for crude oil and a move to test 50, and above is underway.

In the big picture, however, the chart will come under pressure at these levels, and force a retrace into higher support below.

The trading range for crude oil prices suggests support action near 48.94, and resistance behavior near 50.4.

Upside trades on crude oil futures can be staged on the positive retest of 50.04, or after a dip into 49.57, but carefully watch for a failure of price to carry through above 50. There won’t be too much of a range expansion above there (enough to trade intraday but not to hold). I often use the 30min to 1hr chart for the breach and retest mechanic. Targets from 49.57 are 49.74, 49.97, and 50.04. If we expand over that, we could see 50.4, 50.65, and even 50.92.

Downside trades on crude oil futures continue to setup well below failed retests, but are clearly countertrend at the moment. Today, this is the failed retest of 49.4, or at the failed retest of 50.25 with negative divergence. There is also a short sitting at the failed retest of 49.70 under negative divergence. These setups give us targets into 49.95, 49.74, 49.57, 49.43, 49.24, 49.12, 48.84, 48.66, 48.45, 48.22, and perhaps 47.64 – but that seems unlikely here today.

Have a look at the Fibonacci levels marked in the blog for more targets.

If you’re interested in the live trading room, it is now primarily stock market futures content, though we do track heavily traded stocks and their likely daily trajectories as well – we begin at 9am with a morning report and likely chart movements along with trade setups for the day.

As long as the trader keeps himself aware of support and resistance levels, risk can be very adequately managed to play in either direction as bottom picking remains a behavior pattern that is developing with value buyers and speculative traders.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.