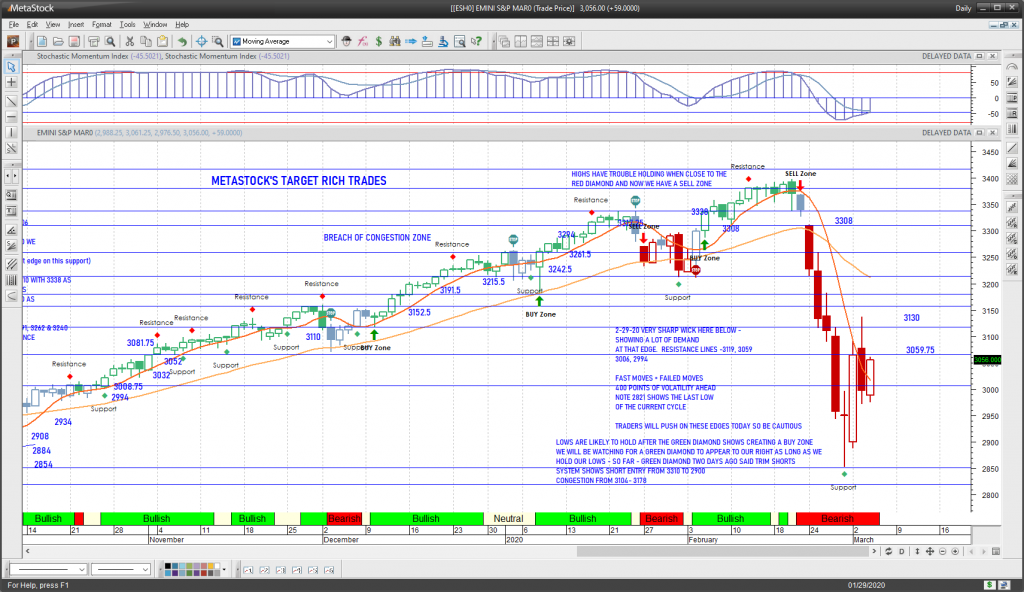

S&P 500 Index Futures Chart

MARKET COMMENTARY

Continuing the wider ranges – but S&P 500 Index futures are holding off the lows.

Momentum traders are moving the markets and capturing gains from the lows to the highs that they find.

This is difficult for the active investor who should be looking for a straightforward ride from price support to resistance. We are entering high volatility environments.

When big money houses come out and say they are going to have their best trading quarters after the monster moves, we know they are influencing the markets with algorithmic motion. Today we sit below 3086 – key price resistance.

In high volatility markets, we look for deep levels of support looking for strength and high levels of resistance looking for any weakness to engage. Our systems are saying cautious short action ahead with a building likelihood that we have made a bottom for now.

WEEKLY PRICE ACTION

Earnings season is tapering off now. Monthly and weekly support on the S&P 500 Index have shifted down and now sit at 2839.5. We have 300 points of congestion to work through-, and we will – with a bit of heavy whipsaw to continue.

COMMODITY & CURRENCY WATCH

Gold broke hard before recovering (remember the volatility squeeze we spoke about that told us something was coming)- these sorts of things it is important to add to your memory. Pullbacks are buying zones and they will continue to be in the current market. The US dollar has rolled right over into deeper support but has stabilized near 97.3.

Currency markets remain extremely volatile with sharp moves across the board, so ripple effects should slip into the US dollar as they have. WTI has made a 13% move to the upside from its low. Recovering 50.12-50.46 will be critical for any bullish motion to take over. And that seems very far away. Right now, we hold steady above 46.7ish – support- amidst a bombing of a Taliban stronghold.

TRADING VIEW & ACTION PLAN

We are still looking at choppy news-driven with deep fades and high spikes by momentum traders who give us trading ranges that are large. The S7p 500 futures are bearish at the first passes from resistance to support. Levels near 2985 are support regions that have seen buyers in the past and 3104-3127 looks like front line resistance for now. Traders will be whipsawed trying to engage, so choose wisely.

The theme of INTRADAY motion is: BREAKDOWN with swift and savage bounces into resistance levels that get pressed higher due to momentum trading.

POSITIVE AS LONG AS WE RISE ABOVE AND HOLD 3136.5 today (with big spikes likely with shallow fades back into breakout)

CHOPPY BETWEEN 2984 AND 3132.75

NEGATIVE AS LONG AS WE BREAK BELOW AND HOLD 2997 today (with sharp bounces failing and deep pullbacks holding)– choppy inside the range.

Follow short term trend and momentum signals while in the intraday trading environment and watch for weakness to develop away from your trade direction in order to leave.

Learn more about my services over at The Trading Book site.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.