The S&P 500 (SPX) rose 17 points to 2793 last week, which was an increase of 0.6%.

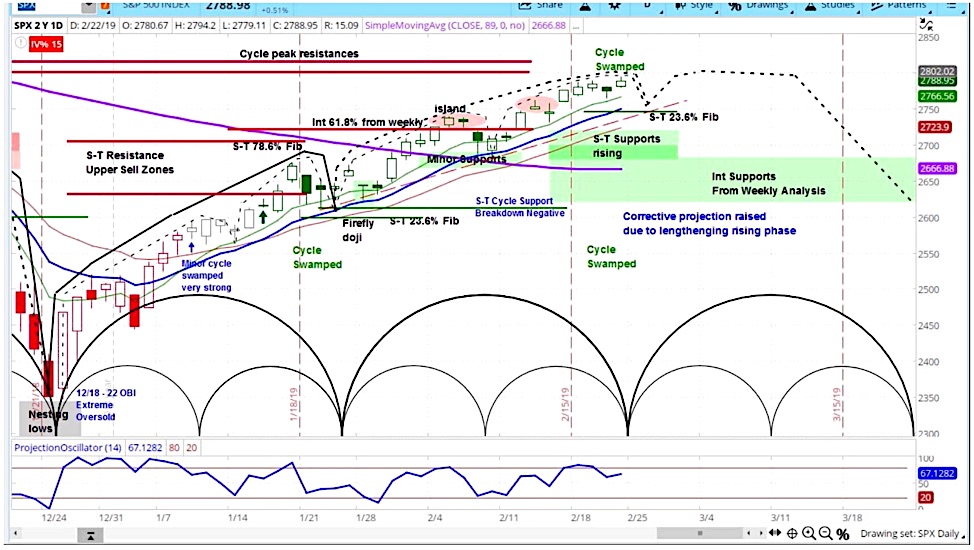

Our projection this week is for more choppiness but higher price action. The broad stock market index could test 2820 before moving lower in early March.

The stock market had a choppy holiday shortened week, as market participants continued to digest the implications of an eight week rebound, as I pointed out in the latest Market Week show.

Looking to this week, our analysis of the S&P 500 (SPX) is for stocks to move higher, after a dip early in the week. It is possible that stocks will test the upper end of our resistance zone at 2820.

The market cycles for the CBOE Market Volatility Index (VIX) suggest that volatility will continue to move lower this week. After that, the probability of higher volatility will increase in the following week.

Combining our VIX analysis with our bearish view of the longer term SPX cycles, we believe risks to the stock market increase significantly in early March.

S&P 500 (SPX) Daily Chart

The Fed heads were back in action after taking some time to breathe. Cleveland President Loretta Mester said that, “we probably have to raise interest rates a little bit later this year,” and argued that continuing the reduce the balance sheet would not have a material economic impact.

However, the minutes from the last Federal Reserve meeting suggested that members viewed the a temporary pause in rate hikes to be the least risky path, as there appears to be little consensus on the best path forward.

The stock market ticked lower when the German manufacturing PMI came out at 47.6, which was below the previous month and below the average analyst estimate of 50. Notably, a rating below 50 indicates a contraction in the manufacturing sector.

With earnings reports now 90% complete, most companies outperformed expectations. Yet this was in many cases after downward revisions to earnings and revenue estimates. In fact, S&P 500 companies continued to revise lower by a ratio of over 2.5 to 1.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel. Here’s our latest video:

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.