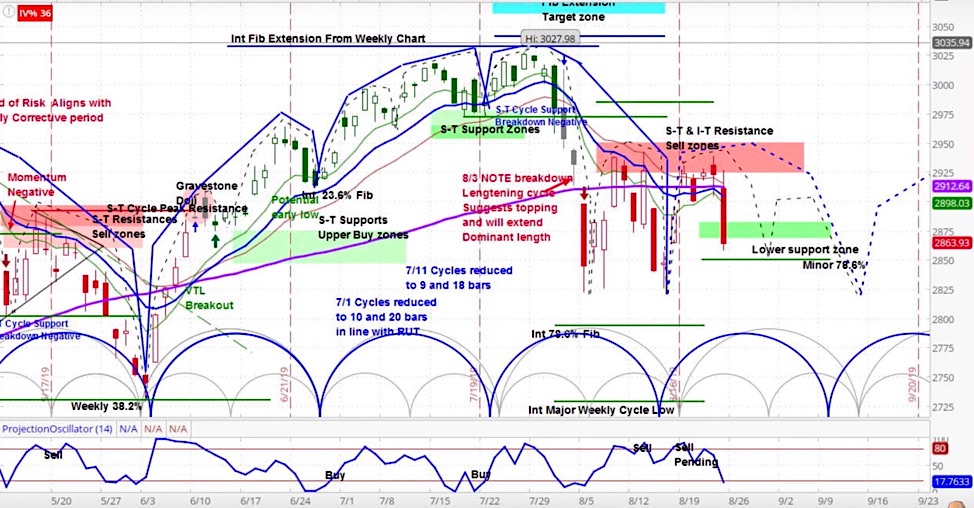

S&P 500 Index INDEXSP: .INX Daily Chart

Stocks tumble as Trump grumbles with more trouble to come this week

Our approach to technical analysis uses market cycles to project price action.

Our analysis this week is for the S&P 500 Index to continue to roll over for 3-5 days within the context of the current minor cycle shown above.

Our near-term target is 2820-2850. We then expect a bounce before the downside action resumes. Expect bouts of volatility into September. INDEXCBOE: VIX

Stock Market Outlook Video – Week of August 26

U.S. News & Market Insights

Last week President Trump asked “who is our bigger enemy” – Fed Chair Jerome Powell or Chinese President Xi Jinping. The stock market started the week strong but faltered as tensions rose, with the S&P 500 (SPX) down 42 points on the week to 2847, a decrease of 1.5%.

Trump’s commentary came before Powell’s speech in Jackson Hole, Wyoming, during which he observed that, “Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States.”

For a more detailed analysis of both of these charts, check out the latest episode of the askSlim Market Week show.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.