That’s a great question. No one knows with any certainty which is why we follow the price action and (indicators related to price). They help investors manage risk/reward.

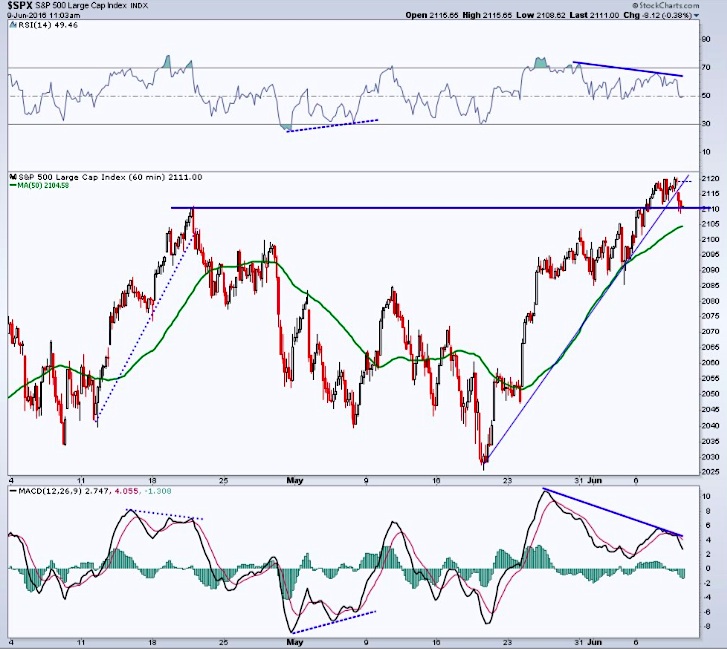

The S&P 500 chart below was shared this morning on my Twitter feed this morning with the following comment:

“S&P 500 testing prior high as potential support following bearish divergences in momentum $SPY $SPX” – @AndrewThrasher

It’s a short-term trading observation, but a worthy nugget to monitor. The April highs were taken out in June and are a visual support level. As noted in my tweet, a bearish divergence with momentum formed in the process… and that bears watching as we retest those the cluster of price action around the April highs.

As of right now (early afternoon), the stock market is attempting to bounce off this support.

Thanks for reading and have a great rest of your week.

The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

More From Andrew: Market Breadth Indicator: Large Caps In Favor

Twitter: @AndrewThrasher

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.