Yesterday’s whoosh doused some water on the near-term prospects for a bullish breakout on the S&P 500 Index (INDEXSP:.INX).

I was leaning toward an upside resolution to the current trading range, but that’s not in the cards. It’s possible that the larger stock market pullback I had been looking for is taking shape.

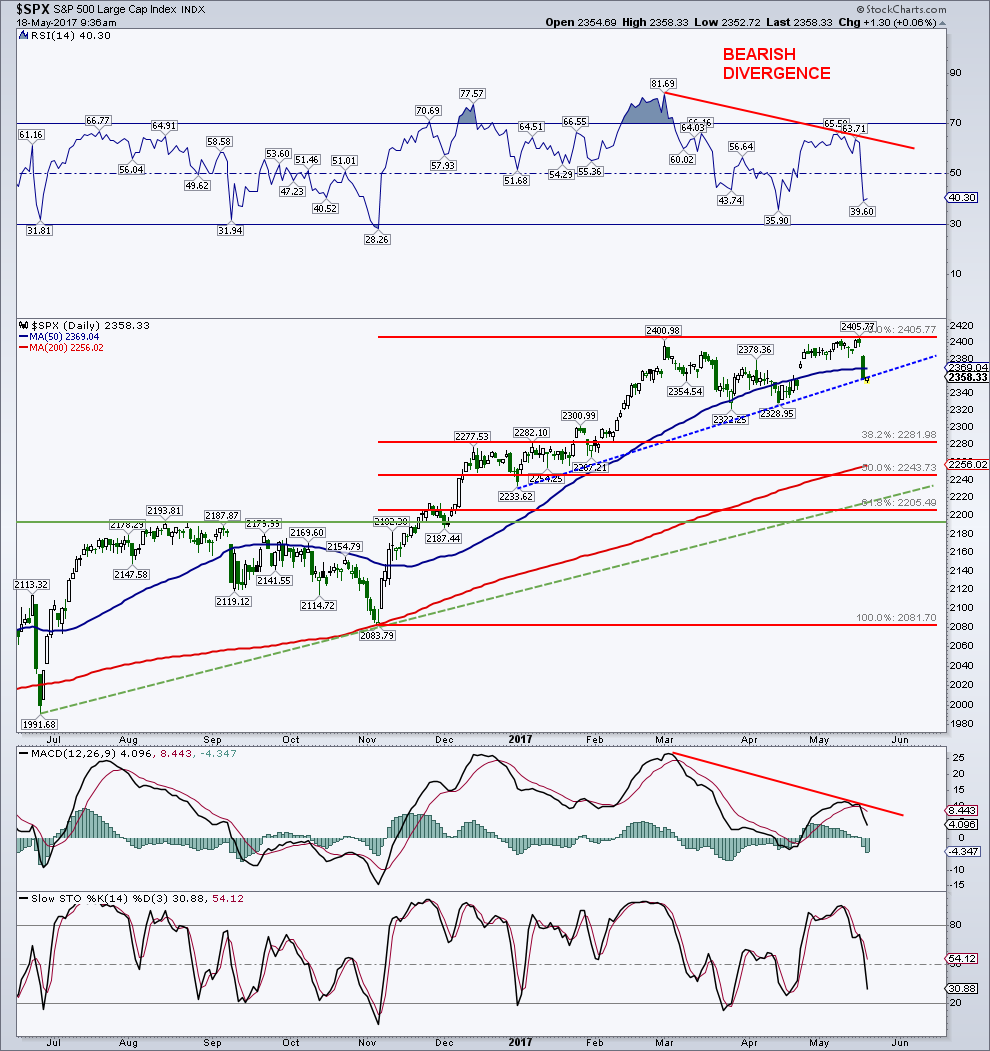

The S&P 500 is broke its 50-day average after tracing out a bearish divergence on the daily RSI and daily MACD. For any real damage, the “500” will need to take out trendline support at 2,358 and then the bottom of the trading range at 2,322. That would open the door for a possible trip down to the next layer of chart support between 2,234 and 2,300.

The 200-day comes in down at 2,255. On a break of 2,322, we could see a measured move based on the size of the top (80 points) down to 2,242. This is also options expiration week which has a tendency for early week declines followed by late week rallies.

I would continue to implore a layering strategy on weakness.

The first buy is at the 50-day, followed by the bottom of the range at 2,322. Then in the next chart support range between 2,234 and 2,300 or at the 200-day at 2,255. Looking out, this is a pullback in a bull market I still see the “500” hitting 2,500+ later this year.

S&P 500 Index – Daily Chart

Feel free to reach out to me at arbetermark@gmail.com for inquiries about my newsletter “On The Mark”.

Thanks for reading.

Twitter: @MarkArbeter

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.